1. Introduction

The Republic of Korea is one of the countries with a trade volume of over USD 1 trillion and is the 5th largest exporter in the world. Currently, it ranks tenth in the list of the world’s economic superpowers and fourth in Asia in 2022.

The strategic partnership between the Republic of Korea and both Central and Eastern Europe (CEE) has been strengthened because of regional rivalry between Japan and China, the conflict between the U.S. and China, and, to some extent, Russia’s attack on Ukraine. South Korea sees Central and East European countries as part of the European Union. EU policy plays a significant role in shaping the direction of cooperation with Central and Eastern Europe. EU membership also increases the region’s attractiveness, which Koreans perceive as a production base in the EU and a gateway to the European single market.

Korea’s growing interest in the region of Central and Eastern Europe fits both its industrial policy and its export policy. These countries are absorptive markets for Korean products. Stable macroeconomic conditions and the quality of the institutional environment speak in favor of investing in this region.

Over the last decade, South Korea has become a strategic partner of the region through cooperation in sectors such as the defense industry and nuclear power. On this basis, the study is divided into five sections: the first section is about FDI in the Eastern and Central European countries (Poland, Czech Republic, Hungary and Slovakia); the second section is about factors of investment attractiveness, the third is about Eastern and Central European countries and the Republic of Korea—Bilateral Trade Relations; the fourth is about South Korea as a foreign investor in the four countries of CEE; and the last one is about Korean investment in the four countries of CEE.

2. FDI in four countries of CEE

This section aims to discuss FDI in the four countries of Central and Eastern Europe (Poland, Czech Republic, Hungary and Slovakia), advantages of FDI in each country and FDI promotion and value chain upgrading in each country.

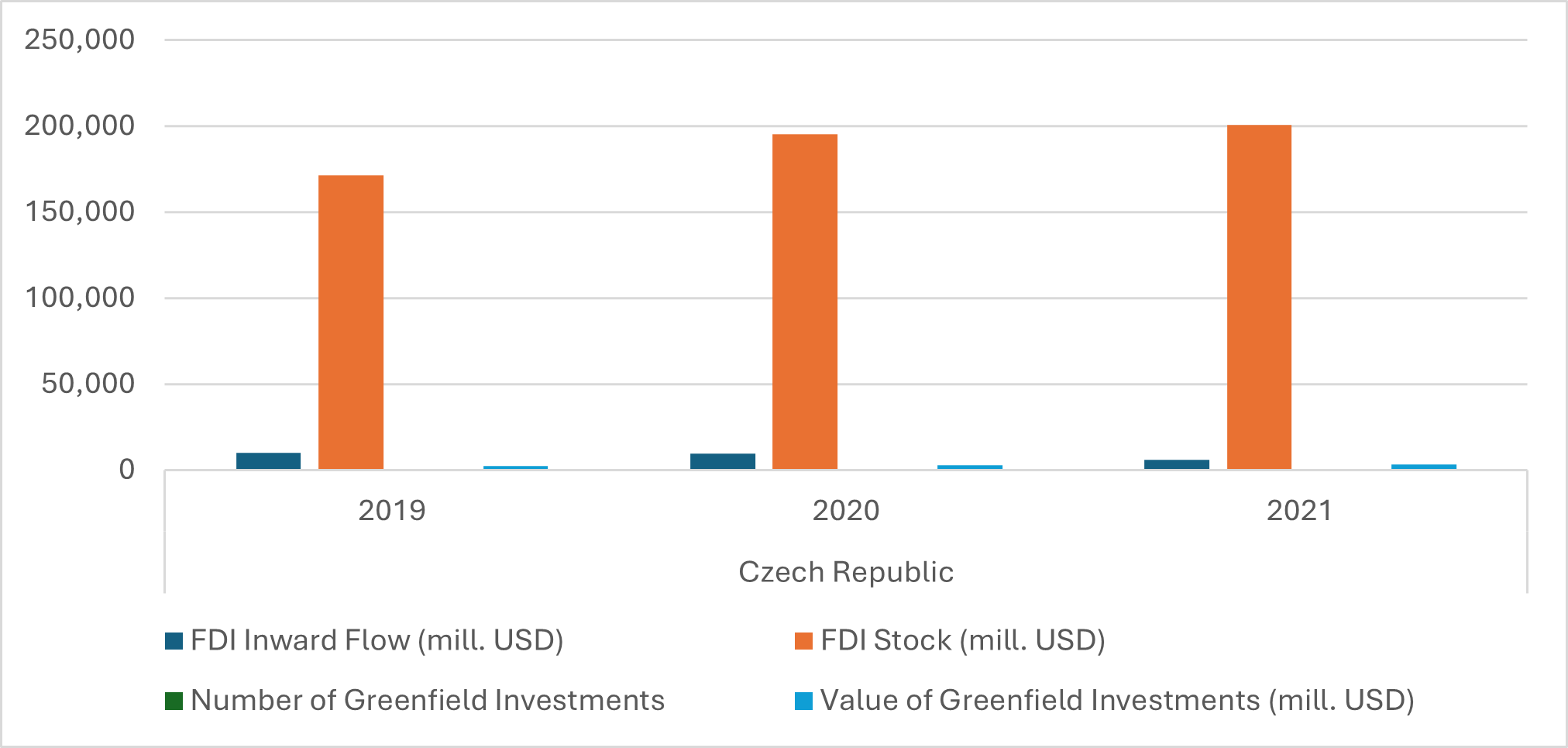

A. FDI in the Czech Republic

The Czech Republic is known as one of the most successful Central and Eastern European countries in attracting FDI. According to the Government Agency for Foreign Direct Investment, the Czech Republic ranks first among Central and Eastern European countries in terms of FDI stock and per capita inflows. [1]

Net FDI inflows for the Czech Republic increased from 1.84% of GDP in 1994 to 9.69% in 1999, declined by 4.32 percentage points during the four-year period between 1999 and 2004, before further decreasing by 2.82%, from 5.36% in 2004 to 2.54% in 2009. The period between 2009 and 2014 saw net FDI inflows marginally increasing by 1.32%, whilst a 4.302 decline in net FDI inflows was experienced between 2019 and 2021 (from 10,108 in 2019 to 5,806 in 2021). The Czech Republic was ranked 41st out of 190 countries in the World Bank’s latest Doing 4 Business report.[2]

Chart 1: FDI in the Czech Republic in 2019-2021

Source: UNCTAD.

Advantages of FDI in the Czech Republic:

- The country’s central bank is strong and independent and regulates a stable currency.

- As a result, the country has excellent access to the European market and has positive and stable international relations.

- A stable banking sector that has proven resilient in recent crises.

- Public spending at a satisfactory and controlled level.

- One of the lowest unemployment rates in Europe creates an optimal and healthy business environment.

- The country’s long tradition of industrial production (the sector continues to have great potential).

- The quality of the labor force (with high intermediate costs).

- Central geographic location.

FDI promotion and value chain upgrading in the Czech Republic:

- The Act on Investment Incentives was revised in 2019 to focus on higher value-added projects. Umbrella support continues to be provided to manufacturing with different conditionalities based on firm size.

- Greater assistance offered to SMEs is intended to extend support to domestic firms. In addition, technological centers and business service centers are strategically favored for financial assistance and fiscal benefits.[3]

- Special tax allowances for R&D expenditures are in place, which allow for a deduction of up to 100%.[4]

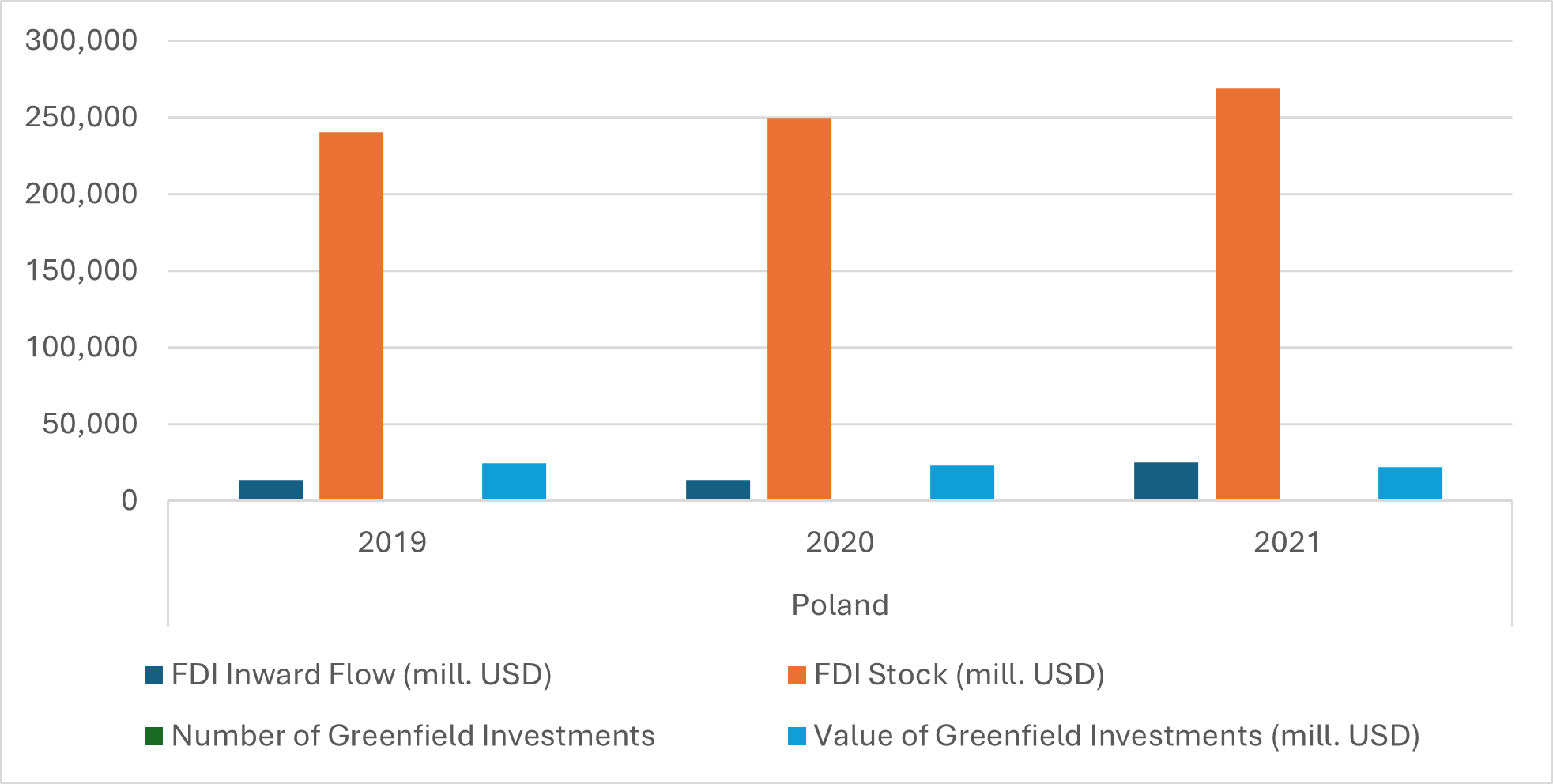

B. FDI in Poland

FDI inflows to Poland increased in 2020, reaching USD 13,831 million, more than the 2019 figure of USD 13,510 million, despite the outbreak of the COVID-19 pandemic causing a 42% drop in global FDI. The country’s total investment stock amounted to USD 249,723 million in 2020. In terms of the value of greenfield projects announced in the same year, Poland ranked fifth in the world with a total of USD 24,462 million.[5]

Chart 2: FDI in Poland in 2019-2021

Source: UNCTAD.

Advantages of FDI in Poland:

Poland has a lot to offer to foreign investors: first, it is well-connected and guarantees free access to the rich EU market, while remaining a country with a relatively cheap, well-educated and numerous labor force and whose productivity is growing rapidly.[6]

Therefore, it is an excellent location in the heart of Europe for companies looking to build factories or establish service centers and scores well in the ranking of the largest recipients of greenfield investments.[7] In addition, Poland has several dynamic Special Economic Zones, and the government founded the Polish Investment and Trade Agency [8] and has a growing economy, a stable banking sector, a controlled currency and a healthy and resilient economy even during economic crises.[9]

The Polish business climate is good. The World Bank ranks Poland 40th out of 190 countries in its 2023 Doing Business ranking, [10] seven positions lower compared to the 2022 edition.

FDI promotion and value chain upgrading in Poland:

- Polish Investment Zone created in 2018 makes certain tax exemptions now available in the entire country and not restricted to regional special economic zones as before. This was undertaken to introduce a more selective and strategic approach to incoming FDI, as well as to level off the field for both foreign and domestic investors. [11]

- In a similar way, the Act on Supporting New Investments of 10 May 2018 granted extra support for greenfield investments in R&D centers in Poland. Despite some signs of this new strategic approach to foreign capital (perhaps best exemplified by the forward-looking invitation for the LG battery factory), the overall policy is still lenient and many investments in manufacturing reproduce low-tech, labor-intensive modes of production.[12]

- Diverse agencies of the Polish Development Fund Group provide institutional support also for outgoing FDI and exports. Consolidation and reform of the Group, as a part of the Strategy for Responsible Development (SOR) after 2017, increased the scope and availability of instruments for foreign expansion, which span: export insurance schemes, export promotion and diplomacy, and direct subsidies to outgoing FDIs.[13]

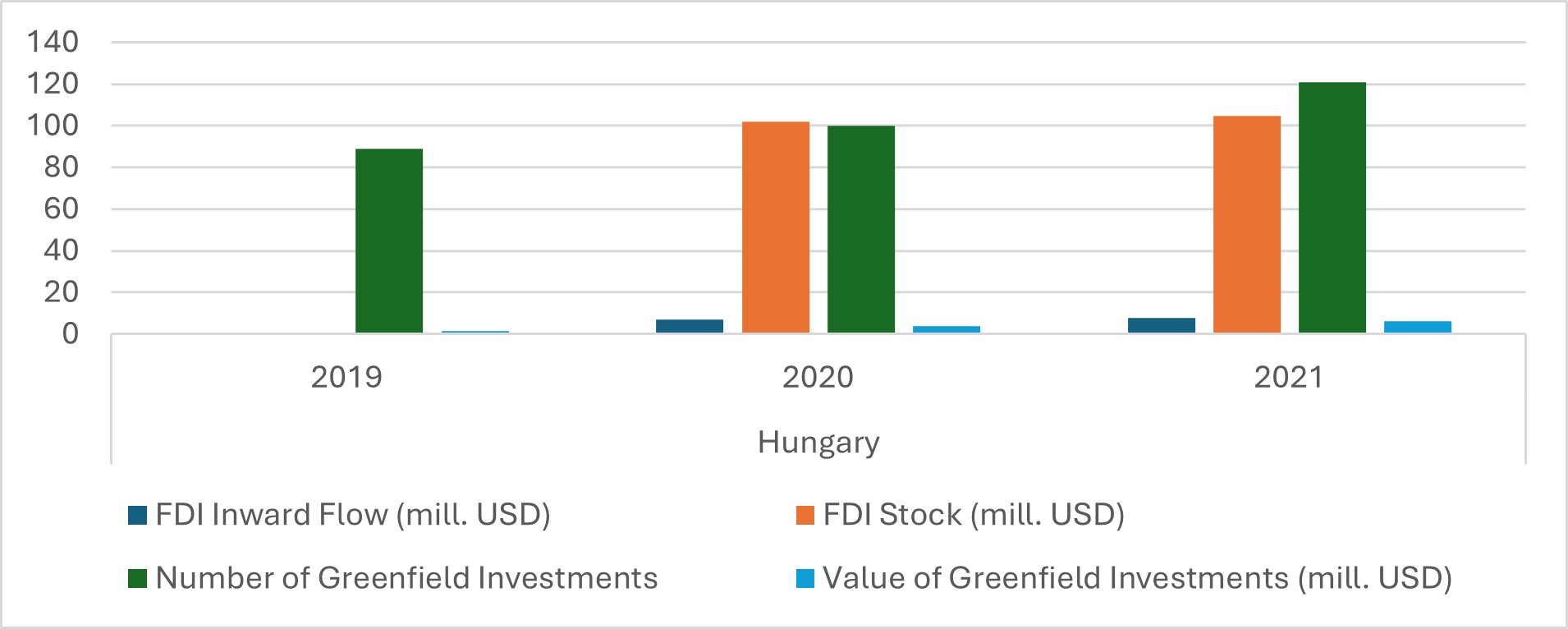

C. FDI in Hungary

In the years 1995/2000, the highest dynamics of growth were noted in Hungary. In the years 2000/2005, a relatively high dynamic in the growth of FDI outward stock was observed in 3 countries: Poland, Hungary and the Czech, while in 2010/2015, the highest growth dynamics were recorded in Slovakia. In 2010 /2015 and 2015/2020, the dynamics of the FDI outward stock growth were not as high as in the earlier periods.

Chart 3: FDI in Hungary in 2019-2021

Source: UNCTAD.

Advantages of FDI in Hungary:

- A well-qualified workforce at an advantageous cost. The labor force consists of roughly 4.7 million individuals, and the unemployment rate was 4.2% (in December 2023). Since the end of 2023, the minimum wage in Hungary is around EUR 700.

- Hungary’s membership in the European Union and access to the single market enable it to benefit from financing opportunities in the European Union.

- It is at the crossroads of three major European transport corridors. Hungary has one of the highest motorway densities in Europe and has three international, and four regional business airports.

- Credit ratings, 2023: Moody´s analytics Baa3 Standard & Poor´s BBB Fitch ratings BBB

FDI promotion and value chain upgrading in Hungary

Economic and FDI policy aim, since 2017, to change Hungary from a ‘manufacturing hub’ to an ‘advanced manufacturing & innovation Center’. New forms of cash incentives and tax grants were introduced to enhance corporate R&D activities and technology-intensive investments. Investors in new production capacities are eligible for cash grants to cover half of the training costs for employees.

Individual ‘VIP support packages’ were introduced for the most significant projects, which give priority treatment by government offices. Contractual research services have also become eligible for cash grants benefiting R&D projects and the country has attracted several digital service centers. The government’s aim is to maintain the car industry in the electric car age by attracting battery manufacturers. Foreign policy has targeted Asian investors, mainly from China and South Korea.

The government initiates and promotes national ownership in all other economic sectors than manufacturing. Support is provided to national investors to overtake foreign-owned businesses in banking, retail, telecommunication, etc. Companies in these sectors, still to a large extent foreign-owned, are subject to surtaxes that drain their profits and may prompt them to leave. National investors concentrate on those sectors which serve the domestic market and can benefit from public procurement. The FDI screening mechanism is stricter than the EU recommendations and enables the government to hinder foreign takeovers of assets put up for sale and initiate national take-over. The most recently identified priority of industrial policy is the military industry. New production facilities involve FDI or other forms of international cooperation.

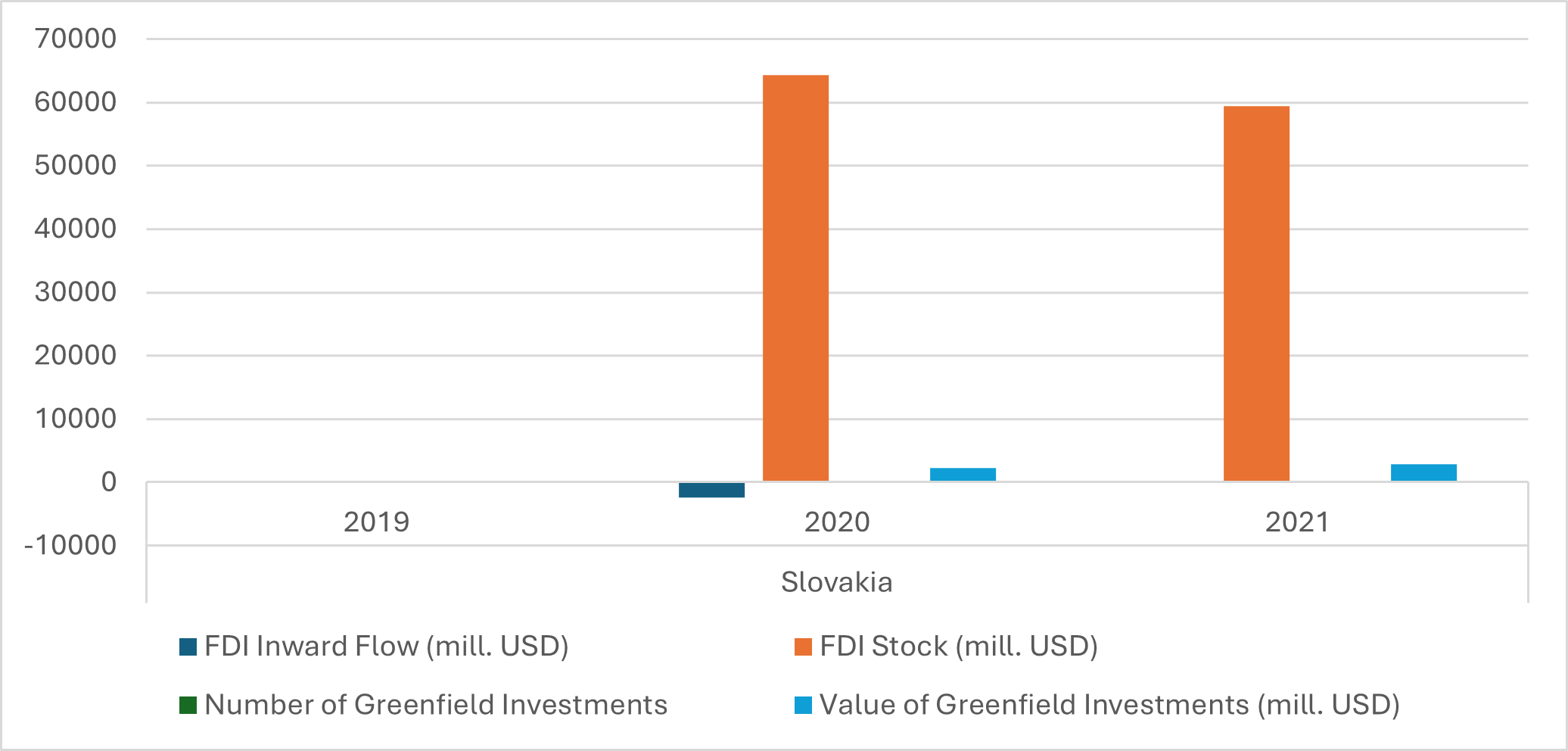

Chart 4: FDI in Slovakia in 2019-2021

Source: UNCTAD.

D. FDI promotion and value chain upgrading in Slovakia

Investment aid is primarily aimed at reducing regional disparities (aid intensities depend on the GDP per capita of the respective region), though in reality, attracting FDI into the least developed regions presents a major challenge. A tax allowance is the preferred form of investment aid. Supported areas include industrial production, technology centers, shared service centers, and a combined project of industrial production and technology center.

There are also some efforts to target higher-value-added activities, including the Research and Development Super deduction, whereby companies located in Slovakia can deduct an additional 100% of their R&D costs from their corporate income tax base; or the Patent Box, a special tax regime for intellectual property rights-related income.[14]

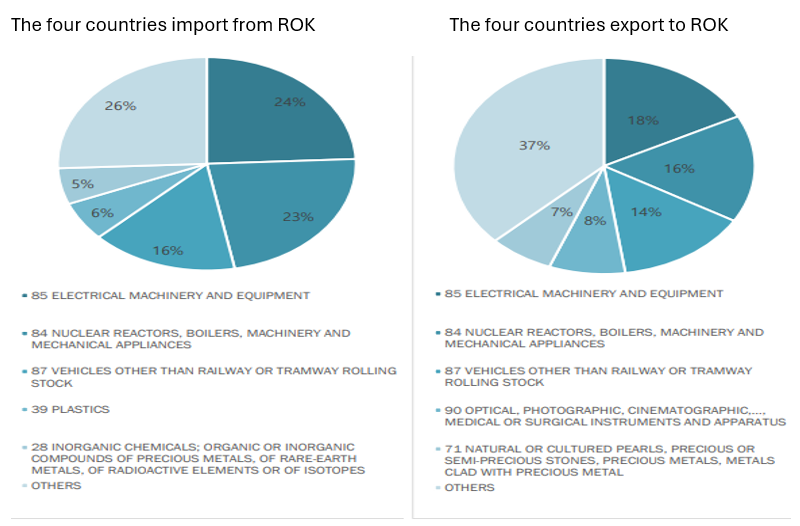

3. Eastern and Central European countries and the Republic of Korea—Bilateral Trade Relations

In this section, the study explains CEE-South Korea Bilateral Trade (2004-2022) and elaborates on each country (Poland, Czech Republic, Hungary and Slovakia), imports from South Korea and exports to South Korea. In 2004-2022 the value of bilateral trade expanded more than tenfold. The imports of the four countries of CEE from South Korea have increased from EUR 2.2 billion in 2004 to EUR 20.3 billion in 2022, which makes the combined four countries the most important partner for Korean exports to the European Union, accounting for almost 1/3 of total exports to the EU.

Over the last 20 years, trade cooperation between the four countries of CEE and the Republic of Korea has expanded dynamically, which reflects both the growing role of the partners in international trade and developing bilateral relations between the four countries of CEE and South Korea.

South Korea is ranked 2nd most important supplier of goods from East Asia (after China) and 3-4th from extra-EU global partners (respectively for individual four countries of CEE members). The combined markets of the four countries absorb 2.93% of Korean exports (2022) and take the 8th position (behind Singapore and before India) among the most important destinations for goods exported from South Korea.

The bilateral trade is highly imbalanced. The total exports from four countries of CEE amounted to only EUR 2.26 billion in 2022. For all four countries, South Korea is not among the main export destinations and takes distanced positions in the hierarchy of export markets. South Korea is mostly ranked in the 30th-40th positions as an export market for the four countries and even in extra-EU exports of CEE countries, Korea does not rank in the top 10 (except Slovakia, 9th place, 2022).

In 2022, the four countries were responsible for only 4% of total exports from the EU to South Korea. Respectively, only 0.6% of Korean imports (2021) came from the four countries. This highly imbalanced bilateral merchandise trade is visible in the growing trade deficit for the four countries of CEE that amounted to 18 bn EUR in 2022.[15] Bilateral trade is contracted within sectors where most of the regional South Korean investments have been located, namely the automotive industry, machinery as well as electrical and electronic products. The dominant sectors for both import and export are mechanical and electrical machinery, and motor vehicles, including their parts and accessories. These sectors alone are responsible for almost 2/3 of the four countries’ imports from South Korea and almost half of their exports.

It is clearly visible that the structure of trade has been dominantly fueled by the FDIs, where the four countries import from SK is substantially purposed for production processes by Korean investments/factories in those countries.[16]The sectoral profile of Korean investments in the region and their mentioned impact on the structure of trade might suggest the assumptions about the positive change in technology of the four countries’ exports. Contrary to Hungary, the share of automotive goods has decreased to only 4.6% (2022) from 11.4%. Similarly, to import, the importance of high-tech goods in four countries’ exports to South Korea has decreased in the analyzed timeframe.

In 2004-2022, the combined share for all four countries decreased from 32.8% to 22.9% in 2022, This general downward trend has been fueled by Hungary (from 55.4% in 2004 to 34.2% in 2022) and Slovakia (31.6% to 4.6%), while some positive trends have been noted by the Czech Republic (from 17.5% in 2004 to 31.2% in 2022) and Poland (14.5% to 18.3%). At the same time, the general region-level analysis suggests quite a stable share of medium-tech goods exported to Korea. Poland and the Czech Republic have experienced a decreasing share of those goods in their exports to South Korea (from 54.4% and 53.1% in 2004 to 30.0% and 33.8% in 2022). Contrarily, Hungary (from 19.2% to 34.5%) and Slovakia have expanded their exports in this category.

Chart 5: Trade Intensity Index for the four countries, the EU and the Republic of Korea (2004-2022)

Source: Eurostat/Comext 2023.

4. South Korea as a foreign investor in the four countries of CEE

The automotive industry plays an important role in Europe’s economy, providing direct and indirect jobs to 13.8 million Europeans, representing 6.1 percent of total EU employment and accounting for 7 percent of the European Union’s (EU) GDP.

The EU is one of the world’s largest car-producing regions. However, the automotive industry has increasingly shifted eastwards over the last two decades: the Western European car market stagnated between 1990 and 2000, and further growth could only be achieved through geographical expansion. CEE proved (and continues) to be an ideal location for expansion, as the economies of these countries were growing rapidly, economic growth and increasing prosperity allowed more consumers to buy cars, and wage levels were considerably lower than in Western Europe, granting significant cost savings for car manufacturers. The countries with the largest automotive industries in the CEE region are the Czech Republic, Poland, Slovakia and Hungary—that is, the countries of the CEE.

Therefore, in this section, the study elaborates factors of investment attractiveness, which include Location, Human capital, Demography, Economic indicators, Market, Culture and lifestyle, Innovativeness, Domestic and foreign policy, Economy, Clusters and business networks (shown in table no. 6).

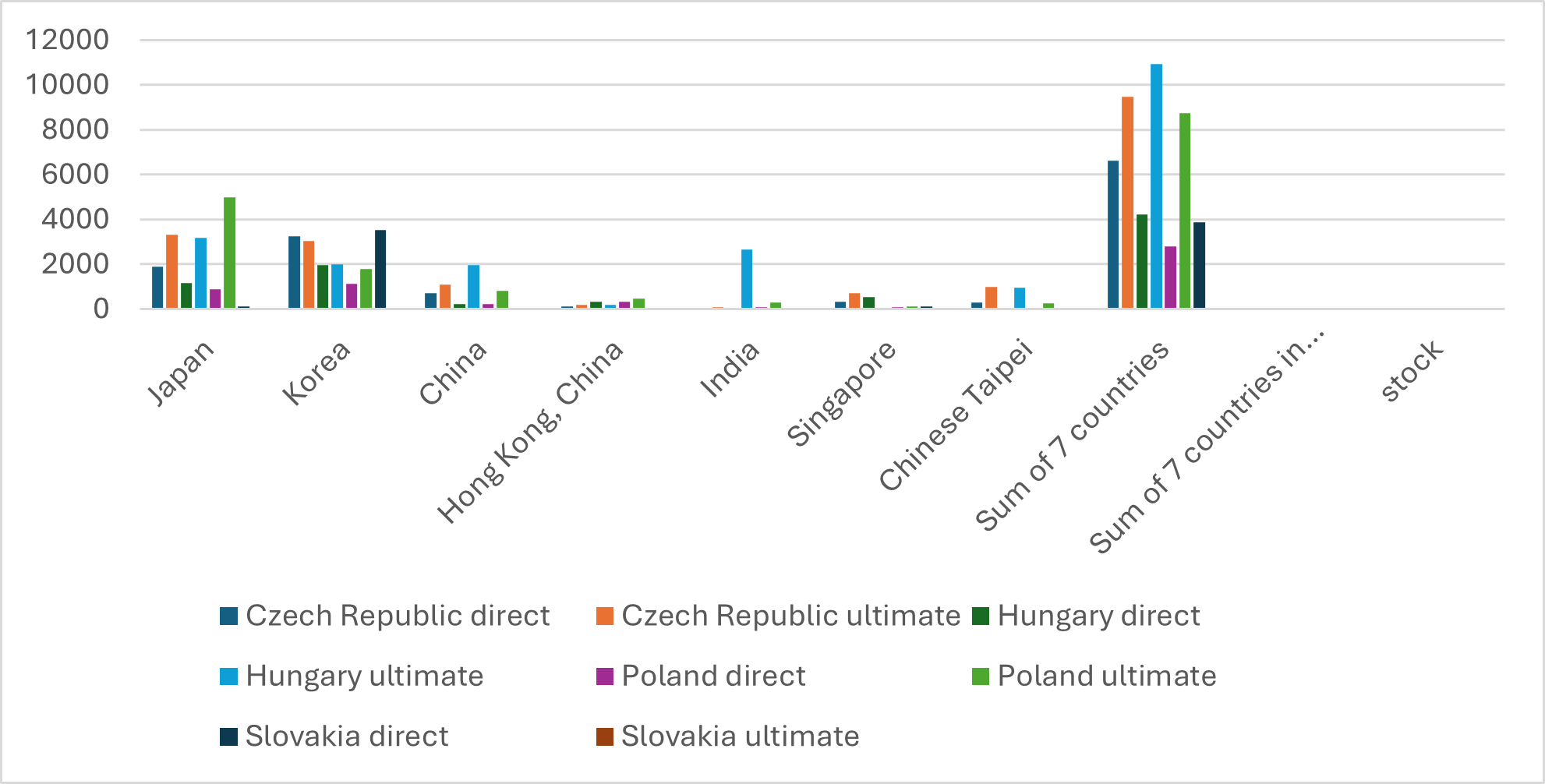

Chart 6: FDI stock by leading Asian investor countries in the four countries of CEE, 2019 (million USD)

Source: UNCTAD.

In addition, in this section, the study will answer the following question: why the four countries of CEE from the Korean perspective are an attractive investment area? South Korean investors have been present in the region since the beginning of the four countries’ economic transformation, although initially at a marginal level. The acceleration of FDI inflows to the CEE countries was related to their membership in the European Union. These countries attracted more attention from external investors in the years following their unification with the Single European Market.[17]

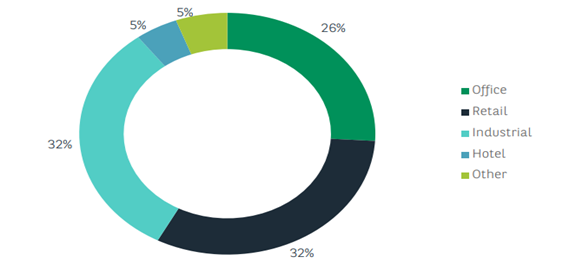

Chart 7: Investment by Sector in 2023 in the CEE Region, M EUR

Source: 108 REAL ESTATE, BNP Paribas Real Estate Poland, Fortim Trusted Advisors *excluding Residential; data on the investment market in Slovakia comes from the RCA

The strategic partnership between the Republic of Korea and both of Central and Eastern Europe (CEE) has been strengthened by global challenges such as climate change and the Russia-Ukraine war. Regional rivalry with Japan and China and the conflict between the U.S. and China can be seen as opportunities to strengthen South Korea’s relations with Central and Eastern Europe.

From the Korean perspective, Central and Eastern Europe countries are an attractive investment area. There are several arguments for this:

Firstly, these countries are located close to Western Europe, and continuously developing infrastructure (logistics, transport and communication infrastructure) have been providing easy access to the whole EU/European market. The competitive edge of the four countries has also been strongly improved by their membership in the EU, and in particular in the European Single Market with all its opportunities. Poland and Hungary also have the best-developed transport networks. Access to natural resources is also important for Koreans, which is why they recognized Lower Silesia as the most attractive area in Poland in terms of location. Access to copper and nickel, as well as the proximity to Korean factories located in the Czech Republic and Slovakia, make this region an attractive place for Korean investments in Poland.[18]

Another characteristic of the Korean development strategy is the absorptivity of the sales market. Here, again, Poland and Hungary are considered the most promising economies. The third factor is lower wages in the industrial and service sectors in CEE countries. The fourth factor is both historical and geopolitical. From the perspective of the Koreans, Central Europe is an area where there is a clash of American and Chinese influences. Each of these powers is making efforts to subjugate the area by means of investments or other forms of support.

By the end of 2021, South Korean companies were among the most significant foreign investors in the four countries. The total value of Korean FDIs in the four countries amounted to USD 19.3 billion. That constituted more than 1/4 of all Korean FDIs in the EU. This ranks the Republic of Korea as the most important Asian investor in the four countries (except Hungary for which Singapore is a leader), outpacing Japanese and Chinese companies in the region (USD 5.5 billion and USD 5.03 billion, respectively).[19]

For the Czech Republic, Poland and Slovakia, the Republic of Korea is the most significant non-European investor. This is particularly evident in the case of Slovakia, where South Korea is the 5th largest investor globally and is responsible for approximately 80% (2021) of all non-European investments located in the country (for the Czech Republic and Poland, the shares amounted to 30-40%, respectively). The share is lower for Hungary (3.5%), but even in this case, South Korea remains in the top 10 most important investors.

Korean investment projects in the four countries have been heavily concentrated in the manufacturing sector. In 1991-2021, almost 90% of all Korea FDI inflows to the region were in this sector (for Slovakia, the share was extremely high and amounted to 98.3%). The remaining sectors, in which Korean investors located their capital in the four countries, were: wholesale and retail trade—3.6% of all FDIs (with a relatively high share in the Czech Republic—8.7% of Korean FDIs in this country), real estate activities—2.6% (with the highest value for Poland—5.3%) and construction—2.1% (4.5% in Poland).

Korean FDIs in financial and insurance activities constitute also a relatively high share of 6.6% only in Hungary, while they are marginal or nonexistent in other countries of the region. The sectoral structure of Korean investments in the four countries has been strongly determined by the motives of Korean companies standing behind their decisions to locate FDIs in Central Europe. Those are based on competitive advantages and opportunities provided by the four countries as host countries.

5. Korean investment in the four countries of CEE

Although Korea considers the broader CEE as a bloc, some countries indeed seem to be more popular investment destinations than others: the four countries host more than 70 percent of the total Korean FDI to the broader CEE region. The reason for this distribution is twofold. On the one hand, Korean companies prefer to establish or purchase company sites in EU member states to avoid trade barriers. On the other hand, Korea is playing it safe. It targets countries that have already attracted investments from elsewhere like the U.S., Japan, or Germany, in particular. This is particularly true in industries such as electronics and automotive, where the target region has significant manufacturing experience.

This section aims to discuss Korean investment in each of the four countries, as follows:

A. Korean Investment in Czech Republic:

The following are the Korean investments in the Czech Republic.

The Korean company Hyundai Motor Group is one of the world’s largest automobile manufacturers. It has been producing cars in the Czech Republic, specifically in the industrial zone in Nosovice, since 2008. Hyundai car factory in Nosovice, built in 2006, began series production in 2008-Hyundai’s investment of CZK 34.4 billion in its factory in Nosovice is the largest investment that CzechInvest has succeeded in attracting to the Czech Republic to date. Hyundai Motor Manufacturing Czech (HMMC) has created nearly twelve thousand jobs in the Moravia-Silesia region. The company’s cooperation with CzechInvest has endured for more than fifteen years.

NEXEN TIRE: Value of EUR 850 million, creation of more than 1,500 new jobs. The company’s plant in Zatec is strategically located in the heart of Europe, allowing it to meet the rising demands in the region. It also gives the company access to around 30 carmakers.

HYUNDAI MOBIS: The company is the largest automotive component manufacturer in Korea. It is a core supplier of Hyundai Motor Co., Ltd. The company conducts its business in two operating segments (automotive modules and major automotive parts, aftermarket products) announced in 2015, valued at EUR 150 million, opened in 2017 in Ostrava Mosnov Hyundai Mobis produce car lamps for Hyundai manufacturing operations in Czech and Slovakia.

Sungwo Hitech plant located in Ostrava, Czech Republic. The company was founded in 1977 in Korea and has a branch in the Czech Republic. producing car body parts, and the Plakor Czech company, producing plastic component parts for South Korean car makers Hyundai and Kia Motors. Received the “Investor of the Year 2005” award from Czech Invest.

In 2009, South Korean engineering group Doosan bought Czech Plzen-based company Skoda Power (now Doosan Skoda Power), one of the five biggest turbine producers in the world.

B. Korean investment in Hungary:

- Korea plays a pivotal role in the Hungarian economy as it forms the third-largest investor community and is Hungary’s 12th most significant trade partner. The most recent Korea-related FDI in the automotive sector.

- Hanon Systems Hungary Kft. is a company located in Szekesfehervar. It was formed in 1986 and has since grown to become a full-line thermal and energy management solutions provider. Leading automotive thermal solutions supplier Hanon Systems is investing EUR 117 million to develop three of its sites in Hungary.[20]

- LG Magna e-Powertrain, a joint venture between LG Electronics (of Korea) and Magna (the Canadian automotive component supplier), built its first European production facility in Miskolc (195 km northeast of the capital) in an investment worth EUR 51.6 million.[21]

- HANKOOK TIRE Magyarorszag Gyarto es Kereskedelmi Kft. is a company located in Racalmas. It was founded in 1941 and has become a global leader in the tyre industry. The company is building a gigantic 66,000 sqm tyre plant for close to EUR 540 million.

- South Korean battery manufacturer Samsung SDI has announced plans to boost its Hungarian research and development (R&D) activities in the city of Göd in the north of the country, according to a statement released by the Hungarian Investment Promotion Agency. The investment is valued at EUR 61.9 million and will create 25 jobs. Samsung SDI has so far invested a total of EUR 5 billion in Hungary, creating more than 6,600 jobs in the country.

- SK On (South Korean company) has two plants in Komárom (90 km northwest of the capital); its total announced investments in Hungary are now close to EUR 3 billion to accelerate the process of creating a robust EV ecosystem in the Hungarian economy.[22]

- Lotte Aluminium manufactures aluminum anode foils (investment volume: EUR 133 million), EcoPro BM will produce cathode materials (EUR 728 million). Nice LMS makes battery cases (EUR 14.4 million).

C. Korean investment in Poland:

Nearly 550 Korean-invested companies operate in Poland, which makes the Republic of Korea one of the main foreign investors in Poland (it is the second, after the USA, largest investor from outside Europe). At the end of 2020, the value of all investments from South Korea in Poland amounted to EUR 3.06 billion.[23]

The most important South Korean investment in Poland has been the construction of an LG Chem lithium-ion battery factory for electric cars in Biskupice Podgórne (municipality of Kobierzyce) near Wroclaw. The first stage of the construction was completed in 2018. Investment outlays have amounted to 1.3 billion euros so far. However, the company has already decided to expand its production capacity. As a result, LG Chem invested a total of 2.7 billion euros in Kobierzyce and employed up to 6,000 in 2020. In terms of value, the LG Chem factory is the largest investment in Poland since 1989. Thanks to the LG Chem investment, Poland became the EU’s leader in the export of lithium-ion batteries in the first quarter of 2019.[24]

SK, the first in South Korea and the third in the world, developed the separators, a key component in lithium-ion batteries, by applying chemical technologies, accumulated over the span of 50 years and advanced nanotechnologies. Korean companies are investing in electromobility as on 6 October 2021, in Dąbrowa Górnicza Poland, the opening of the SK hi-tech battery materials factory (the separator factory for lithium-ion batteries—a battery for electric cars) and to engage in the construction of four 1,400 MW nuclear reactors and in the chemical industry. Also, the polypropylene factory started in June 2023.

In the field of transport cooperation, the appointment of Incheon International Airport Corporation, the company managing Korea’s largest airport as a strategic advisor to the Centralny Port Komunikacyjny (CPK), and the implementation by Hyundai Rotem of a large contract for the supply of trams for Warsaw are noteworthy.[25]

After the Russian attack on Ukraine, Poland became a key partner for Korea in terms of arms purchases. Cooperation in the arms field increased rapidly. The contracts signed so far include the delivery of 180 K2 tanks, 48 K9 howitzers and the same number of FA-50 combat and training aircraft. From 2026, a tank production line is to be launched in Poland.[26]

In June 2022, Polish Defense Minister Mariusz Błaszczak signed agreements for the purchase of 1,000 K2 main battle tanks, 672 K9 self-propelled howitzers, and 48 FA-50 light combat aircraft from South Korea. The total net value of the contracts signed by Korean companies Hyundai Rotem, Hanwha Defense, and Korea Aerospace Industries amounts to USD 8.77 billion.[27] This bilateral cooperation intensified even further in October 2022, when Poland decided to purchase 218 K239 Chunmoo rocket artillery systems with logistics packages and ammunition supplies worth USD 3.55 billion.

All four deals represent the largest arms contracts in the history of the Korean military industry.[28] The recently established military relationship between South Korea and Poland is a multidimensional phenomenon, reaching beyond security in its traditional meaning.

On 31 October 2022, the Polish Energy Group (Polska Grupa Energetyczna) signed a deal to develop a nuclear plant with South Korean state-owned Korea Hydro & Nuclear Power (KHNP). In addition to investments in the semiconductor, battery, and hydrogen industries.

D. Korean investment in Slovakia:

South Korea is the largest Asian investor and the fifth largest overall investor in Slovakia. Slovak-Korean economic relations started 25 years ago already. Samsung made its first investment in Slovakia in the early 1990s. However, due to the tense political situation during the government of Vladimir Meciar, it decided to abandon its investment in 1997. Nevertheless, Meciar’s defeat, reforms of the Dzurinda government and entering the EU caused it to return to Slovakia in 2005. Around the same time, Kia also made its entrance to Slovakia and established a manufacturing plant near Zilina in 2004.

FDI from South Korea amounts to 2.9 billion euros (as of 2016). This represents as much as 7 %of the overall stock of FDI in Slovakia. The largest investors are Kia and Samsung, who established factories in Slovakia. Currently, there are over 100 Korean companies present in Slovakia, such as Kia, Samsung, Mobis, YURA, Sungwoo Hitech, Hyundai Steel, Donghee Slovakia, Daejung Europe, Seoyon E–Hwa Automotive, which provide more than 20,000 jobs to Slovak workers.

The automotive industry in Slovakia is the main growth engine, with approximately 40% share of total industrial production. It is currently home to four key OEMs: Volkswagen (Germany), Groupe PSA (France), Kia (South Korea) in the northern part of the country is located the only production plant for Kia vehicles in Europe and Jaguar Land Rover (UK/India). The country is a world leader in per capita production of personal vehicles, with an average of around 1 million cars annually.

6. Conclusion

The four countries of CEE have also been an attractive place for Korean investments in Europe. Their unique central location on the European continent, membership in the EU with unrestricted access to the Single European Market, and well-qualified and still relatively cheap workforce have made those countries a very attractive place for South Korean investments. While historically most of Korea’s FDIs in the region have been located in manufacturing (automotive, electronics), there are potentially attractive growing prospects for investments in other sectors such as energy production, infrastructure, transportation and the digital economy.

The analysis in this study reveals that first and foremost, improving macroeconomic stability is essential to attract more FDI. Investors look for stable environments where predictability is high. Reducing obstacles to international trade is vital for foreign investors, as they export and import significantly, given their linkages with regional and global supply chains. Further, expecting more FDI in economies where country risks are high is unrealistic. Countries that minimize country risks by improving institutional quality and political stability tend to see a surge in FDI inward flows.

Due to the ongoing diversification of their trading partners, inward FDI in CEE will be less dependent on a few countries, thus enhancing its appeal while reducing its economic risk. CEE’s political stability and robust infrastructure are other key factors.

7. Appendix

Table 1: FDI in the Czech Republic in years 2019-2021

| FDI | Czech Republic | ||

| 2019 | 2020 | 2021 | |

| FDI Inward Flow (mill. USD) | 10,108 | 9,411 | 5,806 |

| FDI Stock (mill. USD) | 171,334 | 195,240 | 200,587 |

| Number of Greenfield Investments | 90 | 57 | 109 |

| Value of Greenfield Investments (mill. USD) | 2,369 | 2,596 | 3,094 |

Source: UNCTAD.

Table 2: FDI in Poland in years 2019-2021

| FDI | Poland | ||

| 2019 | 2020 | 2021 | |

| FDI Inward Flow (mill. USD) | 13,510 | 13,831 | 24,816 |

| FDI Stock (mill. USD) | 240,586 | 249,723 | 269,225 |

| Number of Greenfield Investments | 448 | 467 | 511 |

| Value of Greenfield Investments (mill. USD) | 24,462 | 22,757 | 21,871 |

Source: UNCTAD.

Table 3: FDI in Hungary in years 2019-2021

| FDI | Hungary | ||

| 2019 | 2020 | 2021 | |

| FDI Inward Flow (mill. USD) | 4 884 | 7.047 | 7.559 |

| FDI Stock (mill. USD) | 91 015 | 102.128 | 104.788 |

| Number of Greenfield Investments | 89 | 100 | 121 |

| Value of Greenfield Investments (mill. USD) | 1.605 | 3.760 | 6.372 |

Source: UNCTAD.

Table 4: FDI in Slovakia in years 2019-2021

| FDI | Slovakia | ||

| 2019 | 2020 | 2021 | |

| FDI Inward Flow (mill. USD) | 2 449 | -2,404 | 59 |

| FDI Stock (mill. USD) | 49.350 | 64,293 | 59,367 |

| Number of Greenfield Investments | 25 | 27 | 46 |

| Value of Greenfield Investments (mill. USD) | 2.430 | 2,276 | 2,907 |

Source: UNCTAD.

Table 5: Priority sectors for investment promotion in the four countries of CEE

| Czech | Hungary | Poland | Slovakia |

| Aerospace | Automotive | Aerospace | Aerospace |

| Automotive Business | Electronics | Automotive | Automotive |

| Support Services | Food industry | Biotechnology | Chemical industry |

| Data Centres | ICT | Business support services | Electrical engineering |

| Electronics & Electrical Engineering | Life sciences | Domestic appliances | ICT |

| Energy & Environment | Logistics | Electronics | Machinery industry |

| High-Tech Mechanical Engineering | Medical technology | ICT | Shared service centres |

| ICT | Renewable energy | Machinery and steel industry | Wood processing |

| Life Sciences | Shared service centres | Renewable energy | |

| Nanotechnology & Advanced Materials | Research & development |

Source: IPA websites

Table 6: Factors of investment attractiveness

| Location | • Availability of transport (near the hub and transport routes, sea routes, ports, airports, etc.) • The central geographical location (ease in reaching the country, the position of the border etc.) • Landform • Availability of land • Road infrastructure |

| Human capital | • Resource of workforce • Education of labor • Mobility of labor • Work productivity • Cost of labor • Willingness to learn • The education system, colleges, vocational schools |

| Demography | • The age structure of society • Birthrate |

| Economic indicators | • GDP and GDP per capita • The unemployment rate • The sectoral structure of the economy • The structure business ownership • The number of SMEs and corporations |

| Market | • Absorption sales market • The number of domestic consumers • Market competition |

| Culture and lifestyle | • Openness to other nationalities • Tolerance society • Knowledge of foreign languages in society |

| Innovativeness | • The ability to produce the innovation • The presence of innovative technologies and business • Innovation policy of the state support of innovative actions • The innovative potential of industry and labor • Existing research – development units, specialized laboratories |

| Domestic and foreign policy | • Political Stability • The overall situation in the country • Security in the country • The performance of public institutions • Membership in international organizations • Membership in the integration groups (preferential tariffs, harmonization of laws, and access to such funds. EU funds) • Promotion of the country in the international arena • Political risk |

| Economy | • Special economic zones • Investment incentives (tax breaks, subsidies, preferential land prices). • Investment climate • The presence of other foreign investors • Efficiency investor service • Export and its structure • The tax system • The rules and transparency • Economic risk • Domestic • Expertise of the local and national economy |

| Clusters and business networks | • Clusters with an established position in the economy • Potential clusters • Cluster policy • Existing enterprise networks • Technology parks |

| Other | • The subjective experience of the investor • Fortuity |

Source: Author’s own work.

Table 7: FDI stock by leading Asian investor countries in the four countries of CEE, 2019 (million USD)

| Czech Republic | Hungary | Poland | Slovakia | |||||

| direct | ultimate | direct | ultimate | direct | ultimate | direct | ultimate | |

| Japan | 1907.66 | 3314.14 | 1152.56 | 3185.93 | 887.43 | 4996.26 | 125.16 | n.d. |

| Korea | 3254.71 | 3046.01 | 1979.25 | 1986.48 | 1134.81 | 1783.54 | 3535.08 | n.d. |

| China | 707.27 | 1096.04 | 210.96 | 1973.42 | 223.11 | 826.51 | 55.12 | n.d. |

| Hong Kong, China | 115.69 | 204.41 | 319.81 | 207.51 | 347.08 | 465.06 | 25.03 | n.d. |

| India | −1.12 | 99.51 | −16.04 | 2657.56 | 103.38 | 299.41 | −2.72 | n.d. |

| Singapore | 344.64 | 699.07 | 532.29 | −55.72 | 84.74 | 109.56 | 118.49 | n.d. |

| Chinese Taipei | 283.53 | 1007.46 | 47.28 | 971.91 | 30.76 | 254.14 | 18.27 | n.d. |

| Sum of 7 countries | 6612.36 | 9466.65 | 4226.11 | 10927.09 | 2811.31 | 8734.48 | 3874.42 | n.d. |

| Sum of 7 countries in % of total FDI stock | 4.42 | 6.33 | 4.64 | 12.01 | 1.18 | 3.66 | 6.94 | n.d. |

Source: OECD FDI positions by partner country BMD4: Inward FDI by immediate and by ultimate investing country and Hungary: Hungarian National Bank

Table 8: CEE-South Korea Bilateral Trade (2018-2022)

| Import from South Korea | Export to South Korea | ||

| Czech Republic | |||

| 8708 Parts and accessories of the motor vehicles | 31.9% | 9027 Instruments and apparatus for physical or chemical analysis | 10.9 % |

| 8512 Electrical lighting or signaling equipment, windscreen wipers, defrosters and demisters | 4.2% | 4011 New pneumatic tyres of rubber | 6.2% |

| 8407 Spark-ignition reciprocating or rotary internal combustion piston engine | 3.8% | 8708 Parts and accessories of the motor vehicles | 4.7% |

| 8703 Motor cars and other motor vehicles principally designed for the transport of persons | 2.8% | 4002 Synthetic rubber and factice derived from oils; mixtures of natural rubber | 4.5% |

| 8526 Radar apparatus, radio navigational aid apparatus and radio remote control apparatus | 2.7% | 9012 Electron microscopes, proton microscopes and diffraction apparatus | 4.5% |

| Hungary | |||

| 3824 Prepared binders for foundry moulds or cores; chemical products and preparations | 15.1 % | 8708 Parts and accessories of the motor vehicles | 9.6% |

| 3002 Blood, immunological products; vaccines, toxins, cultures of microorganisms | 14.8 % | 8507 Electric accumulators; parts thereof | 6.5% |

| 8479 Machines and mechanical appliances having individual functions; parts thereof | 14.2 % | 8471 Automatic data-processing machines; (…) machines for transcribing and processing data | 6.2% |

| 8471 Automatic data-processing machines; (…) machines for transcribing and processing data | 6.8 % | 8516 Electric water heaters; electric space- and soil-heating apparatus; electro-thermic appliances | 4.6% |

| 8703 Motor cars and other motor vehicles principally designed for the transport of persons | 4.4% | 6909 Ceramic wares for technical uses | 3.9% |

| Poland | |||

| 8507 Electric accumulators; parts thereof | 14.1 % | 7112 Waste and scrap of precious metal or of metal clad with precious metal (…) | 17.9% |

| 2841 Salts of oxometallic or peroxometallic acids | 8.9% | 8510 Electric shavers, hair clippers and hair-removing appliances; parts thereof | 5.0% |

| 2853 Phosphides; inorganic compounds; compressed air; amalgams | 5.5% | 8212 non-electric razors and razor blades of base metal | 4.5% |

| 8703 Motor cars and other motor vehicles principally designed for the transport of persons | 4.6% | 6909 Ceramic wares for technical uses | 3.7% |

| 8529 Parts suitable for use solely or principally with the apparatus of headings 8525 to 8528 | 3.6% | 8504 Electrical transformers, static converters, and inductors; parts thereof | 2.4% |

| Slovakia | |||

| 8708 Parts and accessories of the motor vehicles | 23.0 % | 703 Motor cars and other motor vehicles principally designed for the transport of persons | 55.0 % |

| 8409 Parts suitable for use solely or principally with internal combustion piston engine | 9.4% | 4011 New pneumatic tyres of rubber | 8.2% |

| 8407 Spark-ignition reciprocating or rotary internal combustion piston engine | 7.0% | 8708 Parts and accessories of the motor vehicles | 6.1% |

| 8414 Air or vacuum pumps; compressors and fans; ventilating or recycling hoods incorporating a fan | 5.2% | 8479 Machines and mechanical appliances having individual functions; parts thereof | 4.2% |

| 8529 Parts suitable for use solely or principally with the apparatus of headings 8525 to 8528 | 3.4% | 8414 Air or vacuum pumps; compressors and fans; ventilating or recycling hoods incorporating a fan | 3.5% |

Source: Eurostat 2023.

Table 9: South Korean Battery gigafactories in CEE

| Company | 2021 capacity (GWh) | Start date | Location | Notes |

| LG Energy Solution | 45.0 | 2018, expansion 2022 | Wrocław, Poland | Total investment €1.5 billion. Investment incentives €95 million to expand the plant |

| SK innovation | 7.5 | 2020 | Komárom Plant 1, Hungary | Investment €688 million |

| SK innovation | 2022 | Komárom Plant 2, Hungary 9.8 | 9.8 GWh, option up to 16 GWh. Investment €753 million | |

| Samsung SDI | 2.5 | 2017 | Göd Plant 1, Hungary | 12 GWh in 2023 option up to 20 GWh by 2028 |

| Samsung SDI | 7.5 | 2021 | Göd Plant 2, Hungary | Investment €740 million. Investment incentives €108 million. In partnership with Mercedes-Benz |

Source: Based on AMS (2021b), Harrison (2021), various news reports and company press releases

Table 10: Hungarian- South Korean Economic Relations

(in billions of USD, 2021)

| Imports | 4.2 | Up 7.2% |

| Exports | .6 | Up 24.7% |

| Bilateral Trade | 4.8 | Up 9.1% |

Source: HIPA, KOTRA

Table 11: South Korean Investor community in Hungary

| Number of businesses | 260-plus |

| Number of employed | 20,000-plus |

| Share of total FDI stock | 5.5% |

Source: HIPA, KOTRA

Table 12: Investment and production status of

SK IE Technology’s battery separator plants

| Location | CAPA (mil.m2) | Start of investment | Start of mass production |

| KOREA (Jeungpyeong, Changzhou) | 520 | ||

| China 1st (Changzhou) | 340 | Jun 2018 | Q4 2020 |

| Poland 1st (Silesia) | 340 | Nov 2018 | Q3 2021 |

| China 2nd (Changzhou) | 170 | Apr 2019 | Q1 2021 |

| China 3rd (Changzhou) | 170 | Oct2019 | Q1 2022 |

| Poland 2nd (Silesia) | 340 | Oct 2020 | Q1 2023 |

| Poland 3rd (Silesia) | 430 | Mar 2021 | Q4 2023-q2 2024 |

| Poland4th (Silesia) | 430 | Mar 2021 | |

| Total | 2.730 |

Source: SKinno News

Table 13: The Largest Suppliers in the Automotive Sector in Slovakia

| Company Name | Country | Sales Revenue 2020 (EUR) | Employees 2020 |

| Mobis Slovakia | South Korea | 1,473,631 | 2,047 |

| Schaeffler Slovensko | Germany | 1,131,219 | 10,096 |

| Continental Matador Rubber | Germany | 1,089,290 | 3,205 |

| SAS Automotive | Germany | 909,870 | 596 |

| Faurecia Automotive Slovakia | France | 863,542 | 2,504 |

| Continental Matador Truck Tires | Germany | 585,016 | 1,518 |

| ZF Slovakia | Germany | 479,221 | 3,215 |

| Hanon Systems Slovakia | South Korea | 405,255 | 734 |

| Yura Corporation Slovakia | South Korea | 381,053 | 1,630 |

| Adient Slovakia | USA | 345,639 | 2,578 |

| Continental Automotive Systems Slovakia | Germany | 340,809 | 1,236 |

| ZKW Slovakia | Austria | 336,018 | 2,398 |

| Lear Corporation Seating Slovakia | USA | 333,565 | 1,602 |

| Magneti Marelli Slovakia | Italy | 298,192 | 681 |

| ArcelorMittal Gonvarri SSC Slovakia | Luxembourg | 264,515 | 134 |

| TRW Automotive (Slovakia) | USA | 256,676 | 633 |

| HBPO Slovakia | Germany | 244,408 | 215 |

| Sungwoo Hitech Slovakia | South Korea | 211,985 | 651 |

| Visteon Electronics Slovakia | USA | 200,339 | 504 |

| Panasonic Industrial Devices Slovakia | Japan | 198,867 | 1,712 |

| Hyundai Transys Slovakia | South Korea | 197,259 | 380 |

| Leoni Slovakia | Germany | 191,978 | 2,348 |

| Inteva Products Slovakia | Netherlands | 190,790 | 765 |

| Magna PT | Canada | 186,860 | 705 |

| Matador Automotive Vráble | Slovakia /Portugal | 176,734 | 1,181 |

| U-Shin Slovakia | Japan | 175,070 | 1,334 |

| Iljin Slovakia | South Korea | 160,734 | 274 |

Source: SARIO, Trend Top 2020

References

[1] Sass, M. Mihalyi, “Introduction to the Special Issue on the Internationalization of Central and Eastern European Firms,” Acta Oeconomica 69, no. S2 (2019): 5–9.

[2] Doing Business 2020, Retrieved from: worldbank.org., 2.07.2024.

[3] Investment Climate in Czechia, Investment and Business Development Agency – CzechInvest , available on: www.czechinvest.org , p.5.

[4] “Incentives which were granted from April 1998 to 15 August 2012,” Czechinvest (2012), http://www.czechinvest.org/investicni-pobidky-nove.

[5] UNCTAD (2021), “World Investment Report, Investing in sustainable recovery,” UNCTAD/WIR/2021.

[6] Jaroslaw M. Nazarczuk and Stanislaw Uminski, “The Impact of Special Economic Zones on Export Behaviour: Evidence from Polish Firm-Level Data,” Ekonomie 21, no. 3 (2018): 4–21.

[7] UNCTAD (2021), World Investment Report, Investing in sustainable recovery, UNCTAD/WIR/2021.

[8] PAIH. Why Poland. Polish Investment and Trade Agency.

[9] U.S Department of State, “2023 Investment Climate Statements: Czechia,” https://www.state.gov/reports/2023-investment-climate-statements/ Poland /.

[10] Doing Business (2021), Retrieved from: worldbank.org, 2.07.2024.

[11] “Investment incentives,” Polish Investment & Trade Agency, https://www.paih.gov.pl/en/why_poland/investment_incentives/.

[12] European Commission (2022), Publications Office of the European Union, Luxembourg, Analysis of the recovery and resilience plan for Poland, Commission Staff Working Document.

[13] Rutkowski, E., J. Marszałkowski, and S. Biedermann, “The Game Industry of Poland-Report 2020,” Polish Agency for Enterprise Development: Warszawa (2021).

[14] Antaloczy, K., Birizdo, I., Sass, M., Regional Investment Promotion to Handle the Consequences of the COVID Pandemic – The Case of Tatabanya. Manuscript, ELKH KRTK Institute of World Economy, Budapest (2021).

[15] Eurostat/Comext. Eurostat International Trade Database [Dataset], https://ec.europa.eu/eurostat/comext/newxtweb/ (accessed June 29, 2024).

[16] Michalski, B., “EU-Korea FTA and Its Impact on V4 Economies. A Comparative Analysis of Trade Sophistication and Intra-Industry Trade,” Comparative Economic Research 21, no. 1 (2018), pp. 523, https://doi.org/10.2478/cer-2018-0001.

[17] Mazur, G. and M. Takemura, “The evolution of merchandise trade between the Eastern and Central Europe Group countries and Japan in the 21st century,” Journal of International Studies 13, no. 3 (2020).

[18] Myant M., “Why are wages still lower in eastern and central Europe?,” ETUI Working Paper 2018.01, https://www.etui.org/Publications2/Working-Papers/Why-are-wages-still-lower-in-eastern-and-central-Europe 10.2139/ssrn.3112152.

[19] Éltető, A. and Szunomár, Á., “Ties of the Eastern and Central Europe Countries with East Asia. Trade and Investment, Centre for Economic and Regional Studies,” Working Paper, no. 214 (2015), Institute of World Economics, Centre for Economic and Reginal Studies Hungarian Academy of Sciences.

[20] https://www.bestmag.co.uk/gs-yuasa-first-overseas-lithium-ionbattery-plant-start-operations-hungary/, published on 23 October 2019.

[21] https://www.electrive.com/2021/02/24/samsung-sdi-expands-battery-production-in-hungary/

[22] Chris Randall, “SK Innovation Subsidized for Hungarian bettery plant,” Electrive, July 20, 2021, https://www.electrive.com/2021/07/20/sk-innovation-subsidized-for-hungarian-battery-plant.

[23] https://www.ft.com/content/5e896f2e-faf2-4d64-bf73- b04bcbbf55d8, published on August 12, 2022.

[24] J. Kastner, “South Korean arms find interest in Europe amid Ukraine war,” Nikkei Asia, September 9, 2022, https://asia.nikkei.com/Business/Business-Spotlight/South-Korean-arms-find-interest-in-Europe-amid-Ukraine-war.

[25] See the activities of the Business Council for Sustainable Development in Hungary, https://bcsdh.hu/category/news/.

[26] S. Sang-ho, “KAI signs USD 3 bln deal with Poland to export 48 FA-50s,” Yonhap News Agency, July 28, 2022, https://en.yna.co.kr/view/AEN20220728003151325?section=national/defense.

[27] J. Kastner, “South Korean arms find interest in Europe amid Ukraine war,” Nikkei Asia, September 9, 2022, https://asia.nikkei.com/Business/Business-Spotlight/South-Korean-arms-find-interest-in-Europe-amid-Ukraine-war.

[28] “Polish defence minister approves deal to buy tanks, howitzers from SouthKorea,” PolskieRadio.pl, August 27, 2022, https://www.polskieradio.pl/395/7784/artykul/3026609,polishdefence-ministerapproves-deal-to-buy-tanks-howitzers-from-south-korea.