Introduction

China is making great progress toward a cleaner energy future as it transitions to green energy and remains one of the leading countries in the energy transition sector. This energy transition reflects on many aspects of China’s economic relations with other nations, especially with Russia. Russia was the top supplier of oil to China in 2023 and until now. According to data from China’s General Administration Customs, “China’s crude oil imports from Russia, which include supplies sent via pipelines and the sea, were 9.26 million metric tons last month, or 2.25 million barrels per day (bpd).”[1] Russia strengthened its position as China’s leading oil supplier for a full year, with April marking the 12th month in a row. This dominance is fuelled by a 30% increase in volumes compared to last year, likely due to attractive discounts offered by Russia. Meanwhile, Saudi Arabia’s exports to China fell by a quarter following an increase in their prices.

Although it is difficult to fully realize, China’s energy policy has largely been driven by the objective of energy independence. By replacing coal with domestically obtained renewable energy, the power sector is rapidly decarbonizing; by 2050, domestically produced coal will mostly suffice for the remaining coal demand segments. The use of gas and oil, however, will still be dependent on imports. Even though oil consumption will have dropped by half by 2050 from its peak in 2027, 84% of its use will still come from imports due to its use in petrochemicals and heavy transportation (shipping and aviation). Natural gas consumption is expected to stay high, with 58% of it coming from imports and a little decline from 2023 levels in 2050.[2]

To address this subject, the following analysis examines the most important indicators of China’s energy transition and its future determinants. It also provides answers to the questions of how the Russian economy might be affected by China’s energy transition and what Russian mitigation options are.

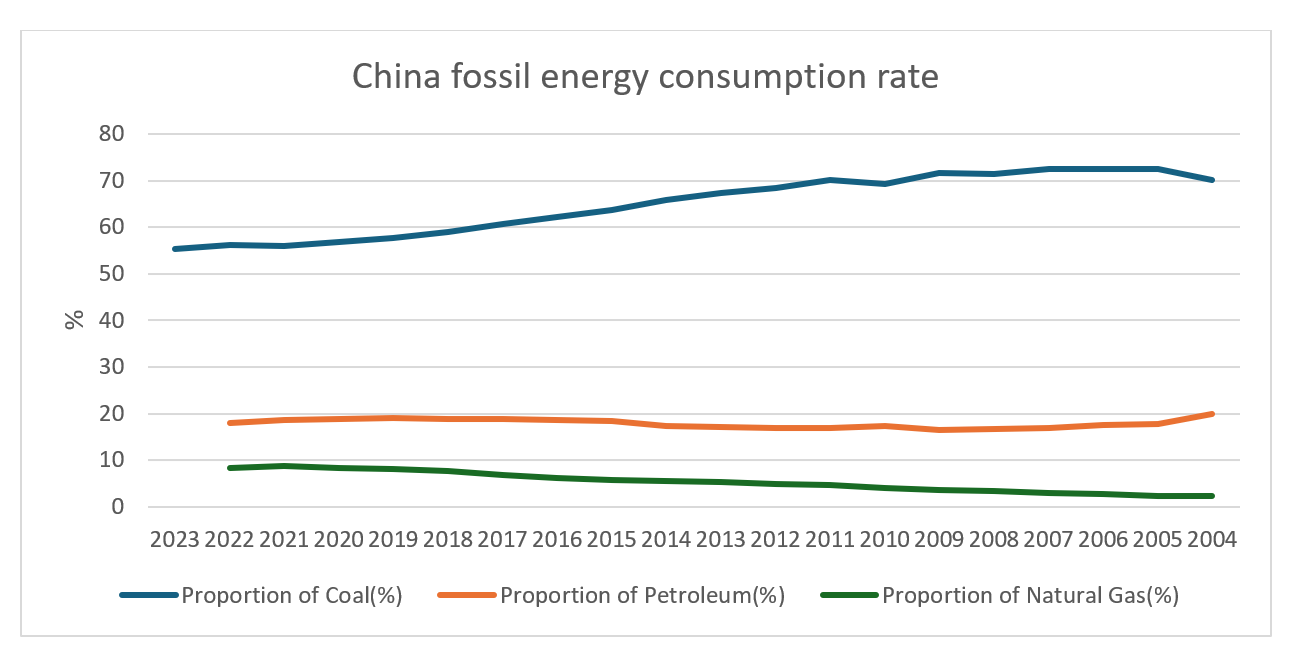

China’s energy transformation: indicators and implicationsThere are several indicators of China’s energy transition.[3] The figure below shows how China’s fossil fuel consumption has been gradually declining, with the rise in the use of natural gas replacing coal. While there has been a decrease in oil consumption, as the figure shows, this is due, among other significant factors, to energy transition programs in favor of new and renewable energy.

Source : “National Data,” National Bureau of Statistics of China, https://data.stats.gov.cn/english/easyquery.htm?cn=C01

Despite the ongoing energy transformation in the Chinese economy, there are factors that will determine this transformation in the next few years:

All the above variables show that the energy transformation in the Chinese economy does not depend on local factors and determinants alone; international economic trends, the stability of the global economic environment, and the levels of technological competition will exert additional influences on the acceleration of the energy transformation in the Chinese economy in the future.

How will Russia be affected by China’s energy transformation?However, this reliance on gas and oil imports creates a difficult position with Russia. Even though China presently sources most of its oil from Russia, China’s shift to renewable energy will eventually result in a decline in the country’s overall oil consumption. This implies that Russia’s profitable oil shipments to China will probably stop eventually. Even though China is promoting renewable energy at home, this could hinder future growth in Russian gas exports, even if there will still be a need for imported gas. Russia’s energy exports to China face an uncertain future as the country emphasizes energy independence and a cleaner future.

Revenue Loss

Russia relies heavily on oil and gas exports, with China being its largest single customer.[4] A significant decline in Chinese demand would result in a substantial loss of export earnings, which are a key component of Russia’s GDP. This could translate to:

- Reduced Government Budgets: Lower revenue would force the Russian government to make significant cuts in public spending, potentially impacting vital social programs like healthcare and education.

- Decreased Investment: Reduced government spending could ripple through the economy, hindering investment in key infrastructure projects and stifling economic growth.

- Currency Devaluation: A decline in export revenue could weaken the Russian ruble, leading to inflation and further economic instability.

China’s transition away from oil will inevitably lead to a decline in demand. This could significantly impact Russia’s export revenue, a major pillar of its economy. Lower export volumes could lead to a reduction in government budgets, investment, and possibly economic instability. Faced with a shrinking Chinese market, Russia might seek alternative markets for its oil. This could involve strengthening ties with other Asian economies or exploring new partnerships in Africa or Latin America. Alternatively, Russia may choose to deepen its economic and political cooperation with China, potentially creating a more strategically aligned bloc. A decline in Chinese oil demand could push down global oil prices. This would negatively affect Russia’s energy revenue, potentially making it more difficult for the country to finance social programs and military modernization. Russia’s influence within the Organization of the Petroleum Exporting Countries and its allies (OPEC+) could become crucial in managing production levels to maintain price stability.[5]

Price Pressures

A decline in Chinese oil demand could trigger a global oil price slump with significant consequences for Russia:

- Reduced Energy Income: Lower oil prices would negatively impact Russia’s energy income, hampering its ability to fund vital programs like military modernization and social welfare.

- OPEC+ Influence: Russia’s influence within OPEC+ will be crucial in managing production levels to maintain price stability.[6] However, conflicting interests with other member states, particularly those with lower production costs, could complicate this strategy.

- Mitigating strategies for Russia

Russia’s strategies to mitigate the Chinese energy shift depend on several factors, including domestic economic diversification, opening new markets for the Russian energy sector, especially for economies with a high dependence on fossil energy, and other alternatives available in the medium term.

4-1 Diversification

Diversification of oil export markets is a crucial strategy for oil-dependent economies like Russia to reduce their vulnerability to price fluctuations and political pressures. Here’s a breakdown of why Russia might consider this approach, focusing on the potential targets mentioned:

4-2 Fast-growing Southeast Asian economies

- High energy demand: Southeast Asia is experiencing rapid economic growth, which means that there is a growing demand for energy. Russia can position itself as a reliable supplier to meet this demand.

- Infrastructure development: Building pipelines and export terminals would be key to facilitating these oil exports. Russia could collaborate with Southeast Asian countries on infrastructure projects to improve efficiency and mutual benefit.

- Trade agreements: Free trade agreements or preferential trade deals could incentivize trade and make Russian oil more competitive in the region.

4-3 Energy-hungry countries like India

- Diversifying supply sources: India, a major oil importer, is actively seeking to diversify its oil imports to reduce dependence on any single supplier. Russia can offer itself as a credible alternative.

- Competitive prices: Russia can be a price-competitive supplier, especially compared to some other major oil producers. Highlighting this advantage can be key to attracting Indian buyers.

- Reliable supply: Russia has a history of being a reliable oil supplier, and emphasizing this track record can give it an edge over other potential partners.

4-4 Focus on LNG

While oil demand might decline, China’s demand for natural gas is projected to grow. Russia, a major natural gas producer, could capitalize on this by increasing its Liquefied Natural Gas (LNG) exports to China, offering a cleaner alternative fuel source. Russia should also conduct a comprehensive market analysis to identify potential alternative buyers, considering both the long-term economic potential and the political stability of these markets. The feasibility of forging new partnerships needs to be evaluated, considering infrastructure requirements and potential political complexities. Strengthening ties with China offers temporary relief but requires careful negotiation of long-term trade deals to ensure favorable terms and a stable income stream during the transition.

Therefore, close cooperation with OPEC+ and strategic production cuts might be necessary to maintain oil prices at a level that sustains Russia’s economic well-being. However, Russia needs to be prepared for potential disagreements within the organization and develop alternative strategies to mitigate the impact of price fluctuations.

4-5 Challenges and considerations

- Logistics: Transporting oil to Southeast Asia can be expensive due to the long distances. Russia would need to find cost-effective transportation solutions.

- Competition: Other oil producers, including members of OPEC, will also be vying for market share in Southeast Asia and India. Russia would need to develop a competitive strategy.

- Political landscape: Russia’s political relationship with some Southeast Asian countries may not be as strong as with traditional partners. Building diplomatic bridges would be essential.

Overall, diversification of oil export markets is a complex undertaking, but it offers significant potential benefits for Russia. By carefully considering the opportunities and challenges presented by Southeast Asia and India, Russia can develop a successful diversification strategy that strengthens its economic security in the long run.

ConclusionIn conclusion, China’s energy transition presents both challenges and opportunities for Russia. While a decline in Chinese oil demand could trigger a significant economic shock, proactive strategies like diversification, increased LNG exports and a calculated partnership with China can offer some mitigation. Ultimately, the key to Russia’s long-term success lies in embracing the global shift toward clean energy by developing its own sustainable energy infrastructure. The future of the Russia-China energy relationship and the viability of Russia’s economic model, will depend on their ability to adapt to this evolving energy landscape.

[1] “Russian is China’s top oil supplier for the 12th month in April,” BusinessLine, May 20, 2024, https://www.thehindubusinessline.com/news/world/russian-oil-continues-to-be-chinas-top-choice-in-april/article68195360.ece

[2] “China’s energy transition outlook gives insights into China’s complex energy landscape and its enormous green energy shift,” DNV, April 23, 2024, https://www.dnv.com/news/china-energy-transition-outlook/.

[3] “National Data,” National Bureau of Statistics of China, https://data.stats.gov.cn/english/easyquery.htm?cn=C01

[4] “RPT China’s imports of Russian oil near record high in March,” Reuters, April 23, 2024, https://www.reuters.com/business/energy/chinas-imports-russian-oil-near-record-high-march-2024-04-20/

[5] OPEC, “Several OPEC+ countries announce extension of additional voluntary cuts of 2.2 million barrels per day for the second quarter of 2024,” https://www.opec.org/opec_web/en/press_room/7305.htm.

[6] Ibid.