President Donald Trump’s visit to the Kingdom of Saudi Arabia, the State of Qatar, and the United Arab Emirates from May 13 to 16 marked his first official overseas visit since taking office on January 20, 2025. It is obvious that this visit has many important connotations, as it is described as “historic,” not only because it preceded his visit to America’s traditional allies in Europe or neighboring countries, but also because it came before his expected trip to Israel, Washington’s strategic partner in the Middle East.

The first of these connotations is related to the “high economic and strategic importance of these countries to the United States,” as emphasized by the U.S. Deputy Special Envoy to the Middle East.[1] In addition to that, the significant influence of the Gulf states in global energy markets cannot be overlooked, not to mention the pressing economic needs within the United States and the global geopolitical developments.[2] The U.S. is also increasingly counting on the growing international role of the three Gulf states, or what is called the “Gulf Moment,”[3] to help achieve regional and international stability.[4]

Ahead of his visit to Saudi Arabia, President Trump announced that his country will adopt the term “Arabian Gulf” or “Gulf of the Arabs” instead of “Persian Gulf,” signaling strong “symbolic” support for the Arab Gulf states.[5]

While Trump’s Gulf tour covered a wide range of important political, economic, and strategic issues of mutual interest—notably U.S.-Gulf economic partnership, energy policies, U.S.-Iran nuclear negotiations, defense deals and security guarantees, the Gaza war, the Syrian file, the Abraham Accords, and the Ukraine war—the 5th US-GCC Summit, held on May 14 in Riyadh, also discussed these topics,[6] giving a strong boost to the strategic partnership between the two sides.

This study, structured around political and economic issues, seeks to analyze the implications and outcomes of President Trump’s Gulf visit, with a special focus on the announced investment deals and shared visions between the United States and the three Gulf countries.

1- An Overview of Gulf–US Economic Relations

At a time when Gulf–U.S. relations are thriving across all levels, a closer look at the development of their economic ties reveals how much trade and investment ties contribute to strengthening these relations. These ties not only shed light on the importance of President Trump’s current visit to the region for both sides but also offer valuable insight into the future trajectory of these relations during Trump’s second term.

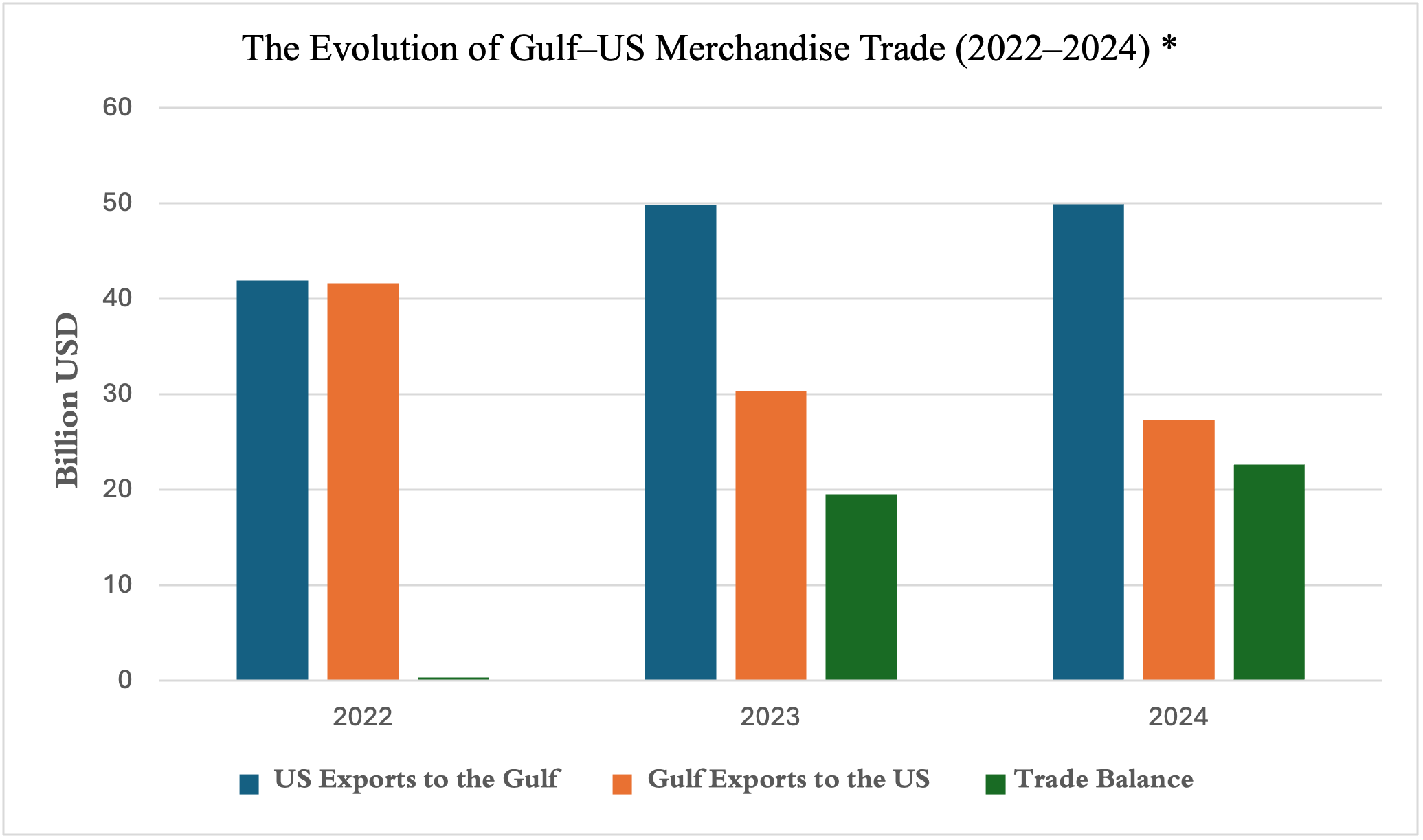

The following figure shows the evolution of Gulf–U.S. trade[7] between 2022-2024.

* Source: www.trademap.org

While the previous figure shows that Gulf merchandise trade with the United States was around $80 billion over the past three years, the trade balance, in terms of value, has consistently tilted in favor of the U.S. Additionally, the structure and composition of bilateral trade between the two sides reflect the relative importance of Gulf oil exports to the U.S. market, contrasted with the relative importance of U.S. exports to the Gulf made up of vehicles, mechanical devices, electrical equipment, and aircraft.

Despite the high transportation costs due to the geographic distance between the Gulf and U.S. markets, bilateral trade data[8] reveals that Gulf imports of American-manufactured goods accounted for about 6.2% of its total global imports, while U.S. exports to the Gulf made up about 2.5% of its total global exports (based on 2023 data).

The table below shows key indicators of the value of U.S. merchandise trade with the economies of the United Arab Emirates, Saudi Arabia, and Qatar in 2024.

| Merchandise Trade | US Exports | US Imports | |

| United Arab Emirates | 26.9 | 7.8 | |

|

|

13.1 | 13.1 | |

| Qatar | 3.8 | 1.8 |

Source: Trade Map, www.trademap.org.

In the case of the UAE, which is America’s largest trading partner in the Middle East and North Africa, bilateral trade with the U.S. has not only flourished in volume but also evolved in diversity. Trade between the two countries reached nearly $40 billion in 2024, up from around $12.7 billion in 2010, encompassing many goods important to both markets. It is noteworthy that the UAE has become the world’s second-largest exporter of aluminum, a metal that is particularly important to the U.S. market.

The U.S. trade surplus with the Gulf countries in general, and with each of the three countries, explains why these countries were treated within the minimum reciprocal tariffs announced by President Trump in early April 2025. While some countries were subjected to tariff rates of nearly 70%, the three Gulf states[9] were subjected to a much lower rate of 10%.

What applies to Gulf-U.S. trade indicators also applies to mutual investment flows, technical cooperation, and long-term alliances and economic partnerships. A quick look at the UAE-U.S. investment relationship reveals its strategic depth and strength. Its key highlights include:[10]

- UAE investments in the United States totaled approximately $3.7 billion between 2018 and 2023, while U.S. investments in the UAE during the same period reached around $9.5 billion.

- Technology cooperation is the most prominent in the UAE’s economic ties with the United States, with major Emirati direct investments in the U.S. directed toward renewable energy, telecommunications, energy, real estate, software services, and information technology. On the other side, artificial intelligence represents a leading sector for U.S. investments in the UAE, noticeably with Microsoft’s recent $1.5 billion strategic investment in the Emirati AI group G42.

Similarly, Saudi and Qatari direct investments in the U.S. have seen strong growth. According to the U.S. Department of State,[11] Saudi investments reached $9.5 billion in 2023, with a focus on transportation, real estate, and the automotive industry. The Saudi Public Investment Fund (PIF) has also expanded its portfolio in ride-sharing companies, gaming firms, and electric vehicle manufacturers.[12]

The abovementioned indicators show the vital role of intra-direct investments in deepening Gulf-U.S. strategic ties, alongside flourishing trade exchange. Added to this is the significance and influence of both parties in shaping the global energy market, traditional and renewable energy alike, and the strategic maritime position of the Arabian Peninsula on key East-West trade routes, and the growing influence of the three Gulf states in heated global economic debates. These include sovereign debt, reforms to the international monetary system, and the emergence of new alliances in the Global South. All these factors have given the Gulf countries exceptional importance within the new American administration’s foreign policy agenda and also explain why these countries remain a top priority for both Trump’s first and second administrations.

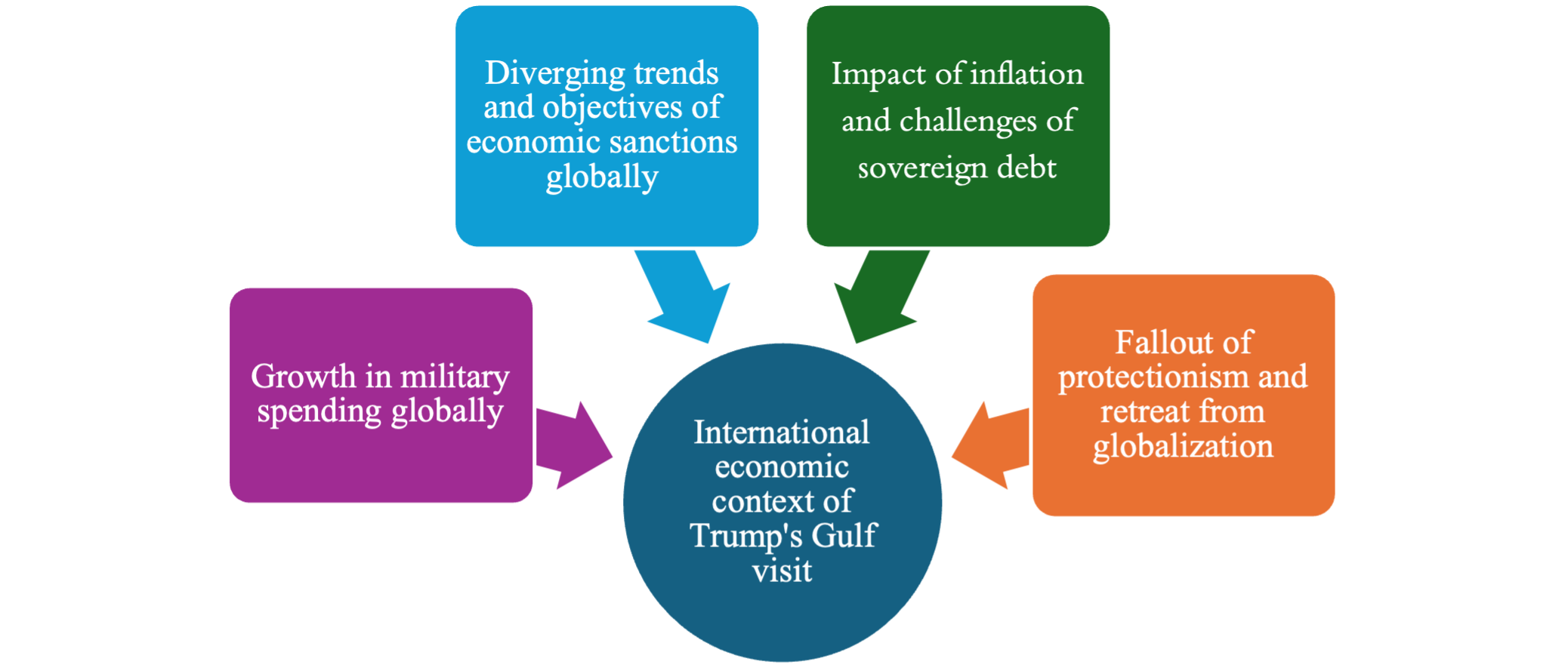

In any case, understanding the international economic context surrounding President Trump’s visit to the Gulf region sheds further light on the significance of the trip and its wide-ranging implications for the global economy. This is precisely what the following paragraphs aim to address.

2- The Significance of the International Economic Context of Trump’s Gulf Visit

There are several factors that shape the international context and define the global economic landscape during President Trump’s visit to the Gulf region. These factors give the visit an exceptional importance. First and foremost, protectionism, which has reached record levels, signals a corresponding retreat from globalization and enormously affects the sovereign debt crisis and the persistent pressures of global inflation.

- The Fallout of Protectionism Threatens the Rules of Globalization

Amid the wave of tariffs introduced by President Trump to protect American jobs and industries and to fund the extension of his 2017 tax cuts, the long-standing rules of international free trade that have been in place since the 1940s are now witnessing a severe shock. This shock is reshaping global trade relations, and some observers argue that the World Trade Organization itself is now in danger.[13] Despite global trade reaching approximately $33 trillion and growing at a rate of 3.7% in 2024, driven by the expansion of the services sector and the efforts of developing economies to boost exports (according to UNCTAD), the overall outlook for global trade has grown increasingly gloomy.

The disruption began when President Trump imposed sweeping 25% tariffs on goods from Mexico, Canada, and China.[14] These were later suspended for Mexico and Canada but remained in force against China. On March 12, 2025, the U.S. expanded its trade measures by imposing 25% tariffs on all steel and aluminum imports,[15] regardless of country of origin.[16] Then, in early April 2025, a major shock hit global trade[17] when the U.S. introduced reciprocal tariffs on nearly all its trading partners, with rates determined by the state of the bilateral trade balance.[18]

As Southeast Asian nations—the new global hub of manufacturing—scramble to secure alternative trade partners and strengthen regional blocs, and as Chinese influence deepens across the region, companies are reconfiguring their investment strategies to shield themselves from protectionist measures. In this changing landscape, global trade routes are being reshaped, whether in the heart of Asia or between South Asia and Europe, passing through the ports of the Gulf region. The India-Europe trade corridor, in particular, is expected to gain special momentum and be redefined within a world marked by protectionist fallout and intensifying competition between major global economic powers.

Adding to the complexity is the rise of economic alliances and South-South cooperation, led by China and exemplified by blocs such as BRICS. These dynamics have further escalated the competition between East and West, introducing new dimensions to the global contest over markets and resources. All these developments suggest that President Trump’s visit to the Gulf comes at a moment when globalization, as it has existed since the mid-20th century, is undergoing a steady decline of its rules, frameworks, and institutions.

- Worsening Sovereign Debt and Persistent Inflationary Pressures

The ongoing global economic challenges resulting from the sovereign debt crisis have spared no country, regardless of its level of development. Many nations now face mounting inflationary pressures alongside a heavy burden of internal and external debt, which continues to worsen in light of the current tariff wars. Tariffs tend to be inflationary in nature, as they increase the cost of imported goods as well as production costs, particularly in industries reliant on foreign materials and components.

Taking the U.S. economy as an example, federal debt is reaching unprecedented levels and it is poised to exceed its World War II-era peak.[19] Similarly, the European Union is showing early signs of a financial crisis, with several countries, including France, Italy, Greece, Belgium, Spain, and Portugal, facing debt levels far above the European average due to excessive borrowing.[20] Meanwhile, China’s real estate crisis has reached a dangerous stage,[21] and many of the world’s poorest nations, especially in Africa, are facing an escalating debt crisis.

In addition to the debt crisis, inflation, which had begun to decline after peaking during the Russia-Ukraine war, now risks resurging due to protectionist policies. As a result, interest rates may remain high for longer than previously expected, driven by persistent instability in global trade. While global inflation is projected to decline to 3.4% in 2025, actual results may be more troubling, with central banks maintaining tighter monetary policies depending on the course of trade negotiations and the possibility of new supply or climate-related shocks.[22]

- Economic Sanctions Complicate the Global Landscape

Beyond global trade volatility and monetary and financial instability, another factor adds to the international significance of President Trump’s visit to the Gulf: the expanding use of economic sanctions. The American sanctions targeting several regional economies, broader Western sanctions on Russia, and various forms of unilateral sanctions are all having varying effects on global energy supply and demand. These sanctions stimulate certain economic sectors while constraining others, increasing the overall complexity of the global economic landscape.

The problem of economic sanctions lies not only in their disruption of global energy and commodity flows but also in the divergence between U.S. and European approaches to sanctions, both in objectives and enforcement tools. This discrepancy creates additional complications for multinational corporations and worsens already fragile global supply chains, which are still suffering from protectionist pressures.

This contrast is starkly illustrated in the way the United States has focused on restricting Iran’s maritime oil and petrochemical trade, particularly targeting Chinese buyers,[23] while the European Union has adopted a more aggressive stance toward Russian oil and gas, despite the economic losses it has incurred. Europe has shifted from pipeline imports to relying on shadow fleets for energy transport. These differences in sanctions strategy further widen the gap between the U.S. and Europe and cause a rift across the Atlantic with broader implications for the world at large.

- The Global Surge in Military Spending

The new era of economic rivalry is not only reshaping trade and investment patterns, but it is also fueling a sharp rise in global military spending. This trend is exemplified by NATO’s recent discussions[24] on increasing defense budgets, potentially reaching 5% of member countries’ GDP by 2032, which is the largest military spending increase since the Cold War.

This record increase in military spending is in line with recent data from the Stockholm International Peace Research Institute (SIPRI),[25] which highlights a 155% increase in European arms imports between 2020 and 2024. The escalation is a direct result of the Russia-Ukraine war and heightened uncertainty surrounding the future of U.S. foreign policy. The same data shows the U.S. now accounts for 43% of global arms exports, while Russia’s share has dropped by 64%.

In a world suffering from excessive protectionism, collapsing globalization frameworks, inflationary pressures and mounting debt, sanction regimes varying in objectives and directions, and rapidly expanding military budgets, there is an urgent need to revive the spirit of international cooperation. Such a world requires bold deals that can bring it back to the path of growth. In this context, Trump’s visit to the Gulf assumes exceptional significance. So, what about the major deals that were announced?

3- Major Deals and Aspirations for Development: A Closer Look at the Gulf-U.S. Agreements and Their Economic Goals

The huge economic deals announced before and during President Trump’s visit to the three Gulf states far outweigh any other dimension of the trip in terms of strategic impact. These deals can be called historic due to their value. However, some important parts of them, particularly those signed with the UAE and Saudi Arabia, focus on technology, artificial intelligence, and Gulf investment in future-oriented sectors of the U.S. economy. This underscores not only the depth of Gulf-U.S. ties but also the Gulf development ambitions driving these deals.

It is perhaps useful to take a broad look at the most important economic deals announced between the two sides.

- Key Saudi-American Deals:

As part of broader plans, announced[26] in January 2025, for Saudi investments totaling $600 billion in American manufacturing industries, products and services, the most prominent economic deals signed during President Trump’s visit to Saudi Arabia, in addition to military agreements, which will be covered later, included:

- NVIDIA signed a deal[27] to supply its AI chips.

- AMD entered into a similar $10 billion partnership with a Saudi company, while Amazon is developing an AI Zone with an investment plan exceeding $5 billion.

- Google is backing a new $100 million AI fund, alongside a $20 billion data deal with the American company Supermicro.[28]

- Key Qatari-American Deals:

Following Qatar’s announcement of a $1.2 trillion investment pledge,[29] deals worth over $243.5 billion were signed during President Trump’s visit to the country. These agreements included:

- Qatar Airways signed a $96 billion deal[30] to purchase up to 210 aircraft from Boeing, marking the largest-ever order for wide-body aircraft and the largest single order for 787s.

- The Qatar Investment Authority plans to invest an additional $500 billion in the United States over the next decade, targeting sectors such as AI, data centers, and healthcare, all aligned with the U.S. reindustrialization agenda.

- Key Emirati-American Deals:[31]

In addition to the UAE’s announcement of $1.4 trillion in investment commitments in the U.S. market over the next ten years, President Trump’s visit to the UAE saw the signing of direct deals[32] worth $200 billion across several leading economic sectors, including:

- A commitment from Etihad Airways to invest $14.5 billion in 28 aircraft from Boeing.

- A $60 billion plan between ADNOC and leading American oil companies to expand oil and natural gas production.

- A $4 billion primary aluminum smelter project to be developed by Emirates Global Aluminum in Oklahoma, along with additional investments by the company and the UAE’s Tawazun Council in a gallium project aimed at bolstering the U.S. supply of critical minerals.

- In the technology sector, American company Qualcomm announced plans to help develop a new “global engineering hub” in Abu Dhabi focused on AI and data centers.

- A new AI complex was announced to be built by UAE-based G42 in partnership with several American companies. The complex will include 5 gigawatts of AI data center capacity, providing a regional platform for large-scale or cloud computing service providers.

- Amazon Web Services is set to collaborate with UAE telecom provider e& and the UAE Cyber Security Council to enhance the country’s public cloud services.

While these deals underscore the sectors of strategic interest to the Gulf states, the key question remains: how can these agreements accelerate development by powering the engines of Gulf growth?

The direct answer to this question lies in the fact that a strengthened and expanding framework for Gulf-American economic cooperation can, with targeted additional efforts, help address lingering trade issues between the two sides, particularly those stemming from Trump’s tariff policies. Moreover, the acceleration of Gulf investment deals in U.S. markets is a calculated bet on high returns, which Gulf economies will benefit from once realized, especially since these investments are directed toward high-growth sectors closely linked to global technological transformations. This visit is also expected to yield greater alignment in energy market outlooks between producers and consumers in the fossil fuel sector while accelerating the transition to renewable energy. Additionally, further American efforts are anticipated to reduce risks in the region’s logistics sector, paving the way for increased commercial prosperity.

It is also crucial not to overlook the importance of this visit and the announced investments in bolstering the Gulf’s technological capabilities. These include expanding existing capacities, particularly in the UAE, for data centers and cloud computing, as well as strengthening the region’s position within global digital technology supply and value chains. The ultimate ambition is to localize parts of the production, operations, and export chains within Gulf economies. Underscoring the significance of this visit in embedding technology across the Gulf is the fact that the United States is currently considering allowing the UAE to own over one million of NVIDIA’s most advanced chips, potentially positioning the country as the world’s leading hub for this segment of digital technology.[33]

4– The Political and Strategic Implications of President Trump’s Gulf Visit

While the economic dimensions of President Trump’s visit are significant, as outlined above, the visit also carries a wide range of political and strategic implications. From the U.S.-Iran nuclear negotiations to defense deals and security guarantees; from the Gaza war to the Abraham Accords; and from the Syrian file to the China factor, the visit gained additional momentum and is expected to leave a varied impact on these issues. The following points highlight this.

- S.-Iran Nuclear Negotiations

President Trump discussed with GCC leaders the progress of the indirect U.S.-Iran nuclear negotiations that have been underway since April 12, aiming to reach a new agreement on Iran’s nuclear program. He also listened to their perspectives on the matter. Unlike the 2015 negotiations that led to the Joint Comprehensive Plan of Action (JCPOA), the current talks reflect a shared interest between the U.S. and GCC states in reaching a new nuclear agreement that would spare the region further turmoil and instability stemming from a potentially dangerous confrontation between Iran (and its allies) on one side and the United States and Israel on the other. In addition to the mediation efforts being undertaken by the Sultanate of Oman between the U.S. and Iran, both the UAE and Saudi Arabia have played roles in facilitating message exchanges, communications, and de-escalation between the two sides.[34]

In this context, the Saudi Foreign Minister, on the sidelines of the Fifth GCC-US Summit, affirmed his country’s full support for the U.S.-Iran nuclear negotiations and expressed hope that “these talks will lead to positive outcomes that contribute to enhancing regional stability.”[35]

During Trump’s visit, several media reports confirmed that the United States had presented a new nuclear agreement proposal to Iran during the fourth round of talks in Muscat (May 11, 2025).[36] From Doha (on May 15), President Trump announced that Iran had agreed, to some extent, to the terms of the U.S. proposal and expressed optimism that an agreement was within reach.[37]

- Defense Deals and Security Guarantees

Advanced military equipment and services, including next-generation fighter jets, air defense systems, drones, space capabilities, and information and communications systems, topped the list of Gulf states’ orders from the United States. In this context, the largest Saudi-American defense agreement in history was signed, valued at approximately $142 billion. Notably, on May 2, the United States approved a $3.5 billion missile deal with Saudi Arabia, including 1,000 AIM-120 medium-range air-to-air missiles.[38]

In Qatar, America’s second-largest foreign partner in military sales, two agreements worth $3 billion were signed to supply the country with MQ-9B unmanned aerial systems, among the most advanced multi-mission drone systems, as well as American-made FS-LIDS counter-drone systems. Qatar thus became the first international buyer of this defensive technology. Additionally, Qatar and the United States signed a statement of intent to strengthen their security partnership, valued at over $38 billion, which includes joint investments in Al Udeid Air Base and support for Qatar’s air defense and maritime security capabilities.[39]

Just before President Trump’s regional tour, the U.S. Department of State approved a $1.4 billion defense deal with the United Arab Emirates, a key American defense partner, covering modern military equipment and weaponry, particularly for its air force.[40]

There is no doubt that these defense agreements with the three GCC states renew America’s commitment to Gulf security, a commitment that had been called into question under previous U.S. administrations. The agreements restore the Arabian Gulf region to the forefront of U.S. global geopolitical priorities after a period of diminished attention.[41] President Trump’s visit to Al Udeid Air Base in Qatar, the largest U.S. military base in the region, carried symbolic weight in reaffirming American dedication to the Gulf’s security and stability. Trump himself underscored these points when he addressed U.S. forces at the base, stating, “We nearly lost the Middle East because of the Biden administration’s policies,” and affirming that the United States would continue to provide collective security, saying, “We will protect the Middle East.”[42]

- Gaza War

Discussions focused on the urgent need for a ceasefire in Gaza, the release of Israeli hostages held by Hamas, and the delivery of food, medical, and humanitarian aid to the territory, which is facing the worst humanitarian crisis in modern history. A new U.S.-controlled or U.S.-managed mechanism for aid delivery was proposed.[43]

During their summit in Riyadh, GCC leaders and President Trump discussed the necessity of a phased, full Israeli withdrawal from Gaza, along with securing financial support for the reconstruction of the war-ravaged territory. In this regard, the Saudi Foreign Minister stated that Saudi Arabia and the United States had reached an agreement to end the war in Gaza, which includes a halt to military operations and the release of all Israeli hostages.[44]

Trump’s visit to Qatar on May 14 coincided with a negotiation session in Doha aimed at achieving a ceasefire in Gaza. The talks involved a high-level Israeli delegation, U.S. Special Envoy for the Middle East Steve Witkoff, U.S. Special Presidential Envoy for Hostage Affairs Adam Boehler, and a closed-door meeting including the two American officials, Qatar’s Emir H.H. Sheikh Tamim bin Hamad Al Thani, and indirect participation from Hamas.[45]

While President Trump did not raise, during the GCC-US Summit, the issue of forcibly displacing Gaza’s population, an idea firmly opposed by GCC states, nor the proposal for a U.S.-led temporary or transitional administration in Gaza after the war, he later reiterated during a business meeting in Doha on May 15 his desire for the United States to “take over Gaza and transform it into a freedom zone”. He previously stated his vision to turn Gaza into the “Riviera of the Middle East” after displacing its population.[46] This vision remains a point of contention between the U.S. and GCC countries, who support the Arab plan for Gaza’s reconstruction without displacing its people.

- Abraham Accords

The Abraham Accords were another item on the agenda of Trump’s GCC tour. He urged Saudi Arabia to join the accords and called on the UAE to renew its existing commitments. In a surprising development, Trump also indicated that Syria would eventually join the accords, one of the key topics he raised during his meeting with Syrian President Ahmed Al-Sharaa in Riyadh, on the sidelines of the GCC-US Summit.[47]

- The Syrian File

The issue of reintegrating Syria, under President Al-Sharaa, into the regional and international system, led by GCC states, particularly Saudi Arabia, as well as the normalization of U.S.-Syrian relations, was on the agenda during President Trump’s visit to Riyadh. The much-anticipated and repeatedly teased “very, very big” announcement Trump had promised to make in Saudi Arabia was likely the lifting of sanctions on Syria and his meeting with the Syrian president. This meeting was attended by Saudi Crown Prince Mohammed bin Salman and Turkish President Recep Tayyip Erdoğan, who participated via video link. During his meeting with Al-Sharaa, Trump pledged to normalize relations between the United States and Syria and discussed several key issues, foremost among them the fight against “terrorism”, especially with regard to ISIS, the departure of foreign fighters from Syria, the deportation of Palestinian resistance members, and ensuring the security of the Kurds. According to Reuters, Trump’s announcement that he would lift all sanctions on Syria came as a surprise to some members of his administration.[48]

President Erdoğan’s participation in the Trump-Al-Sharaa meeting indicates that Turkey, alongside Saudi Arabia, played a role in facilitating the U.S. opening toward the new Syrian administration. This American shift toward Syria may also have implications for changing Israel’s “aggressive” behavior toward the country.

- The China Factor

The China factor featured prominently on the agenda of Trump’s regional visit. He aimed to pressure GCC countries, not only the UAE, Qatar, and Saudi Arabia, but all six GCC member states, to distance themselves from Beijing.

Beyond the large-scale, advanced defense deals, the signing of multi-billion-dollar agreements between the United States and both Saudi Arabia and the UAE; the launch of major Gulf investments in artificial intelligence; the announcement of the construction of the largest UAE-U.S. AI complex outside the United States, with a 5-gigawatt capacity in Abu Dhabi; and the establishment of the “U.S.-UAE AI Acceleration Partnership”, all served one overarching objective: to draw the GCC states away from China.[49]

- Ukraine War

During his visits to Saudi Arabia, Qatar, and the UAE, President Trump made a concerted effort to leverage the effectiveness of GCC diplomacy to mediate an end to the Russia-Ukraine war, or at the very least, to encourage both sides to agree to a ceasefire and resume direct negotiations aimed at resolving the conflict. This push comes in light of the limited success of U.S. efforts so far to bring about a ceasefire, let alone end the war. As time runs out, Trump sees the GCC states, especially Saudi Arabia, as a valuable channel of communication with Moscow. Saudi Arabia has already hosted secret talks between the United States and Russia, further cementing its position as a neutral mediator.[50] Meanwhile, the UAE has brokered 15 prisoner exchange deals between Russia and Ukraine as of May 2025, the first of which took place in January 2024. Through these efforts, a total of 4,181 prisoners have been exchanged between the two countries under UAE mediation. The UAE’s success reflects the strong ties of friendship and partnership it maintains with both nations and its status as a trusted intermediary. The UAE Ministry of Foreign Affairs expressed its gratitude to the governments of both the Russian Federation and Ukraine for their cooperation, which contributed to the success of its mediation efforts. It’s also worth noting that in December 2022, the UAE successfully facilitated a prisoner exchange between the United States and the Russian Federation involving two detainees.[51]

During the GCC-US Summit, the Saudi Crown Prince reaffirmed the Kingdom’s readiness to continue its efforts toward reaching a political solution to end the Ukraine crisis. And during his visit to Qatar, President Trump addressed Emir Sheikh Tamim bin Hamad Al Thani directly, stating, “You are helping us bring peace to several regions, such as Russia and Ukraine, and we will see progress on this issue.”

Conclusion

In light of the initial outcomes of the visit, particularly its focus on mutually beneficial deals, enhanced access to mutual markets, and discussions on overcoming trade protectionism and streamlining customs procedures, and given the longstanding strength of GCC-US economic ties over the past decades, it is clear that this visit marks a new milestone in advancing a comprehensive economic partnership between the three GCC states and the United States. Building on this, and considering the visit has been described as historic, working toward a strategic GCC-US partnership that safeguards mutual interests and reinforces the GCC states’ technological standing in an increasingly digital world will not only capture the Gulf moment but also contribute to rebalancing U.S. diplomacy globally and, beyond that, promote development and stability across diverse regions of the world.

[1] “Trump in UAE: US official talks about important messages,” Sky News Arabia, May 15, https://shorturl.at/EiVIi. [In Arabic].

[2] Mohamed Eldoh, “Trump’s Middle East Visit: A Calculated Power Play in the New Geopolitical Normal,” Geopolitical Monitor, May 6, 2025, https://shorturl.at/qWcDF.

[3] Compare: Abdul Khaleq Abdullah, The Gulf Moment in Contemporary Arab History: How Six Gulf States Have Become the New Arab Center of Gravity (Beirut: Dar Al-Farabi, 2018). [In Arabic].

[4] Nabil Fahmy, “Trump Gulf visit: Connotations, Expectations and Hopes,” Al-Shorouk, May 13, 2025, https://2u.pw/zsBqv. [In Arabic].

[5] Matthew Lee, “Trump plans to announce that the US will call the Persian Gulf the Arabian Gulf, officials say,” AP, May 7, 2025, https://shorturl.at/mmHzY.

[6] “Security, economy, and Gaza: Important files at the US-Gulf summit,” Al-Arabiya, May 14, 2025, https://2u.pw/C2qUf. [In Arabic].

[7] This data includes exports and imports of goods for the six Gulf countries: the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman.

[8] See Trade Map data published on its website www.trademap.org.

[9] See: https://www.bbc.com/news/articles/c5ypxnnyg7jo.

[10] The data in this paragraph is taken from the Emirates News Agency (WAM) report: https://2u.pw/JmFii. [In Arabic].

[11] See the U.S. State Department website: https://2u.pw/0r8EN.

[12] See: https://www.bbc.com/news/articles/crk2me7vjxxo.

[13] https://www.nytimes.com/2025/02/14/business/trump-tariffs-world-trade-organization.html.

[14] https://edition.cnn.com/2025/02/01/politics/mexico-canada-china-tariffs-trump/index.html.

[15] https://www.reuters.com/markets/asian-eu-steelmakers-shares-fall-after-trump-escalates-tariffs-2025-02-10/.

[16] It is noteworthy that the United States imports steel and aluminum products with about 23% of its steel needs and about half of its aluminum needs. For more details, see the following link: https://www.ft.com/content/54810a2c-1db7-488b-ab38-7d00c2dcf016.

[17] For more details and repercussions of the shock of Trump’s tariffs on the global economy, see: Trade Crises and Protectionist Storms: The Global Repercussions of Trump’s Tariff Policies, from TRENDS Research and Advisory Publications, April 2025, at: https://2u.pw/colOS. [In Arabic].

[18] https://www.bbc.com/news/articles/c5ypxnnyg7jo.

[19] https://www.bloomberg.com/news/newsletters/2025-02-16/could-the-us-have-a-sovereign-debt-crisis?sref=BtkSCofS.

[20] https://ec.europa.eu/eurostat/web/products-euro-indicators/w/2-22102024-bp.

[21] https://www.bloomberg.com/news/features/2025-02-11/china-s-real-estate-crisis-property-sector-debt-is-getting-worse?sref=BtkSCofS.

[22] https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/MB187_fig2.png.

[23] https://apnews.com/article/iran-sanctions-shadow-fleet-oil-china-trump-d0f677185a09fc1f3392de209670b3d5.

[24] https://www.bloomberg.com/news/newsletters/2025-05-14/nato-discusses-biggest-spending-increase-since-cold-war?sref=BtkSCofS.

[25] https://www.sipri.org/media/press-release/2025/ukraine-worlds-biggest-arms-importer-united-states-dominance-global-arms-exports-grows-russian.

[26] https://www.businessinsider.com/trump-saudi-arabia-trip-deals-tech-middle-east-nvidia-amazon-2025-5.

[27] https://nvidianews.nvidia.com/news/humain-and-nvidia-announce-strategic-partnership-to-build-ai-factories-of-the-future-in-saudi-arabia.

[28] https://www.businessinsider.com/trump-saudi-arabia-trip-deals-tech-middle-east-nvidia-amazon-2025-5.

[29] https://www.bloomberg.com/news/articles/2025-05-14/us-announces-more-than-243-billion-in-deals-with-qatar?sref=BtkSCofS.

[30] https://www.bloomberg.com/news/articles/2025-05-14/us-announces-more-than-243-billion-in-deals-with-qatar?sref=BtkSCofS.

[31] https://www.bloomberg.com/news/articles/2025-05-15/trump-touts-200-billion-in-uae-deals-in-wrapping-mideast-trip?srnd=homepage-middle-east&sref=BtkSCofS.

[32] https://www.reuters.com/world/middle-east/trump-heads-uae-it-hopes-advance-ai-ambitions-2025-05-15/.

[33] https://www.bloomberg.com/news/articles/2025-05-13/us-weighs-letting-uae-buy-over-a-million-advanced-nvidia-chips?sref=BtkSCofS.

[34] Mohamed Eldoh, “Trump’s Middle East Visit: A Calculated Power Play in the New Geopolitical Normal,” Geopolitical Monitor, May 6, 2025, https://shorturl.at/qWcDF.

[35] “Trump in Doha and Historic Deals: Key Developments from Day Two of the U.S. President’s Gulf Tour” [in Arabic], CNBC Arabia, May 14, 2025. https://shorturl.at/i41u1.

[36] Barak Ravid, “Scoop: U.S. presented Iran with nuclear deal proposal,” Axios, May 15, 2025, https://shorturl.at/0l7BD.

[37] “Axios: Trump Administration Presented Iran with Written Proposal on Nuclear Deal” [in Arabic], Al Jazeera, May 15, 2025, https://shorturl.at/iKAul.

[38] The White House, Fact Sheet: President Donald J. Trump Secures Historic $600 Billion Investment Commitment in Saudi Arabia, May 13, 2025, https://2u.pw/v7hQF.

[39] The White House, “Fact Sheet: President Donald J. Trump Secures Historic $1.2 Trillion Economic Commitment in Qatar,” May 14, 2025, https://shorturl.at/gfdzC.

[40] Ellen Michel, “State Department approves $1.4B helicopters, F-16 parts sale to UAE,” The Hill, May 13, 2025, https://shorturl.at/3oXuR.

[41] David B. Roberts, Re-Examining the Foundations of US–Gulf Relations,” Middle Eastern Studies, January 1–12, 2025. doi:10.1080/00263206.2025.2453428.

[42] “Trump: We Will Protect the Middle East… and Are Very Close to Reaching a Deal with Iran” [in Arabic], Al-Arabiya, May 15. https://shorturl.at/jHVHT.

[43] Salah Al-Ghoul, “Trump’s Tour and the Gulf Moment” [in Arabic], Al-Khaleej, May 15, 2025.

[44] “Trump in Doha and Historic Deals: Key Developments from Day Two of the U.S. President’s Gulf Tour” [in Arabic], CNBC Arabia, May 14, 2025. https://shorturl.at/i41u1.

[45] “Intensive Negotiations in Doha… Israel Insists on Not Ending the War” [in Arabic], Al-Khaleej, May 15, 2025.

[46] “Trump: I Want the United States to ‘Own’ Gaza” [in Arabic], Sky News Arabia, May 15, 2025. https://shorturl.at/rqb2P.

[47] Gram Slattery, Pesha Magid and Andrew Mills, “Trump meets Syrian president, urges him to establish ties with Israel” Reuters, May 15, 2025, https://2u.pw/Fu0m1.

[48] Ibid.

[49] Patrick Seitz, “Who Needs China? Saudi Arabia Steps Up as Big Buyer of AI Chips,” May 15, 2025, https://shorturl.at/wYfFO.

[50] Al-Ghoul, “Trump’s Tour”.

[51] Ministry of Foreign Affairs, United Arab Emirates, “New UAE Mediation Between Russia and Ukraine Succeeds in Releasing 410 Prisoners” [in Arabic], May 6, 2025. https://2u.pw/mYapd.