The Eastern Mediterranean (East Med) is a complex microcosm of the global geopolitical scene. Conflicts in this neighborhood have their roots in history, religion, and geography. On the stage of diverse interests vying for political influence, offshore natural gas discoveries have heightened the region’s importance both as a conduit and an exporter on vital energy supply routes. In the early 2010s, optimism was high as governments, investors, and clients scrambled to leverage gas trade as a catalyst for regional peace and to capitalize on gas deposits to lock in long-term supply contracts. Monetization proposals from Cyprus, Israel, and Egypt floated abound, aimed at securing the most viable export path to aggregate gas extracts from the region to demand centers around the globe. Turkey could have been one of the preferred pipeline routes to Europe, but divisions along geopolitical and ideological lines got in the way of a solution for all parties and the realization of such a project. This is the context in which regional partnerships in energy, defense, and trade evolved into an intergovernmental organization called the East Med Gas Forum (EMGF) in January 2019.

As plans to reduce global carbon emissions and transition to clean energy gained pace following the Paris COP21 summit, much of that initial enthusiasm died down and the investment sentiment shifted towards renewables and sustainable growth. Rivalries around maritime demarcation and energy claims acted as another source of friction that increased political risk for investment appraisals. Despite the rhetoric in the EMGF about joint gas production since 2019, doubts remained about the feasibility of controversial export projects – such as the much-debated East Med Gas Pipeline – that go against economic rationality, not to mention political hurdles along the way. More recently, Washington’s expression of reservation towards the pipeline was unsurprising in light of global economic currents, regional constellation of powers, and energy demand projections. However, Russia’s monopolization of energy supply routes to Europe and the recent war in Ukraine has led energy consumers of the industrialized world to finally become more serious about hydrocarbon alternatives. This article explores the underlying motives behind the recent shift in East Med energy geopolitics and the implications of the new equilibrium for the wider Middle East.

East Med gas and maritime geopolitics

Offshore gas potential in the East Med dates to the late 2000s when the Isramco-Delek-Chevron consortium made discoveries in Tamar (2009) and Leviathan (2010) off the coast of Israel. When Israel announced the discovery of the Leviathan gas field, it had also detected geological formations of the Aphrodite field in Block 12 of the Exclusive Economic Zone (EEZ) of the Republic of Cyprus (RoC). As expected, in 2011, the Noble Energy-Shell-Delek consortium announced the discovery of a gas deposit in the Aphrodite field with a (revised) estimated reserve of 124 billion cubic meters (bcm). After signing EEZ delimitation agreements with Egypt in 2003, Lebanon in 2007, and Israel in 2010, the Greek-administered RoC began the process for natural gas exploration in 2011, granting licenses to international oil companies such as ENI-KOGAS, Chevron, Total, Exxon Mobil, and Qatar Petroleum between 2013 and 2019 for drilling and production.

The combined proven reserves of recoverable gas resources around the Levant basin, including Cyprus, Israel, Lebanon, and Syria, amount to over 3.5 trillion cubic meters (tcm).[1] The Nile Delta in Egypt’s EEZ has an additional 6.2 tcm of gas potential. Israel and Egypt produce offshore gas for both domestic consumption and export, but not on a game-changing level for global markets. Altogether, the economic viability of large-scale production in these offshore fields is contingent on the disputant parties – namely Turkey-Greece-RoC and Israel-Lebanon-Syria – overcoming their disagreements on equitable delimitation of maritime boundaries and energy resources therein. Optimism prevailed in the early 2010s that gas monetization over the East Med Pipeline could act as a catalyst to settle political disputes between Cyprus, Israel, and Turkey, but even then, many analysts considered it “a delusion, an unrealistic project that cannot die soon enough” due to geopolitical and financial roadblocks.[2]

East Med Gas Pipeline Proposal, 2012-2021

Source: Wharton Energy Group (2020), http://bitly.ws/AZIf

There was little reason to revise earlier assumptions, but major shifts in the geopolitical constellation since 2022 have raised hopes of a shared vision for energy exploitation at a regional level. First, much to the surprise of observers of the long-run political standoffs, Lebanon and Israel reached a breakthrough agreement under US mediation on maritime delimitation and energy sharing. The agreement brought commercial interests to the table without a pre-requisite for formal recognition between the two countries. That both sides needed access to energy acted as an incentive: Israel relies on gas for 70% of its electrical consumption and Lebanon perceives access to gas deposits as a rescue line to lift its ailing economy out of dire straits.[3] But more importantly, both countries wanted more security than instability. As usual, it was politics that led and economics that followed. Once they reached a deal, Amos Hochstein, Senior Advisor for Energy Security at the US State Department, held signing ceremonies with political leaders from both sides in two separate meetings. Soon after, the Greek offshore drilling firm Energean started production in Israel’s Tanin and Karish blocks, while Qatar Energy formed a consortium with Italian ENI and French Total to split the shares of two offshore blocks in Lebanon’s EEZ (Blocks 4 and 9) by 30% and 35%-35%, respectively.[4] The consortium is expected to start surveys at the beginning of September 2023, with a view to providing an update by the end of the year.

Second, the global energy crisis resulting from the war in Ukraine has created further opportunities for the region. As Europe tries to diversify its supplier base, there are curiosities as to whether gas deposits in the East Med offer viable, alternative sources to replace Russian gas. At first sight, the situation is promising: Israel is expected to have 500 bcm surplus gas reserves for export in the next twenty-five years;[5] the RoC’s total recoverable amount, including the Zeus, Glaucus, Calypso, and Aphrodite fields, is estimated at 450 bcm; Lebanon is likely to have 700 bcm gas potential in its EEZ; and Egypt is also keen to become a regional gas hub. But to aggregate gas deposits in this regional jig-saw puzzle is a challenge and is further compounded by the EU’s mixed signals. While the EU agreed to extend the voluntary 15% gas demand reduction target until April 2024,[6] it also signaled how the European Bank for Reconstruction and Development (EBRD) and the European Investment Bank (EIB) could help fund East Med gas projects.[7]

In 2022, the EU hastily cut imports of Russian gas and luckily faced a relatively mild winter, but its ability to backfill the gap beyond 2023 remains in doubt due to financial disincentives and supply shortages. With its objective to reduce greenhouse gas emissions by 55% over the next few years, offshore projects that require long-term investment unfortunately lack economic feasibility. The only exception is the EU-Egypt-Israel MoU signed in June 2022 to boost gas exports from the East Med to Europe by an additional 10 bcm via LNG terminals in Egypt. The important point though is that this tri-partite export deal does not entail a greenfield investment,[8] but an enhancement to Israel’s earlier $15 billion-worth project with Egypt for gas exports through the existing infrastructure. Any significant expansion in Egypt’s export capacity will require more investment into production facilities, which is yet to be agreed upon by the tri-partite group.[9]

Whether the EU-Egypt-Israel and Israel-Lebanon deals might set precedents for further breakthroughs in the East Med is questionable. Despite heightened interest in energy monetization, the outlook does not warrant optimism for economic and political reasons. Currently, Israel produces 12 bcm per year from the Leviathan reservoir for the supply and sale of gas to its domestic market as well as Egypt and Jordan.[10] Although European countries are investing in additional floating storage and regasification units, enabling them to absorb more LNG,[11] Israel’s Leviathan Phase-1B, operated by the Chevron-NewMed-Ratio consortium, which would raise the field’s gas output to 21 bcm per year, will take several years to mature.[12] The country’s overall gas output is expected to double to 40 bcm per year, but no sooner than 2026.[13]

For the RoC, the situation is gloomy. Greek Cypriot plans to construct a 340-km undersea pipeline from the Aphrodite field to Egypt’s LNG liquefaction facility in Idku by 2027 remains an aspiration on paper, although there is certainly spare capacity and interest in Cairo to become a regional hub.[14] In addition to this, Cypriot gas is dry gas – unsuitable for condensation and export via LNG tankers – and so it is expensive to carry it through a pipeline to Egypt, convert it to LNG, and re-export it from there to buyer markets. Alternatively, Chevron might link up the Aphrodite field to a floating LNG (FLNG) facility via a pipeline and combine it with Israeli deposits for re-export by sea, but the capacity of that floating plant would be 9 bcm per year at maximum compared to 17 bcm in Egypt’s liquefaction facilities.[15] The FLNG may be the preferred option to sell liquified gas to Asian markets due to concerns that Egypt’s persisting economic problems could make it an unreliable transport hub for East Med gas as well Europe’s reluctance to commit to natural gas in the longer-term.[16] While Israel would diversify some of the risk by hedging with Cyprus rather than putting all its gas through Egypt, that would entail a much higher upfront cost. Another option would be to tie Aphrodite gas to Leviathan Phase-1B and pipe it to Egypt LNG terminals, but this would require further appraisal by the project consortium. As Chevron and its partners started drilling an appraisal well at the Aphrodite field in May 2023 – despite Turkey’s protests – Israeli and Greek Cypriot officials discussed a plan to combine gas extracts from both Leviathan and Aphrodite and deliver it via a pipeline to an LNG processing plant in Cyprus. This project also faces uphill hurdles such as financing, market access, and political risks, and is unlikely to go live before 2027.

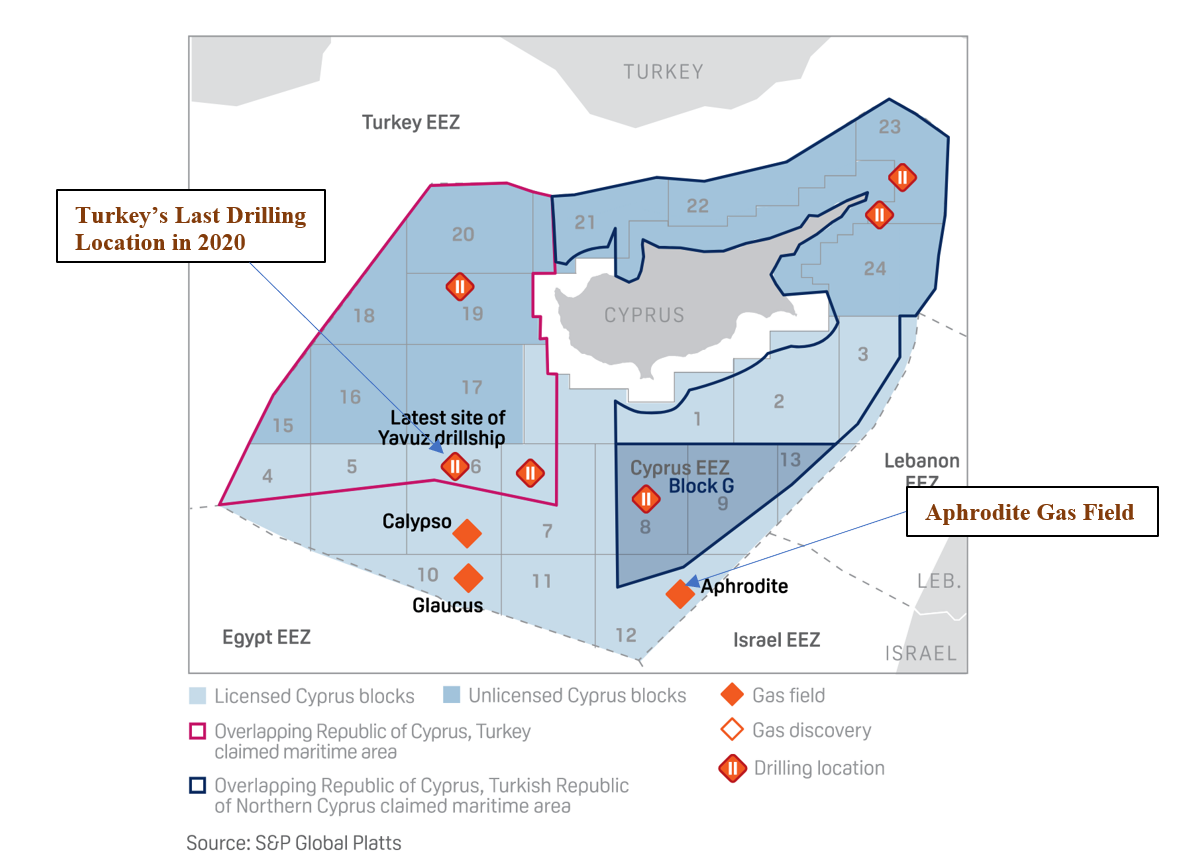

Turkey, Cyprus, and the Aphrodite Gas Field

Source: S&P Global (2020), http://bitly.ws/zybJ

Then there is the political obstacle of the Cyprus Problem. The island of Cyprus has been divided since 1974, after Turkey intervened in the North following a coup attempt by Greece to annex the island. Cyprus – as a de facto divided island – joined the European Union (EU) in 2004, the existing stand-off over energy rights further exacerbating the political conflict over sovereignty and representation on the island. Tensions have been high in the region since the discovery of the Aphrodite field in 2011. Turkish Cypriots are claiming equal rights to the island’s resources, while Turkey is claiming that five of the thirteen offshore research blocks to the island’s west and southwest are within its EEZ – zones which overlap with those of the RoC. Lastly, there is also a disagreement between the RoC and Israel on equitable sharing of gas deposits in the Aphrodite and neighboring Yishai fields, in their respective EEZs. Although they inched closer to an agreement in 2022, the issue of compensation remains unsettled, pending appointment of a third-party expert to determine details of the arrangement on both sides.[17]

The war in Ukraine and implications for the region

In spite of a gradual recovery from the COVID-19-induced recession in 2022, the war in Ukraine is expected to result in 75 bcm of lost annual demand for gas by 2025.[18] As economic recovery and attractive gas prices bring additional suppliers to the market, Australia, Canada, and Norway will continue to serve the same regional markets as they do today.[19] Europe imported on average 155 bcm/year from Russia, most of which went to Central and Eastern European countries. Although the EU as a large consumer market would be able to absorb a demand-side shock to gas markets, the war in Ukraine caused a shock from the supply side, which threatened the steady supply of gas to Europe.

Since Russia’s war in Ukraine, there is now a higher risk of interruption to gas flows and supply shortages due to lack of LNG re-gasification units in many EU countries and surplus capacity that can be diverted from elsewhere. Qatar, for instance, has long-term supply contracts with the Asia-Pacific and is unlikely to be able to increase production and make spare volumes available before 2025. China has become the world’s largest importer of gas, and mega producers around the world like Australia and Qatar have absorbed the market slack and fulfilled orders from the fast-growing Asia-Pacific region. East African countries with large potential such as Mozambique and Tanzania are also expected to join the supplier ring by 2026.

Therefore, Europe is even more determined to accelerate the transition to renewables and clean energy and to reduce fossil fuel consumption.[20] To reduce its excessive dependence on Russia, Europe decided to invest in renewables under a new initiative called “Energy Compact”, which entails cutting gas consumption by 30% by 2030.[21] The EU’s mid-to-long-term plan is to reduce the share of gas in its energy mix during the transition period and achieve net-zero carbon emissions by 2050. However, the European energy crisis in 2022-2023 shows that the rush towards renewables is detrimental in the short-to-midterm, and that it would be economically sound to keep the share of gas in the energy mix. Plus, there is consensus among energy scholars that variable renewable energy technologies are not pure play; “they will play an important role, but more firm generating sources, like next-generation nuclear reactors, natural gas plants with carbon capture technologies, enhanced geothermal, and others that can balance out variable renewables, will be required.”[22] The future is in renewables, but the share of renewable energy in electric generation even by 2060 is expected to be at 40%, which means a 60% share remains for hydrocarbons.[23]

Despite contrary evidence, geopolitical risks in Europe outweigh such considerations and prioritize diversification and replacement of gas suppliers in a shorter timeframe. The International Energy Agency’s “Net Zero by 2050” roadmap states that no new oil and gas projects should be developed beyond 2025 if the world is to reduce emissions sufficiently to prevent global warming.[24] The EU takes this objective very seriously. Over time, as the market share of renewable energy sources and LNG/floating-storage unit gas supplies rise, pipelines will become marginalized in Europe. Germany’s decision to abandon Nord Stream 2 is a testament to this policy shift. At a time of cash crunch and low economic growth, international oil companies (IOCs) are endeavoring to reduce capital expenditure on oil and gas, invest more in clean energy, focus on larger quick-win projects, and reduce carbon footprint. Therefore, given the investment horizon, production volumes, and financing costs, East Med cannot be a cure for Europe’s gas shortages, and gas monetization proposals in the new normal of 2023 should be viewed from that angle. In the long term, East Med gas has no other avenue to go down other than regional markets like Turkey, Jordan, and Egypt. The US was right to cast doubts on the economic feasibility of the long-debated East Med Gas Pipeline project.

In any case, the maximum volume of gas that could be available for export from all fields in the East Med combined would be a plateau rate of 45 bcm/year and would only be able to sustain this peak period for 15-20 years after 2026.[25] This is a far cry from the 155 bcm/year that Europe would need to replace Russia in the short term and so it cannot be a substitute for pipeline gas to Europe. Furthermore, insurance premiums would be lower if gas fields were secure, but in a region like the East Med where the risk of armed conflict is high, insurance fees skyrocket and so do costs of extraction. As Qatar Minister of State for Energy Affairs H.E. Eng. Saad Al-Kaabi highlighted at the Atlantic Council Global Energy Forum in Abu Dhabi, UAE, in January 2023, diversification is a long-term process that requires realistic planning and investment in alternative suppliers.[26] Therefore, contrary to conventional wisdom, East Med is expensive compared to the alternatives and thus can no longer be a priority for Europe in fulfilling its energy demand in the mid-to-long term.

Conclusion

Geopolitical risks have accelerated energy transition in Europe. Gas remains an important transition fuel and draws attention as a lever of coercion in international politics, as demonstrated in Ukraine. Many countries that import gas via pipelines are in search of mitigation strategies including LNG/re-gasification terminals, alternative suppliers, and investment in renewables. Excessive dependence on long-term pipeline contracts with high up-front costs, such as the much-hyped East Med Gas Pipeline, are unpopular and existing infrastructure is likely to be phased out over a shorter time, possibly by 2030, rather than the 2050s as initially planned. Europe is not expected to generate substantial demand growth for gas in the next decade.

With the EU’s plans to reduce carbon emissions by 55% in 2030, there is no appetite for greenfield investments in offshore gas, due to which discoveries around Cyprus have remained idle. This context necessitates closer cooperation between both consumers and producers of the East Med and Middle East to establish a functional and durable regional energy market. The political reconciliation between Lebanon, Israel, and Turkey brings historic opportunities to monetize on the region’s gas deposits in a shorter time frame and catalyze spill-over effects for investment in technology-sharing and electricity interconnection. For regional collaboration, the shift in relations opens the way for projects that have market-uptake potential and better capital recovery. This would also enable the EMGF to then evolve into a wider “energy forum”, setting the foundation for a regional economic union.

References

[1] U.S. Energy Information Administration (EIA), “Eastern Mediterranean Natural Gas Exploration Focused on the Levant Basin, August 20, 2013, http://bitly.ws/AXJD.

[2] Nikos Tsafos, “Can the East Med Pipeline Work?” Center for Strategic & International Studies (CSIS), January 22, 2019, http://bitly.ws/AXKv.

[3] Yaakov Lappin, “The Israeli–Lebanese Maritime and Gas Extraction Deal: An Overview,” Trends Research & Advisory, December 5, 2022, http://bitly.ws/AXKT.

[4] “Qatar’s Energy Giant Joins Lebanon Gas Exploration Group,” Al-Monitor, January 26, 2023, http://bitly.ws/AXLT.

[5] Danny Zaken, “Global Energy Crisis Opens Possibilities for Israeli Natural Gas,” Al-Monitor, May 16, 2022, http://bitly.ws/AXMP.

[6] European Council, “Member States Agree to Extend Voluntary 15% Gas Demand Reduction Target,” March 28, 2023, http://bitly.ws/FCMP.

[7] “East Med Gas Could Help Ease Europe’s Energy Crunch with Right Funding – Officials” Reuters, October 14, 2022, http://bitly.ws/FCMV.

[8] Greenfield investment means building operations from ground up rather than acquiring an existing facility.

[9] Sarah El Safty and Nafisa Eltahir, “EU Expects Egypt to Maintain LNG Export Levels – Official,” Reuters, February 14, 2023, http://bitly.ws/AXNn.

[10] Sharon Wrobel, “Israel’s NewMed Energy and Partners Begin Drilling at Aphrodite Gas Field off Cyprus,” Times of Israel, May 7, 2023, http://bitly.ws/FCNb.

[11] Vijaya Ramachandran and Jacob Kincer, “Europe’s Hunger for Gas Leaves Poor Countries High and Dry,” Foreign Policy, February 1, 2023, http://bitly.ws/AXPC.

[12] “Israel’s NewMed Gas Group to Build Facility in East Med,” Al-Monitor, February 21, 2023, http://bitly.ws/AXPY.

[13] Sarah El Safty and Ari Rabinovitch, “EU, Israel and Egypt Sign Deal to Boost East Med Gas Exports to Europe,” Reuters, June 15, 2022, http://bitly.ws/AXQh.

[14] Peter Stevenson, “Cyprus Gas Ambitions: From Dreams to Reality in 2023?” MEES, January 27, 2023, http://bitly.ws/AXQG.

[15] Theodoros Tsakiris, “What a New Natural Gas Discovery Off Cyprus Means for the East Med,” Ekathimerini [Podcast], December 24, 2022, http://bitly.ws/AXRz.

[16] Charles Ellinas, “Aphrodite Low on List of Chevron’s Gas Plans for East Med,” Cyprus Mail, March 6, 2023, http://bitly.ws/FCNE.

[17] Stevenson, “Cyprus Gas Ambitions: From Dreams to Reality in 2023?”

[18] International Energy Agency (IEA), Gas 2020: Analysing the Impact of the Covid-19 Pandemic on Global Natural Gas Markets, June 2020, http://bitly.ws/AXRS.

[19] Tsafos, “Can the East Med Pipeline Work?”

[20] Charles Ellinas, “The Impact of Russia’s Invasion of Ukraine on Global Energy,” Cyprus Mail, February 27, 2022, http://bitly.ws/AXSP.

[21] Charles Ellinas, “The Energy Transition Has Come Forward; Cyprus Must Act Now,” Cyprus Mail, March 13, 2022, http://bitly.ws/AXTj.

[22] Alex Tembath and Zeke Hausfather, “California Reveals That the Transition to Renewable Energy Isn’t So Simple,” Slate, August 19, 2020, http://bitly.ws/AXTU.

[23] Mehmet Öğütçü, “Kırılgan Enerji Denklemi Altüst Oluyor: Nereye Gidiyoruz?” Panorama [Turkish], May 1, 2020, http://bitly.ws/AXUR.

[24] International Energy Agency (IEA), Net Zero by 2050: A Roadmap for the Global Energy Sector, May 2021, http://bitly.ws/CwGG.

[25] Turkish Energy Strategy and Policy Research Center (TESPAM), “East Med Gas Supply Projections up to 2050,” May 27, 2022, http://bitly.ws/AXVK.

[26] H.E. Eng. Saad Al-Kaabi, “Leadership Fireside Chat,” Atlantic Council Global Energy Forum 2023, Abu Dhabi, UAE, January 14, 2023.