As Japan accelerates its transition toward a carbon-neutral future, the role of energy storage has become more critical than ever. The country has set ambitious goals to expand its renewable energy capacity, including wind and solar power, to reduce dependence on fossil fuels. However, the intermittent nature of renewables necessitates efficient and scalable energy storage solutions to ensure grid stability and reliability. Lithium-ion batteries (LiBs) have long been the dominant choice for energy storage for grid applications.

Despite their widespread adoption, LiBs pose several critical challenges that threaten the sustainability and security of Japan’s energy transition. China dominates lithium refining and battery production, creating vulnerabilities as geopolitical tensions escalate and resource nationalism grows.1 The recent surge in lithium prices, coupled with supply bottlenecks, has exposed the fragility of the global lithium supply chain, making Japan’s energy security increasingly precarious.2

In response to these challenges, Japan is actively exploring sodium-ion technology as a viable alternative. Sodium-ion batteries (SiBs) offer several advantages over LiBs, including abundant and inexpensive raw materials, enhanced safety, and improved performance in specific applications. Unlike lithium, sodium is widely available and can be extracted from seawater or industrial waste, significantly reducing geopolitical supply risks. SiBs are not only more cost-effective but also exhibit superior thermal stability compared to lithium-ion counterparts, making them safer in extreme conditions. In grid-scale applications, sodium-sulfur (NaS) batteries have already demonstrated success in stabilizing power networks. A hybrid energy storage system in Niedersachsen, Germany, integrating NaS and LiB, has proven effective in balancing grid fluctuations and optimizing energy trading models.3 These developments indicate the potential for SiBs to complement and, in some cases, replace lithium-ion technology.

Japan is at the forefront of SiB research and development, with government-backed initiatives and corporate investment accelerating progress. Companies such as NGK Insulators, Sumitomo, and Toyota are pioneering SiB innovations, particularly in stationary energy storage and industrial applications. Notably, Japan’s New Energy and Industrial Technology Development Organization (NEDO) has supported large-scale NaS battery projects, integrating them into the national grid.4 Recent trials in collaboration with Korea Electric Power Corporation (KEPCO) have demonstrated the feasibility of SiBs in long-duration energy storage, further solidifying Japan’s leadership in this sector.5

To understand this shift, this paper will explore key questions: What are the driving forces behind Japan’s investment in SiB technology? How does SiB performance compare to LiB in terms of efficiency, cost, and scalability? What are the geopolitical and economic implications of this transition for Japan and the global battery market? Japan’s shift from LiBs to SiBs represents a strategic realignment of its energy storage policies, driven by the need for greater supply chain resilience, environmental sustainability, and technological innovation. By examining the comparative advantages of sodium-ion technology and its implications for global energy security, this paper aims to assess whether SiBs can serve as a viable long-term solution in Japan’s clean energy transition.

Transition in Battery Technology

Japan has recently invested in battery technology innovation, shaping the global energy storage industry with its advancements in LiBs. Companies like Panasonic, Sony, and Toyota have played pivotal roles in refining LiB technology for consumer electronics, electric vehicles (EVs), and grid-scale storage. However, as Japan accelerates its clean energy transition, growing concerns over lithium supply constraints, price volatility, and geopolitical risks have compelled policymakers and industry leaders to reassess the country’s energy storage strategy. One of the most pressing challenges is Japan’s reliance on imported lithium, cobalt, and nickel, essential components for LiB. With Australia and China dominating global lithium production, Japan faces increasing vulnerability to supply chain disruptions amid rising geopolitical tensions.6 Moreover, lithium prices have surged in recent years due to heightened demand from the EV market, leading to cost uncertainties and complicating Japan’s long-term energy security planning.

Beyond supply chain risks, environmental sustainability is another driving force behind Japan’s search for alternatives. Lithium extraction is highly resource-intensive, requiring vast amounts of water and energy, particularly in South American salt flats. Additionally, cobalt mining, concentrated in the Democratic Republic of Congo, has been associated with severe human rights abuses and ecological degradation.7 These ethical and environmental concerns underscore the need for more sustainable and responsible energy storage mechanisms. The environmental impact of lithium and cobalt mining is further compounded by increasing concerns over water scarcity and toxic byproducts. In South American lithium-producing regions, extraction processes have been found to significantly deplete local water sources, disrupting ecosystems and agricultural livelihoods. Meanwhile, the cobalt supply chain remains heavily dependent on the Democratic Republic of Congo, where reports of child labor and hazardous working conditions persist. These issues have prompted Japan to seek alternative battery technologies that mitigate such environmental and ethical risks.

A primary factor driving Japan’s interest in SiBs is the relative abundance and accessibility of sodium compared to lithium. Unlike lithium, which is geographically concentrated and subject to supply chain bottlenecks, sodium is widely available and can be sourced from seawater or industrial byproducts, significantly reducing Japan’s dependence on foreign suppliers.8 The stable and predictable pricing of sodium offers a substantial advantage over the volatility of lithium markets, making SiB a more cost-effective option for large-scale deployment. In contrast to lithium, which is geographically confined and susceptible to supply chain bottlenecks, sodium is abundant and widely available. Machine learning innovations have further enhanced the potential of sodium-ion technology by identifying optimal material compositions for battery electrodes. This breakthrough has yielded a new SiB electrode material with improved charge retention and energy density, making it a viable alternative to lithium-based storage solutions for Japan’s energy transition.

From an environmental perspective, sodium-ion technology offers several benefits over LiB counterparts. The production of SiBs does not require lithium or cobalt, reducing the need for environmentally harmful mining practices. Furthermore, sodium extraction is less water-intensive, mitigating one of the major ecological concerns associated with lithium mining.9 The elimination of cobalt from battery chemistry also addresses ethical concerns related to exploitative labor practices in cobalt-producing regions. In addition to lower resource extraction impacts, recent research has demonstrated that SiBs can be produced using hard carbon derived from biomass and organic waste, further reducing their ecological footprint. Researchers have explored techniques such as spark plasma sintering and nanoscale material processing to improve the conductivity and stability of SiB anodes. These advancements enhance the overall efficiency of SiB cells, making them even more attractive as a sustainable alternative to LiBs.

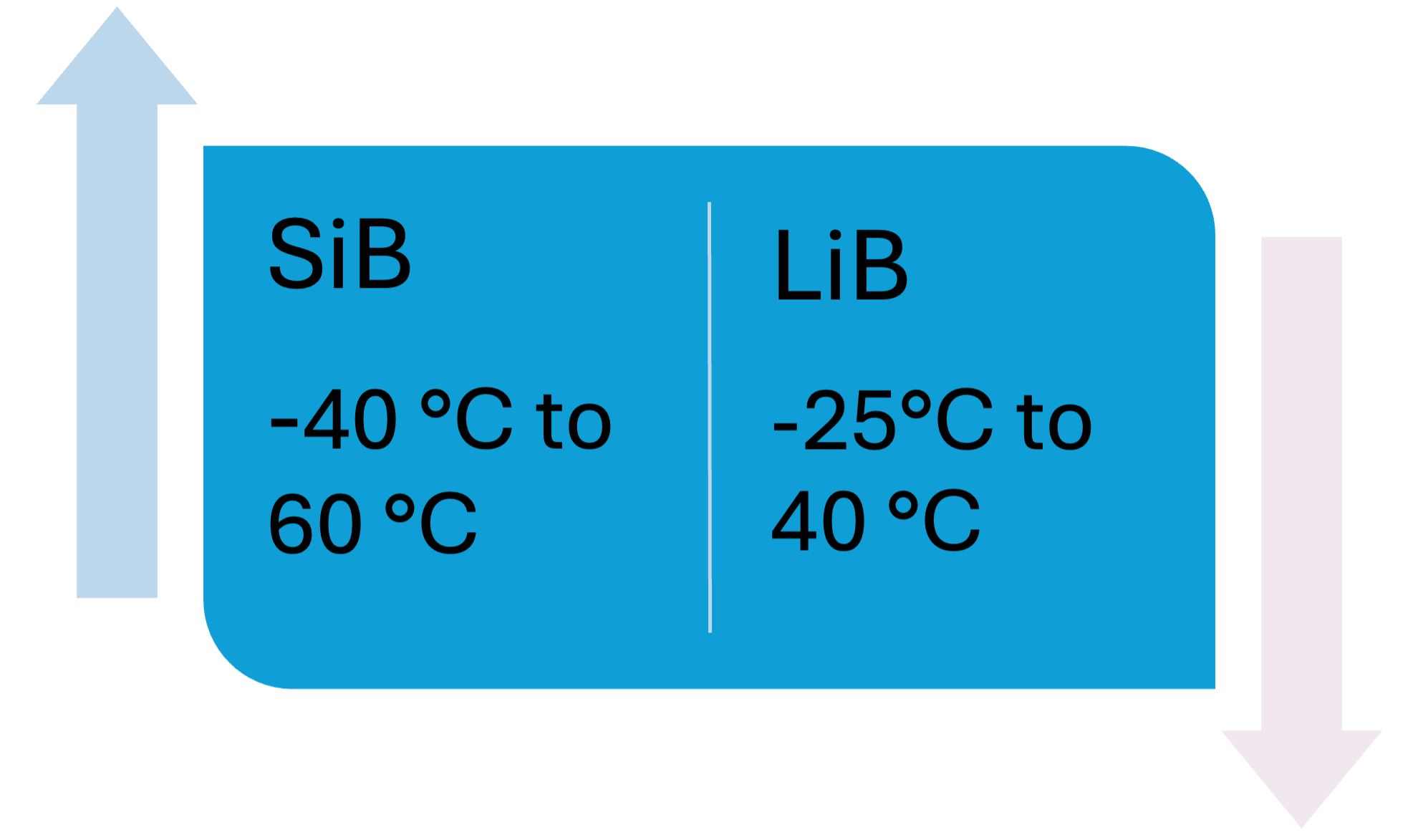

Figure 1: Temperature Resilience Between Lithium-ion Battery (LiB) and Sodium-ion Battery (SiB)

Source: Author’s creation adopting data from EVreporter.com

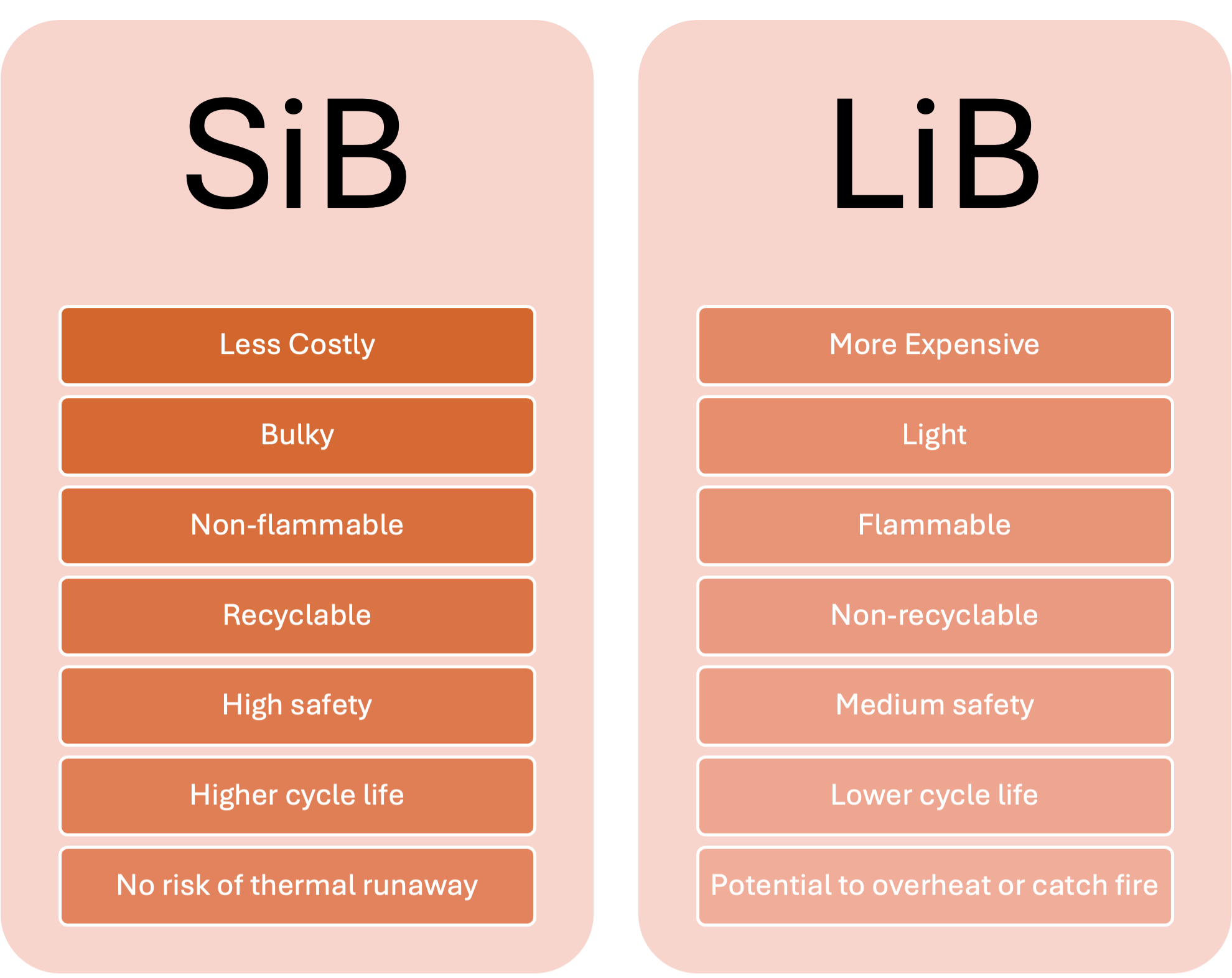

Another crucial advantage of SiBs is their enhanced safety and stability. SiBs exhibit superior thermal performance, making them less prone to overheating and fire hazards compared to LiBs.10 This characteristic is particularly important for grid-scale storage applications, where safety is paramount. Additionally, SiBs perform more efficiently in cold temperatures, making them well-suited for deployment in regions with harsh winters, an important consideration for Japan’s energy infrastructure.

Recognizing the strategic importance of alternative battery technologies, the Japanese government has ramped up support for SiB research and development (R&D). National energy strategies now emphasize diversification in energy storage, with increased funding allocated to alternative battery technologies.11 NEDO has provided grants and tax incentives to accelerate the commercialization of SiBs. The transition to SiB technology is not solely driven by government policies; private-sector investments and research collaborations are also playing a crucial role. Japanese companies like NGK Insulators, Sumitomo, and Toyota are actively pioneering SiB innovations, particularly in stationary energy storage and industrial applications.12 These firms are collaborating with academic institutions and government agencies to refine SiB chemistry, improve efficiency, and scale production capabilities. Japanese policymakers have identified SiB technology as a critical component of their broader energy security strategy. Government-backed research programs have increasingly focused on artificial intelligence and data-driven material science to accelerate SiB development. The Tokyo University of Science’s recent success in optimizing battery electrode materials through machine learning is a key milestone in this effort. This development aligns with Japan’s commitment to reducing reliance on foreign mineral imports while engaging domestic innovation in next-generation concepts for energy storage.

One notable initiative is Japan’s partnership with KEPCO to conduct large-scale SiB trials. Recent demonstrations have proven the feasibility of NaS batteries for long-duration energy storage, a critical requirement for renewable energy integration.13 The success of such pilot projects strengthens Japan’s position as a leader in SiB deployment. Japan’s transition toward SiBs is further utilized by increased financial investments in alternative battery technologies. Venture capital funding and corporate R&D budgets have seen a surge in allocations for SiB development, as companies seek to position themselves competitively in the evolving global battery market.14 Additionally, joint ventures with European firms have demonstrated the effectiveness of hybrid energy storage systems that integrate SiBs and LiBs for grid stabilization.

The transition from LiBs to SiBs represents a significant strategic pivot in Japan’s energy storage policies, with wide-ranging implications for supply chain resilience, environmental sustainability, and technological innovation. By reducing dependence on critical mineral imports, Japan is enhancing its energy security and diversifying its battery supply chain, which could reshape global energy storage dynamics. This strategic shift reflects Japan’s commitment to technological innovation and energy independence. While challenges remain, particularly in improving SiB energy density. Ongoing R&D efforts and industry collaborations indicate that SiB technology has the potential to play a transformative role in Japan’s clean energy transition.

Factors Driving the Shift

A significant factor fueling Japan’s pivot toward SiBs is the increasing volatility in lithium prices and supply constraints. The global demand for LiBs has surged due to the expansion of EVs and renewable energy storage, with projections indicating that worldwide lithium battery shipments will surpass 4,300 GWh by 2030.15 However, lithium extraction remains concentrated in South America’s Lithium Triangle, where more than 75% of lithium refining and battery material processing takes place.16 This monopolization has raised concerns among Japanese policymakers and industry leaders about supply chain security and price fluctuations. In contrast, sodium is vastly more abundant and geographically widespread, offering a stable and cost-effective alternative. SiBs also present lower production costs, as sodium compounds, such as sodium carbonate, are significantly cheaper and less volatile than lithium-based materials. Furthermore, Japan’s ability to integrate SiB production into existing LiB manufacturing infrastructure reduces capital expenditures, enabling a more seamless transition without extensive overhauls in production facilities.

Environmental sustainability also plays a crucial role in Japan’s embrace of SiB technology. Lithium mining is notoriously water-intensive, with extraction in regions like South America’s Salar de Atacama consuming vast amounts of groundwater, leading to ecological degradation and freshwater scarcity.17 Extracting one metric ton of lithium requires approximately 500,000 gallons of water, a growing concern as climate change exacerbates global water shortages.18 Sodium, by contrast, is extracted using less invasive methods that do not result in comparable environmental destruction. Moreover, SiBs exhibit better recyclability and produce fewer hazardous byproducts, aligning with Japan’s goal of achieving net-zero carbon emissions by 2050. As the country scales up its investment in renewable energy sources, the demand for efficient and sustainable energy storage will grow, positioning SiBs as a crucial component of Japan’s clean energy future. Their enhanced safety profile, due to a reduced risk of thermal runaway compared to LiBs, can make them suitable for large-scale grid storage and disaster resilience initiatives, a priority for Japan given its vulnerability to earthquakes and extreme weather events.

Figure 2: Funding in Battery Technology, Japan

| Time | Fund | Budget |

| 2021- 2022 | METI | 100 billion yen |

| 2021 – 2025 | NEDO RISING-3 | 2.4 billion yen |

| 2023 – 2027 | NEDO SOLID-Next | 1.8 billion yen |

| 2021 – 2030 | NEDO Green Innovation | 120.5 billion yen |

Source: Author’s creation adopting data from Batteries+ Europe

Japan’s transition to SiBs is also underpinned by robust research and R&D efforts supported by both the government and the private sector. The country’s Ministry of Economy, Trade, and Industry (METI) has allocated substantial funding toward SiB research, with initiatives aimed at enhancing battery efficiency, longevity, and commercial viability. One notable advancement in this field is the development of nanostructured hard carbon anodes, which have significantly improved the performance and energy density of SiBs, bringing them closer to parity with their lithium-ion counterparts. Additionally, Japan and the European Union have recently formalized a cooperative agreement focused on advanced materials research, particularly in battery technology. In 2020 alone, Japan invested €14 billion in this sector, complementing the EU’s €19.8 billion investment.19 Through this partnership, both regions seek to reduce their dependence on Chinese battery suppliers while setting international standards for long-term energy storage. Japan’s METI has played a central role in advancing SiB research, allocating substantial funding to improve battery performance and commercial feasibility. Currently, Japanese firms are focusing on layered oxide cathodes, similar to lithium nickel manganese cobalt batteries, to boost SiB energy density. Meanwhile, Chinese manufacturers such as CATL and HiNa have taken a different approach, favoring Prussian blue analogs for their low cost and ease of production.20 This divergence in technological strategy highlights the ongoing global race to optimize SiB chemistry for large-scale applications.

Another compelling driver of Japan’s investment in SiB is the geopolitical imperative to bolster supply chain resilience and national energy security. The dominance of China in the global lithium battery market has raised concerns about overreliance on a single source for critical materials, particularly as trade tensions and resource nationalism continue to shape international economic policies. Japan’s shift toward SiBs represents a strategic effort to mitigate these risks by diversifying its battery supply chain. Unlike lithium, which is primarily extracted from a handful of resource-rich nations, sodium is globally abundant and can be sourced from multiple locations, including seawater. By reducing its dependence on imported lithium, Japan can insulate itself from external supply shocks and potential export restrictions. This move is particularly significant in the context of energy storage for national infrastructure, as SiBs can be deployed in smart grids, backup power systems, and renewable energy projects to enhance grid resilience. Furthermore, Japan’s emphasis on developing its domestic battery manufacturing ecosystem will strengthen its economic independence, ensuring that the country remains a key player in the evolving global energy market. Japan’s strategic pivot toward SiBs is also driven by geopolitical imperatives. Unlike lithium, which is primarily sourced from a limited number of regions, sodium is widely available, reducing the risk of supply shocks. Furthermore, Japan’s interest in SiBs aligns with broader efforts by Western nations to reduce dependency on Chinese battery supply chains. The United States’ Inflation Reduction Act and the European Union’s Battery 2030+ initiative both emphasize the need for diversified battery technologies, creating opportunities for Japan to strengthen its role as a key player in this emerging sector.21

Japan’s leadership in battery innovation extends beyond manufacturing to regulatory frameworks. The country is actively collaborating with the European Union on establishing international standards for next-generation battery technologies. This initiative aims to create uniform safety and performance benchmarks, positioning SiBs as a viable alternative to lithium-based systems in global energy storage markets. Japan’s commitment to SiB technology is also reflected in the growing number of pilot projects and commercial ventures aimed at bringing SiBs to market. Several Japanese startups and research institutions are working on scaling up production, with plans to integrate SiBs into consumer electronics, EVs, and industrial applications. Recent breakthroughs in electrode materials have further accelerated the viability of SiBs, with researchers optimizing cathode compositions to enhance energy density and cycle life.22 Meanwhile, global players such as CATL in China and Natron Energy in the United States are also advancing SiB development, signaling a competitive push toward commercializing the technology.23 However, Japan’s stronghold in materials science and battery manufacturing expertise positions it favorably to lead in this domain. With government-backed initiatives supporting collaboration between academia, industry, and policymakers, Japan is building a comprehensive ecosystem to support the mass adoption of SiBs in the coming decade.

Figure 3: Features of LiB and SiB

Source: Author’s creation adopting data from GEP & Iberdrola

Powering the Future

As the demand for energy storage evolves, Japan is faced with the challenge of diversifying its battery technology to enhance energy security, reduce costs, and address supply chain vulnerabilities. The increasing reliance on renewable energy sources such as wind and solar power has further heightened the urgency for effective and sustainable storage solutions. While LiBs have dominated Japan’s energy storage industry, recent advancements in SiB technology are shifting the country’s focus. This transition reflects a broader strategy aimed at securing energy independence and promoting economic resilience in an increasingly competitive and resource-constrained world.

One of the primary drivers behind Japan’s shift to SiBs is the resource constraints and supply chain challenges associated with lithium. As a nation with limited natural resources, Japan is heavily reliant on imported lithium. China, in particular, maintains near-monopolistic control over lithium refining and battery production, creating geopolitical risks that threaten Japan’s energy security.24 The volatility of lithium prices, which surged dramatically due to supply bottlenecks and increasing demand, further highlights the economic risks of continued dependency on lithium-based technologies.25 In contrast, sodium is among the most abundant elements on Earth, readily available in seawater and industrial byproducts, making it a stable and cost-effective alternative. Unlike lithium extraction, which involves environmentally intensive mining operations, sodium can be sourced with significantly lower ecological and ethical concerns. By prioritizing sodium-ion technology, Japan can mitigate the risks associated with lithium supply chain disruptions while reinforcing the sustainability of its energy storage solutions.

The economic viability of SiBs further strengthens their appeal as an alternative to lithium-ion technology. Recent estimates indicate that SiBs are expected to be cheaper than lithium iron phosphate batteries, largely due to the availability of low-cost raw materials.26 Unlike LiBs, which require expensive and scarce elements such as cobalt and nickel, SiBs rely on more readily available resources, reducing overall manufacturing costs. This cost advantage is particularly significant in utility-scale energy storage applications, where affordability and scalability are key considerations. The integration of sodium-ion technology into Japan’s energy infrastructure presents a compelling economic opportunity, not only by lowering costs but also by supporting domestic manufacturing capabilities. By investing in SiB production, Japan can stimulate job creation, drive industrial innovation, and reduce reliance on foreign energy storage technologies, ultimately strengthening its economic resilience in the global energy market.

While SiBs have historically lagged behind LiBs in terms of energy density and cycle life, technological advancements have significantly improved their performance, making them increasingly viable for large-scale applications. Contemporary SiB chemistries, including Prussian white and layered oxide cathodes, have demonstrated enhanced energy storage capabilities and longer cycle lives. NaS batteries, a subset of sodium-ion technology, have already been successfully deployed in grid storage applications, proving their effectiveness in stabilizing power networks.27 Moreover, Japan’s robust R&D ecosystem has played a critical role in advancing sodium-ion technology. Institutions such as Tokyo University of Science and Waseda University have contributed to research on sodium-ion, developing novel electrode materials and electrolyte compositions that improve charge-discharge rates and battery longevity.28 Additionally, NEDO has allocated substantial funding for SiB research, supporting large-scale demonstration projects aimed at integrating this technology into Japan’s energy grid.29 As sodium-ion technology continues to evolve, its potential applications are expanding beyond stationary storage to include certain EV segments, particularly in commercial and low-range vehicles where high energy density is less critical than cost-effectiveness and operational stability.

Government policy and industry initiatives are further reinforcing Japan’s transition to SiBs. The Japanese government has recognized the strategic importance of sodium-ion technology and is actively supporting its development through targeted subsidies, regulatory incentives, and public-private partnerships. NEDO’s initiatives are complemented by investments from leading corporations such as NGK Insulators, Sumitomo Electric, and Toyota, which are spearheading SiB research and commercialization efforts. NGK Insulators, for instance, has successfully deployed NaS batteries for grid storage applications, demonstrating their potential in stabilizing renewable energy integration.30 The entry of global players such as Tesla into the Japanese battery market has also increased competition, driving down battery costs and accelerating innovation.31 Additionally, Japan’s shift from feed-in tariffs to feed-in premiums for renewable energy projects, implemented in April 2022, is expected to incentivize further investment in energy storage technologies.32 By aligning policy frameworks with technological advancements, Japan is positioning itself as a global leader in next-generation energy storage, ensuring that its energy infrastructure remains resilient and adaptable in an increasingly uncertain geopolitical and economic landscape.

Japan’s transition to SiBs underscores a broader strategic realignment aimed at enhancing energy security, economic sustainability, and technological leadership in the global energy storage market. The shift away from lithium-ion technology is not merely a response to resource constraints but a proactive effort to build a more resilient and cost-effective energy storage ecosystem. By leveraging its strengths in materials science, industrial manufacturing, and government support, Japan is well-positioned to lead the development and deployment of SiB technology. As research and innovation continue to drive improvements in sodium-ion performance, the widespread adoption of this technology will not only benefit Japan’s energy sector but also contribute to the global transition toward more sustainable and accessible energy. The future of battery technology is rapidly evolving, and Japan’s commitment to sodium-ion innovation marks a critical step toward a more secure and independent energy future.

The strategic pivot toward SiB technology marks a critical inflection point in the global energy transition. Economic considerations, sustainability imperatives, technological advancements, and geopolitical realities have collectively shaped this shift, reinforcing the need for diversified and resilient energy solutions. By investing in SiBs, Japan is not only securing its position as a leader in next-generation battery innovation but also paving the way for a more sustainable and self-sufficient energy future. As R&D continues to push the boundaries of SiBs’ performance, their integration into mainstream energy systems will become increasingly viable, reshaping the competitive landscape of battery technology and setting a new benchmark for energy worldwide.

Conclusion

Japan’s transition from LiBs to SiBs marks a significant shift in its energy storage strategy, driven by the imperative to enhance energy security, reduce supply chain vulnerabilities, and promote sustainable technological innovation. As global demand for energy storage solutions grows alongside the expansion of renewable energy, Japan recognizes the necessity of diversifying its battery technologies to ensure long-term economic and environmental stability.

By prioritizing SiB development, Japan is reducing its dependence on foreign lithium supplies, mitigating the geopolitical risks associated with resource concentration in a few key regions. The abundance of sodium, coupled with its cost-effectiveness and environmental benefits, positions SiBs as a viable alternative, particularly for grid-scale storage and industrial applications. The government’s proactive investment in research and development, alongside corporate initiatives by leading Japanese firms, underscores a commitment to positioning Japan at the forefront of next-generation battery technology.

However, challenges remain. SiBs still require advancements in energy density and efficiency to compete with lithium-ion technology in certain applications. Scaling up production capacity and developing a robust supply chain for sodium-based battery components will be critical in determining the technology’s commercial viability. Addressing these barriers through sustained research, policy support, and industry collaboration will be essential to unlocking the full potential of sodium-ion energy storage.

The broader implications of Japan’s shift extend beyond national energy security. As SiB technology matures, it has the potential to reshape global energy markets by offering a more accessible and geopolitically stable alternative to lithium-based storage. This transition may encourage other nations to follow suit, diversifying the global battery industry and reducing reliance on critical minerals concentrated in politically sensitive regions.

Japan’s strategic pivot toward SiBs reflects its forward-looking approach to clean energy innovation. By investing in resilient, cost-effective, and sustainable energy storage solutions, the country is not only strengthening its own energy independence but also contributing to the broader global shift toward a low-carbon future. If the necessary technological and industrial advancements continue at pace, SiBs could emerge as a transformative force in the next era of energy storage, reinforcing Japan’s role as a leader in sustainable energy solutions.

References

[1] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transition: Critical Materials,” 2022, https://www.irena.org/Digital-Report/Geopolitics-of-the-Energy-Transition-Critical-Materials.

[2] Perry, Callum, Ewan Thomson, and the Fastmarkets Team, “Facing the Tightening Lithium Supply Challenge in 2025,” Fastmarkets, February 6, 2025, https://www.fastmarkets.com/insights/facing-the-tightening-lithium-supply-challenge-in-2025/.

[3] Colthorpe, Andy, “Japanese Sodium-Sulfur and Lithium Batteries Used in German Grid Demonstrator Project,” Energy-Storage.News, November 2, 2018, https://www.energy-storage.news/japanese-sodium-sulfur-and-lithium-batteries-used-in-german-grid-demonstrator-project/.

[4] “About NEDO: Contributing to Society by Accelerating Innovation and Achieving Results in a Timely Manner,” New Energy and Industrial Technology Development Organization, March 4, 2025, https://www.nedo.go.jp/english/.

[5] Colthorpe, Andy, “South Korea’s KEPCO Celebrates Completion of 889MWh BESS Portfolio,” Energy-Storage.News, October 1, 2024, https://www.energy-storage.news/south-koreas-kepco-celebrates-completion-of-889mwh-bess-portfolio/.

[6] Zhang, Marina Yue, “Global Lithium Supply and Australia’s Role,” Australian Institute of International Affairs, June 15, 2023, https://www.internationalaffairs.org.au/australianoutlook/global-lithium-supply-and-australias-role/.

[7] Dowling, Carmel, and Gerardo Otero, “Mirages or Miracles? Lithium Extraction and the Just Energy Transition,” Energy Research & Social Science 119 (January 2025): 103862, https://doi.org/10.1016/j.erss.2024.103862.

[8] Olivetti, Elsa A., Gerbrand Ceder, Gabrielle G. Gaustad, and Xinkai Fu, “Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals,” Joule 1, no. 2 (October 11, 2017): 229–243, https://doi.org/10.1016/j.joule.2017.08.019.

[9] Chordia, Mudit, Sanna Wickerts, Anders Nordelöf, and Rickard Arvidsson, “Life Cycle Environmental Impacts of Current and Future Battery-Grade Lithium Supply from Brine and Spodumene,” Resources, Conservation and Recycling 187 (December 2022): 106634, https://doi.org/10.1016/j.resconrec.2022.106634.

[10] Li, Zhiyuan, Zhixiang Cheng, Yin Yu, Junjie Wang, Longbao Wang, Wenxin Mei, and Qingsong Wang, “Thermal Runaway Comparison and Assessment Between Sodium-Ion and Lithium-Ion Batteries,” Process Safety and Environmental Protection 193 (January 2025): 842-855, https://doi.org/10.1016/j.psep.2024.11.118.

[11] Clean Energy Ministerial Supercharging Battery Storage Initiative, Battery Storage Unlocked: Lessons Learned from Emerging Economies, November 2024. https://www.nrel.gov/docs/fy25osti/91781.pdf.

[12] Mueller, Simon C., Philipp G. Sandner, and Isabell M. Welpe, “Monitoring Innovation in Electrochemical Energy Storage Technologies: A Patent-Based Approach,” Applied Energy 137 (January 1, 2015): 537–544, https://doi.org/10.1016/j.apenergy.2014.06.082.

[13] Enasel, Eduard, and Gheorghe Dumitrascu, “Storage Solutions for Renewable Energy: A Review,” Energy Nexus 17 (March 2025): 100391, https://doi.org/10.1016/j.nexus.2025.100391.

[14] European Partnership, BATT4EU SRIA 24: Strategic Research & Innovation Agenda, February 2024, https://www.horizon-europe.gouv.fr/sites/default/files/2024-02/t-l-charger-le-sria-batt4eu-f-vrier-2024–6449.pdf.

[15] Fleischmann, Jakob, Patrick Schaufuss, Martin Linder, Mikael Hanicke, Evan Horetsky, Dina Ibrahim, Sören Jautelat, Lukas Torscht, and Alexandre van de Rijt, “Battery 2030: Resilient, Sustainable, and Circular,” McKinsey & Company, January 16, 2023, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/battery-2030-resilient-sustainable-and-circular.

[16] Ahmad, Samar, “The Lithium Triangle: Where Chile, Argentina, and Bolivia Meet,” Harvard International Review, January 15, 2020, https://hir.harvard.edu/lithium-triangle/.

[17] Szwarc, Patrycja, “Lithium Mining in the Atacama Salt Flats, Chile: How the Strive for Environmentally Sustainable Vehicles is Doing More Harm Than Good,” Environmental Justice History, accessed March 18, 2025, https://ejhistory.com/lithium-mining/.

[18] Tedesco, Marco, “The Paradox of Lithium.” News from the Columbia Climate School, January 18, 2023, Accessed March 18, 2025. https://news.climate.columbia.edu/2023/01/18/the-paradox-of-lithium/.

[19] “Japan and the European Union Agree Closer Cooperation to Develop Advanced Materials as They Look to De-Risk from Chinese Supply Chains,” Pamir Consulting LLC Blog, June 3, 2024, https://pamirllc.com/blog/japan-eu-cooperation-develop-advanced-materials-de-risk-from-chinese-supply-chains. Accessed March 18, 2025.

[20] Rostami, Hossein, Johanna Valio, Pekka Suominen, Pekka Tynjälä, and Ulla Lassi, “Advancements in Cathode Technology, Recycling Strategies, and Market Dynamics: A Comprehensive Review of Sodium Ion Batteries,” Chemical Engineering Journal 495 (September 1, 2024): 153471, https://doi.org/10.1016/j.cej.2024.153471.

[21] Curto Fuentes, Monika, et al, Overview of International R&D&I Battery Funding and Global Benchmarks for Battery KPIs, VDI/VDE Innovation + Technik GmbH. Batteries Europe Secretariat, June 2024, https://batterieseurope.eu/wp-content/uploads/2024/06/Report_Overview-of-International-RDI-Battery-Funding-and-Global-Benchmarks-for-Battery-KPIs-1.pdf.

[22] Mamoor, Muhammad, Yi Li, Lu Wang, Zhongxin Jing, Bin Wang, Guangmeng Qu, Lingtong Kong, Yiyao Li, Zaiping Guo, and Liqiang Xu, “Recent Progress on Advanced High Energy Electrode Materials for Sodium Ion Batteries,” Green Energy and Resources 1, no. 3 (September 2023): 100033, https://doi.org/10.1016/j.gerr.2023.100033.

[23] Research and Markets, “Sodium-Ion Batteries: Materials, Technologies and Global Markets to 2029,” Business Wire, November 26, 2024, https://www.businesswire.com/news/home/20241126958525/en/Sodium-ion-Batteries-Materials-Technologies-and-Global-Markets-to-2029-with-CATL-HiNa-Battery-Technology-Faradion-Tiamat-and-Natron-Energy-Dominating-the-%24838.5-Million-Industry—ResearchAndMarkets.com.

[24] Gulley, Andrew L, “The Development of China’s Monopoly over Cobalt Battery Materials.” Mineral Economics, June 10, 2024. https://doi.org/10.1007/s13563-024-00447-w.

[25] Cruz, Alberto. “Lithium Price Fluctuations: Impacts, Opportunities, and Brazil’s Strategic Advantage,” Net Zero Circle, February 27, 2025, https://www.netzerocircle.org/articles/lithium-price-fluctuations-impacts-opportunities-and-brazils-strategic-advantage.

[26] Berman, Kimberly, “Sodium-ion Batteries: New Battery Technologies and the Energy Transition,” SFA (Oxford), May 2, 2024, https://www.sfa-oxford.com/market-news-and-insights/sfa-sibs-commercialisation-path-is-promising-but-fraught-with-uncertainty/.

[27] BASF Stationary Energy Storage GmbH, “NAS Batteries: Long-Duration Energy Storage Proven at 5GWh of Deployments Worldwide,” Energy-Storage.News, June 8, 2023, https://www.energy-storage.news/nas-batteries-long-duration-energy-storage-proven-at-5gwh-of-deployments-worldwide/.

[28] Komaba, Shinichi, Saaya Sekine, Tomooki Hosaka, and Masanobu Nakayama, “Leveraging Machine Learning to Find Promising Compositions for Sodium-Ion Batteries,” Journal of Materials Chemistry A, November 6, 2024, https://www.tus.ac.jp/en/mediarelations/archive/20241106_7384.html.

[29] “International Demonstration Project on Japan’s Technologies for Decarbonization and Energy Transition,” New Energy and Industrial Technology Development Organization (NEDO), Last modified December 25, 2024, https://www.nedo.go.jp/english/activities/activities_AT1_00175.html.

[30] “NGK Receives an Order for NAS Batteries for a Grid Storage Battery Demonstration Project at a State-Owned Energy Company in Hungary,” NGK Insulators, Ltd, Last modified August 30, 2024, https://www.ngk-insulators.com/en/news/20240830_1.html.

[31] “Global EV Outlook 2024: Trends in the Electric Vehicle Industry,” International Energy Agency, 2024, https://www.iea.org/reports/global-ev-outlook-2024/trends-in-the-electric-vehicle-industry.

[32] “Feed-in-Tariff (FIT) / Feed-in-Premium (FIP),” InfluenceMap, 2024, https://japan.influencemap.org/policy/Feed-in-tariff-FIT-Feed-in-premium-FIP-5353#:~:text=The%20Feed%2Din%20Premium%20(FIP,price%20as%20under%20the%20FIT.