Introduction: Why Arizona, Why Now

Semiconductors have evolved beyond being just a technical component in smartphones, cars, and data centers. They are now essential for economic security, military strength, and advancements in artificial intelligence. With rising geopolitical tensions and fast-paced technological competition, advanced chips are now viewed more as strategic assets than just commercial products. This shift has highlighted the risks associated with the United States’ long-standing reliance on semiconductor manufacturing abroad, especially in East Asia.

The United States is shifting its industrial strategy to focus on rebuilding domestic chip production. Arizona is now at the forefront of this initiative. A location previously considered unlikely for advanced manufacturing is now home to some of the largest semiconductor investments in U.S. history. The rapid growth in Arizona illustrates a significant shift in Washington’s perspective on industrial capacity, supply chain resilience, and technological independence.

This change is happening right now. Arizona’s economic landscape is being reshaped by new fabrication facilities, federal funding commitments, and workforce development programs, all of which are bolstering the United States’ position in the global semiconductor race. Looking at Arizona’s emergence as the “Silicon Desert” reveals how industrial policy, national security, and emerging technologies are coming together, highlighting why semiconductor manufacturing is a key factor in today’s global competition.

From Global Dependence to Domestic Reshoring

For many years, the United States depended on a semiconductor supply chain that was very globalized and focused on cutting costs and improving efficiency rather than being strategically resilient. Taiwan and South Korea became the primary locations for the manufacture of processors and memory chips, while China invested heavily in developing its semiconductor manufacturing capabilities. This model let U.S. companies focus on design and innovation while outsourcing manufacturing. However, it also made companies dependent on each other in ways that put important technologies at risk from outside shocks and geopolitical risk.[1]

It’s becoming more and more difficult to ignore these shortcomings. Semiconductors are now at the center of strategic policymaking because of rising U.S.-China technological competition, export controls, and worries about supply chain security. China’s faster push to strengthen its memory chip sector has made global competition even tougher, which makes the U.S. even more worried about its technological leadership and access to advanced manufacturing capacity, as Nikkei Asia points out.[2] The COVID-19 pandemic also showed how shortages in semiconductor supply could quickly hurt industries from making cars to making consumer electronics. These events demonstrated the economic and strategic costs of relying too heavily on production in other countries.[3]

As a result, bringing semiconductor manufacturing back to the U.S. has become more of a national priority than a market-driven solution. Federal assistance and substantial private investments have endeavored to restore domestic production capacity and mitigate the risks associated with dependence on a limited number of foreign supply chains. Arizona’s emergence as a major semiconductor hub further demonstrates this shift in U.S. industrial strategy. As capital shifts from Asia to the American Southwest, Arizona has become a key part of the United States’ efforts to find a balance between economic competitiveness and supply chain security in a technology world that is becoming more competitive.[4]

The chip market is in constant competition as countries compete over the ability to produce high-technology chips. As such, the U.S., China, and Taiwan are more concerned about the chip market’s strategic value than the commercial aspect of producing chips. As this reality has developed, it is clear that the U.S. will continue to look for ways to reduce its dependence on concentrated production areas and rebuild chip production facilities in the U.S.[5]

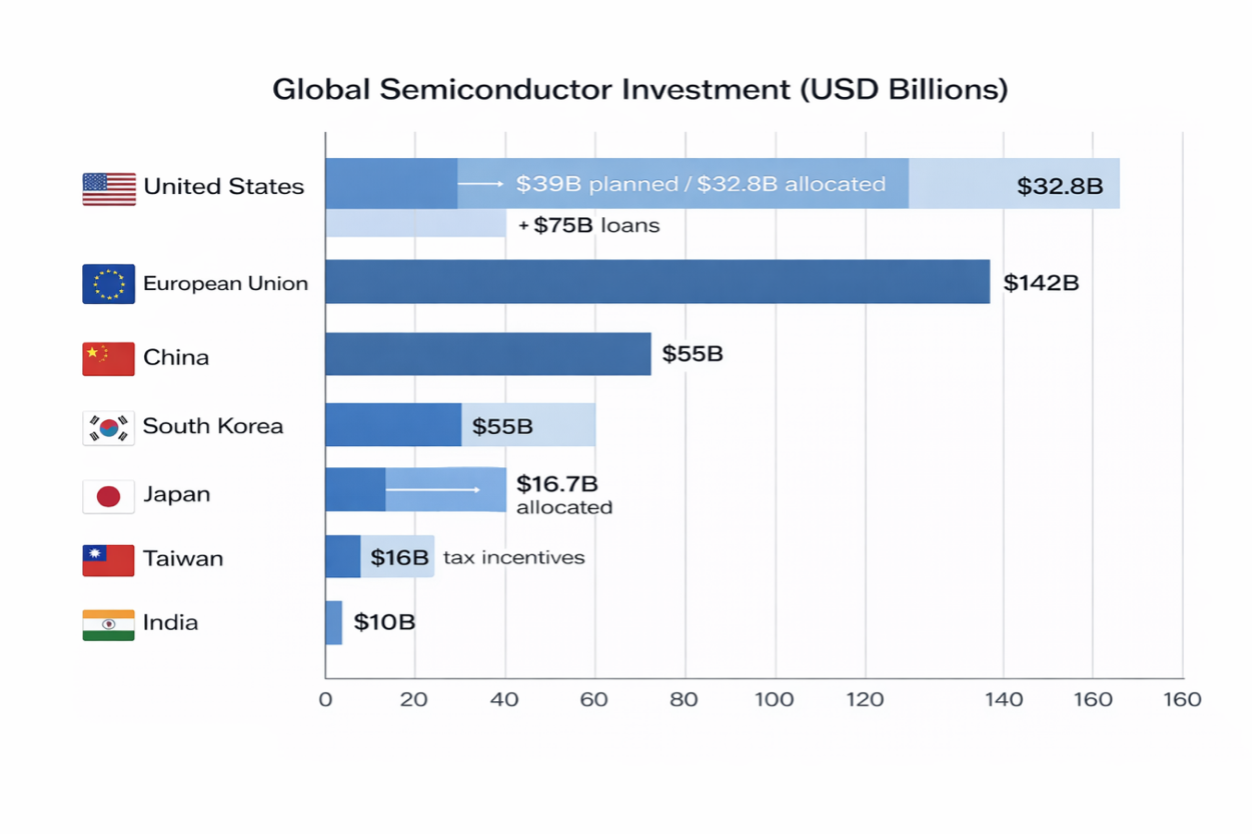

The amounts being invested globally in the semiconductor industry by different governments are shown below. These investments also indicate that there is going to be an increase in competition between countries to produce strategic semiconductors.

China will spend $55 billion to improve its semiconductor manufacturing capabilities and increase technological independence; the United States has allocated $39 billion to expand domestic semiconductor production and $75 billion in loans for advanced manufacturing as part of the CHIPS and Science Act. These investments are intended to increase U.S. production facilities and decrease dependence on foreign manufacturing.

The European Union has approximately $142 billion available for investment in the semiconductor industry as part of a regional coordinated strategy for securing secure technologies. South Korea has committed $55 billion in tax incentives to encourage the development of its semiconductor industry, while Japan and Taiwan have contributed $25.3 billion and $16 billion, respectively, to develop their semiconductor industries. Finally, India has allocated $10 billion to enhance its position in the global semiconductor supply chain.

In conclusion, the shift from the semiconductor industry being just another commercial sector to being a significant part of the political landscape means that there has been significant government investment of taxpayer money as governments try to establish themselves as technology leaders and ensure they have access to the resources necessary to develop future technologies.

Arizona’s Emergence as a Semiconductor Hub

Arizona’s rise as a semiconductor manufacturing center reflects a convergence of structural advantages, policy support, and shifting industry priorities. Long regarded as an unlikely location for advanced manufacturing, the state has leveraged its available land, existing industrial infrastructure, and business-friendly environment to attract large-scale semiconductor investment. As U.S. firms and foreign manufacturers reassess supply chain concentration risks, Arizona has increasingly been positioned as a viable alternative to overseas production hubs.[6]

Central to this transformation is the clustering effect now taking shape across the state, particularly in the Greater Phoenix area. Semiconductor manufacturing requires not only fabrication facilities but also a dense network of suppliers, logistics providers, and advanced packaging operations. Recent news stories show that Arizona is no longer just home to isolated projects; instead, it is becoming a larger ecosystem that supports the production of chips from start to finish.[7] This clustering dynamic has accelerated investment momentum, reinforcing Arizona’s appeal as a long-term manufacturing base rather than a temporary reshoring experiment. Major industry players have been instrumental in anchoring this ecosystem.

Taiwan Semiconductor Manufacturing Company’s multibillion-dollar investment has drawn global attention, while U.S.-based firms and specialized manufacturers have followed with complementary projects. According to regional reporting, these developments are reshaping Arizona’s industrial identity and positioning the state as one of the most significant semiconductor growth centers in the United States.[8] The scale of capital inflows also reflects confidence that Arizona’s manufacturing capacity will remain strategically relevant as demand for advanced chips continues to rise. Public institutions have played a supporting role in sustaining this momentum. Coverage from Arizona State University underscores how state-level coordination between industry, education, and local government has helped Arizona absorb rapid industrial expansion.[9]

Workforce development initiatives and research partnerships have become essential components of the state’s semiconductor strategy, ensuring that manufacturing growth is matched by the availability of skilled labor and technical expertise. Taken together, these factors explain why Arizona has moved from the periphery to the center of U.S. semiconductor reshoring efforts. Its emergence as a semiconductor hub is not the result of a single investment decision but of a broader realignment in how the United States approaches industrial capacity, regional development, and technological competitiveness in an increasingly fragmented global economy.

TSMC and the Strategic Logic of Investment

Taiwan Semiconductor Manufacturing Company is at the heart of Arizona’s semiconductor transition. The fact that TSMC is building large-scale manufacturing plants in Arizona is more than just a business move. It shows a change in strategy for how sophisticated semiconductor production is spread out over the world and how it is perceived politically. Because TSMC is the world’s largest contract chipmaker, its investment has effects that go well beyond Arizona’s economy.[10]

The size of TSMC’s commitment indicates that this is a purposeful move. The Arizona facilities, which receive a lot of help from the federal government, are meant to make sophisticated logic chips that are very important for AI, military systems, and high-performance computing.[11] These are exactly the parts of the semiconductor sector that governments and business executives are starting to see as critical to national security. By putting some of this manufacturing capacity on U.S. soil, the investment links business goals with larger strategic goals.

This change also demonstrates how people’s perceptions of global danger are evolving. Tensions in the Indo-Pacific and concerns about the concentration of supply chains have made some think that sophisticated chip manufacturing is more vulnerable. Some reports’ analyses show how China’s simultaneous attempt to expand its own memory chip industry has made competition more fierce throughout the world, making it harder for the U.S. to have dependable access to sophisticated manufacturing technology.[12] In this case, TSMC’s activities in Arizona are a way to protect against geopolitical instability, not a full move of manufacturing.Federal help has been very important in making this investment possible. Reporting on TSMC’s unprecedented amount of government support shows how important public funding has become in changing the way semiconductor supply chains work.[13] The combination of private finance and government backing is a sign of a bigger shift in U.S. industrial strategy. Market mechanisms alone are no longer considered enough to protect important innovations. Arizona is trying this method to show how state-level capabilities may be used to help achieve national goals.

When we put it all together, TSMC’s presence in Arizona shows that semiconductor production is becoming more of a strategic asset than just a way to make money. The company’s investment shows how corporate strategy, government incentives, and geopolitical factors are all coming together to shape the global semiconductor scene today.Economic and Workforce Transformation

The fast growth of semiconductor manufacturing is changing Arizona’s economy in ways that go beyond just the amount of money that is being invested. Large-scale fabrication facilities have created a need for a wide range of skilled and semi-skilled workers, such as engineers, technicians, construction workers, and supply chain experts. Arizona State University reports that the semiconductor boom has become a major factor in the creation of high-paying jobs. This has strengthened Arizona’s position in the national technology economy and diversified its traditional industrial base.[14]

This shift has also put more stress on Arizona’s workforce infrastructure. Making semiconductors requires very specific technical skills, and the speed of growth has outpaced the number of trained workers. Recent research indicates that Arizona’s expansion in the semiconductor sector has revealed significant workforce readiness challenges, especially in advanced manufacturing and engineering positions.[15] To keep long-term growth going, it’s important to fill these gaps. If there aren’t enough workers, production schedules could slow down and costs could go up.

Universities and public institutions have built stronger connections with businesses in response. Arizona State University plays a significant role in workforce development through specialized training programs, collaborative research efforts, and ensuring its curriculum aligns with the demands of the semiconductor industry.[16] These efforts contribute to a larger strategy aimed at ensuring Arizona’s semiconductor plan incorporates the development of human capital. This approach ensures a consistent availability of skilled workers to support industrial expansion.

The semiconductor boom has significantly impacted the economy at the regional level. Reports from local news indicate that investment in chip manufacturing has spurred growth in housing, infrastructure, and service sectors. It has attracted secondary suppliers and technology companies to the state.[17] This multiplier effect enhances Arizona’s status as a semiconductor ecosystem rather than merely a collection of individual production sites.

Arizona’s growth in the semiconductor industry is transforming its economy and job market. The challenge ahead is to maintain investment momentum while ensuring that the workforce and institutions can meet the demands of advanced manufacturing in an increasingly competitive global market.

Arizona in the Global Semiconductor Landscape

Arizona’s semiconductor expansion is closely linked to wider changes in the global semiconductor industry. The state’s rapid growth boosts domestic manufacturing capacity and highlights the increasing competition among major powers for technological leadership. Geopolitical factors are playing a growing role in semiconductor production, as countries aim to minimize external risks while maintaining access to cutting-edge technologies.

Nikkei Asia’s analysis highlights Arizona’s growth in relation to China’s intensified push to enhance its domestic chip production, especially in the memory sector. China’s efforts emphasize the critical value placed on achieving semiconductor self-sufficiency and reveal that the location of manufacturing is increasingly central to technological competition.[18] In this context, Arizona illustrates the U.S. approach to a more divided and competitive semiconductor landscape, where the concentration of supply chains is seen as a strategic risk.

Arizona’s rise does not indicate a step back from global interdependence. Semiconductor production is highly global, with design, fabrication, equipment, and materials spread across various regions. Investment analysis highlights that U.S. reshoring efforts focus on diversification instead of complete decoupling, as global supply chains remain essential for innovation and scale.[19] Arizona’s role adds to, rather than substitutes for, the current manufacturing hubs in East Asia.

Business reporting shows that Arizona is now a key player in global investment flows in the semiconductor sector. As companies evaluate geographic risks and long-term production plans, Arizona has become a more appealing destination for investment, offering stability, supportive policies, and closeness to the U.S. market.[20] This positioning strengthens the state’s importance in the global semiconductor ecosystem, even as competition for advanced manufacturing capacity grows.Arizona’s role in the global semiconductor landscape shows a significant shift in the production of chips and their locations. The state’s growth shows how industrial policy, corporate strategy, and geopolitical competition are changing the landscape of advanced manufacturing. Arizona’s growth indicates a shift toward a more diversified and strategically adjusted global production network in semiconductors, rather than signaling the end of globalization in this sector.

Strategic Implications for the United States

The expansion of semiconductors in Arizona has effects that reach far beyond just local economic growth. This indicates a significant change in the way the United States views economic security and its role in technological leadership. Semiconductor manufacturing is now seen as more than just an industrial process; it is a strategic asset linked to national strength, innovation, and defense preparedness.

One important point is the resilience of the supply chain. The focus of advanced chip production in East Asia puts the United States at risk from geopolitical tensions, trade disruptions, and external shocks. Arizona is becoming a significant manufacturing center, aiming to address vulnerabilities by establishing some advanced production within the U.S. Reporting on TSMC’s Arizona facilities shows that domestic fabrication capacity is now viewed as a protection against supply chain vulnerabilities, rather than a replacement for global integration.[21]The expansion changes the United States’ role in global technological competition. Nikkei Asia’s analysis highlights China’s increased investment in memory chip production, emphasizing that semiconductor manufacturing is now a key battleground in strategic competition.[22] Arizona enhances the U.S. ability to produce advanced logic chips, crucial for artificial intelligence, defense technologies, and high-performance computing. This stance strengthens the United States’ capacity to lead in emerging technologies and address competitive challenges from rival nations.

The federal role in Arizona’s semiconductor initiatives highlights a change in the U.S. industrial approach. Public funding on a large scale and better coordination among institutions demonstrate a shift from previous methods that mainly depended on market forces to distribute manufacturing tasks. The reporting on the significant federal investment in TSMC’s Arizona operations highlights the crucial role of government support in securing key industries that are essential for maintaining long-term competitiveness.[23] This method indicates a fresh readiness to employ industrial policy as a means of strategic statecraft.

Arizona’s growth in the semiconductor industry underscores the shortcomings of relying solely on reshoring as a solution. Business and investment reporting highlights the deep interconnections of global supply chains, indicating that U.S. manufacturing growth should be viewed as diversification rather than a move toward complete self-sufficiency.[24] The importance of Arizona is not about taking over overseas production, but rather about minimizing concentrated risk and enhancing domestic capabilities in key areas of the semiconductor value chain.

Arizona’s transformation shows how the United States is adjusting its strategy regarding industrial capacity amid geopolitical competition. Semiconductor manufacturing is now a focal point where economic policy, national security, and technological ambition come together more than ever. Arizona’s involvement in this change highlights the importance of regional industrial growth and its implications on national and global strategies.

Conclusion: The Meaning of the “Silicon Desert”

Arizona’s emergence as a semiconductor manufacturing center highlights a significant shift in the United States’ strategy regarding technology, industrial capabilities, and risk management. A location that was previously on the outskirts of the global semiconductor landscape has now emerged as a central hub for reshoring initiatives, advanced manufacturing, and sustained investment in essential technologies. The rise of the “Silicon Desert” highlights a geographic change and prompts a reevaluation of how economic efficiency relates to national security.

This transformation is ongoing. Arizona’s industrial landscape is being shaped by new fabrication facilities, expanding supply networks, and workforce development initiatives. With major companies like TSMC establishing advanced production in Arizona, the state’s impact goes beyond just creating jobs and fostering regional growth. The U.S. is using this as a platform to implement a new industrial strategy that views semiconductor manufacturing as a key strategic asset instead of just a business opportunity.[25]Arizona’s expansion underscores the shifting landscape of semiconductor production worldwide. The growing competition, especially with China’s push to enhance its domestic chip production, highlights the importance of having diverse manufacturing sites.[26] Arizona’s growth does not indicate a decline in global interdependence in the semiconductor industry. This indicates a shift toward a more balanced and resilient production network, where domestic capacity supports rather than replaces international supply chains.[27]

Ultimately, Arizona’s semiconductor boom illustrates the convergence of technological competition, industrial policy, and geopolitical risk in real time. The rising demand for advanced chips, fueled by artificial intelligence, defense systems, and digital infrastructure, highlights the growing strategic significance of locations such as Arizona. The “Silicon Desert” exemplifies how regional industrial changes can have national and global significance in today’s landscape of technological competition.

[1] “From Asia to Arizona: Why U.S. Chipmaking Is the Next Mega Trend,” InvestorPlace, December 10, 2025, https://investorplace.com/smartmoney/2025/12/asia-arizona-why-u-s-chipmaking-next-mega-trend/.

[2] Cheng Ting-Fang, “Arizona’s Chip Awakening and China’s Memory Boost,” Nikkei Asia, November 13, 2025, https://asia.nikkei.com/Tech/Tech-Asia/Arizona-s-chip-awakening-and-China-s-memory-boost.

[3] “How the Semiconductor Boom and ASU Are Transforming Arizona’s Economy,” Arizona State University News, August 22, 2025, https://news.asu.edu/20250822-science-and-technology-how-semiconductor-boom-and-asu-are-transforming-arizona-economy.

[4] Taiwan Semiconductor Manufacturing Company, “About TSMC Arizona,” TSMC, https://www.tsmc.com/static/abouttsmcaz/index.htm.

[5] “The Global Chip Wars: Why Semiconductors Matter,” Bloomberg, April 21, 2025, https://www.bloomberg.com/explainers/global-chip-wars-semiconductors.

[6] “From Asia to Arizona: Why U.S. Chipmaking Is the Next Mega Trend.”

[7] Arizona PBS, “Chip Manufacturers Bring New Platforms to Arizona,” Horizon, November 18, 2025, https://azpbs.org/horizon/2025/11/chip-manufacturers-bring-new-platforms-to-arizona/.

[8] “Arizona Semiconductor Industry Revolution,” San Francisco Business Journal, October 3, 2025, https://www.bizjournals.com/sanfrancisco/news/2025/10/03/arizona-semiconductor-industry-revolution.html.

[9] “How the Semiconductor Boom and ASU Are Transforming Arizona’s Economy.”

[10] Taiwan Semiconductor Manufacturing Company, “About TSMC Arizona.”

[11] “TSMC Arizona Secures Record $6.6B Federal Investment for Chip Revolution,” Nanotechnology World, January 30, 2025, https://www.nanotechnologyworld.org/post/tsmc-arizona-secures-record-6-6b-federal-investment-for-chip-revolution.

[12] Cheng Ting-Fang, “Arizona’s Chip Awakening and China’s Memory Boost.”

[13] “TSMC Arizona Secures Record $6.6B Federal Investment for Chip Revolution.”

[14] “How the Semiconductor Boom and ASU Are Transforming Arizona’s Economy.”

[15] “How Arizona Is Working to Bridge the Semiconductor Workforce Gap,” Harvard Business Review, June 28, 2024, https://hbr.org/sponsored/2024/06/how-arizona-is-working-to-bridge-the-semiconductor-workforce-gap.

[16] “How the Semiconductor Boom and ASU Are Transforming Arizona’s Economy.”

[17] Arizona PBS, “Chip Manufacturers Bring New Platforms to Arizona.”

[18] Cheng Ting-Fang, “Arizona’s Chip Awakening and China’s Memory Boost.”

[19] “From Asia to Arizona: Why U.S. Chipmaking Is the Next Mega Trend.”

[20] “Arizona Semiconductor Industry Revolution.”

[21] Taiwan Semiconductor Manufacturing Company, “About TSMC Arizona.”

[22] “Arizona’s Chip Awakening and China’s Memory Boost.”

[23] “TSMC Arizona Secures Record $6.6B Federal Investment for Chip Revolution.”

[24] “From Asia to Arizona: Why U.S. Chipmaking Is the Next Mega Trend.”

[25] Taiwan Semiconductor Manufacturing Company, “About TSMC Arizona.”

[26] Cheng Ting-Fang, “Arizona’s Chip Awakening and China’s Memory Boost.”

[27] “From Asia to Arizona: Why U.S. Chipmaking Is the Next Mega Trend.”