Foreign Direct Investment (FDI) has long been recognized as a catalyst for economic growth and development in Africa. Over the past few decades, African countries have increasingly become attractive destinations for foreign investors seeking new opportunities and markets. This trend has been driven by various factors, including the continent’s abundant natural resources, growing consumer markets, and improving business environments.

The continent’s rich endowment of natural resources has been recognized as one of the key drivers of FDI in Africa, including oil, gas, minerals, and agricultural products. Many African countries have vast reserves of these resources, making them highly attractive to foreign investors looking to tap into these markets. In sub-Saharan Africa, countries like Nigeria, South Africa, Angola, and Ghana have been major recipients of FDI in the extractive industries.

In addition to natural resources, Africa’s rapidly growing population and expanding consumption have also made the continent an attractive market for foreign investors. With over 1.2 billion people and a rising consumer demand for goods and services, many multinational companies see Africa as a lucrative market with untapped potential. This has led to increased investments in sectors such as retail, telecommunications, banking, and manufacturing, as companies seek to capitalize on the continent’s growing consumer base.

Furthermore, African governments have made significant efforts to improve their business environments and attract more FDI. Many countries have implemented economic reforms, streamlined regulatory processes, and reduced barriers to entry for foreign investors. This has helped to enhance a conducive environment for FDI, making it easier for companies to set up operations, access markets, and do business in Africa.

Despite these positive developments, challenges remain for FDI in Africa. Issues such as political instability, corruption, inadequate infrastructure, and regulatory uncertainties continue to deter some investors from committing capital to the continent. Addressing these challenges will be crucial to attracting more FDI and maximizing its potential impact on economic growth and development in Africa. To that end, this paper aims to analyze recent investment trends in Africa, and the main challenges and prospects for FDI on the continent.

FDI to Africa: Trends, distribution and origin

FDI is one of the most important forms of capital inflow into developing countries. In Africa, during the past decade, FDI flow has grown nearly six-fold. However, only fifteen countries accounted for over 80% of the total FDI flow to the continent. Furthermore, the largest inflows are either in sectors with a comparative advantage in Africa (such as the natural resources sector) or where there is a need for investment and returns are high, such as the construction and telecommunication sectors.

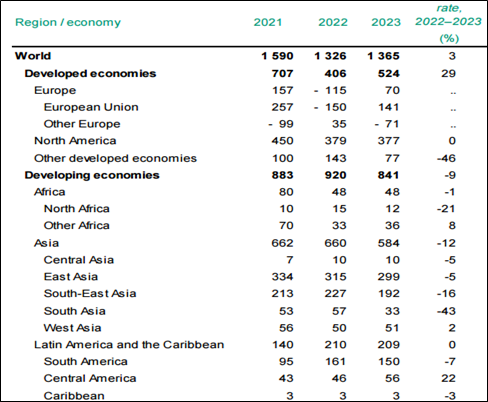

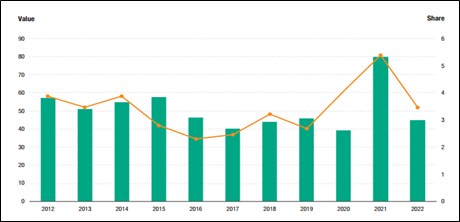

In recent years, Africa has attracted a significant amount of investment across its promising sectors, enhancing economic growth and development. Although 2023 was a challenging year for global investment, the continent continues to hold great potential for investors with its competitive returns. In 2023, FDI flows to Africa were almost constant at $48 billion accounting for only 3.5 percent of global FDI (see figure 1). Greenfield project announcements increased, mostly due to the strong growth in some countries, such as Nigeria and Kenya. However, project finance deals fell by one-third, more than the global average decline, weakening prospects for infrastructure finance flows,([i]) as shown in Table 1.

Table 1: Distribution of Global FDI Inflows

Source: UNCTAD Investment Monitor, January 2024, https://unctad.org/publication/global-investment-trends-monitor-no-46

Figure 1: Africa FDI inflow and Share of Global Flow

Source: UNCTAD Investment Report Africa Regional Trend, 2023, https://unctad.org/system/files/non-official-document/wir2023-regional_trends_africa_en.pdf

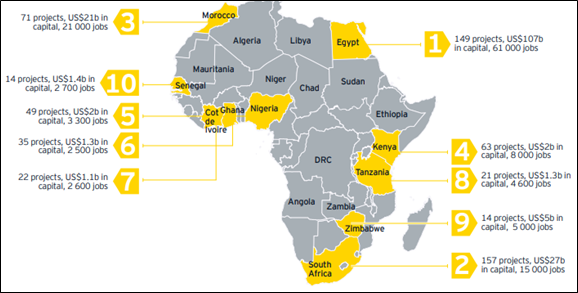

FDI flows to Africa are not evenly distributed across the continent’s regions or countries, in terms of both volume and growth. Egypt’s FDI has doubled to $11 billion in 2023 as a result of increased cross-border merger and acquisition transactions. The total number of announced greenfield projects has more than doubled to 161. FDI flow to Morocco fell by 6% to $2.1 billion in the same year.

Nigeria, in West Africa, witnessed negative FDI flow in 2023 to -$187 million as a result of equity divestment.[ii] However, the total FDI rose by 24 percent to $2 billion. Flow to Senegal remained flat at $2.6 billion, while flow to Ghana decreased by 39 percent to $1.5 billion. FDI to the Democratic Republic of Congo in Central Africa remained unchanged at $1.8 billion. In east Africa, FDI flow to Ethiopia decreased by 14 percent to $3.7 billion, while FDI to Uganda and Tanzania increased by 39 percent to $1.5 billion and 8 percent to $1.1 billion, respectively.([iii])

Figure 2: Largest FDI Recipients in Africa

Source: Africa Attractiveness Report 2023,https://assets.ey.com/content/dam/ey-sites/ey-com/en_za/topics/attractiveness/africa-attractiveness-2023/graphics/new-graphics/ey-com-en-za-2023-ey-africa-attractiveness-report-nov.pdf

Regarding the distribution of FDI in African Regional Economic Communities (RECs), FDI inflow has increased over the past five years in four of the African RECs, with 14 percent to $22 billion in COMESA, quadrable to $10 billion in SADC, doubling to $5.2 billion in WAEMU, and by 9 percent to $3.8 billion in EAC.([iv])

The sectoral distribution of this investment reflects the structural distortion of African economies. The majority of the investment flows to the energy and gas supply and extractive industries (73% of FDI inflow), followed by investment in the services sector, especially in construction (12.3%), transportation and storage (4%), and information and communication (3%).([v]) Some analysts correlate the increasing investment in the oil sector in Africa with the Russia-Ukraine war and the disruption in the Russian oil supply caused by it.([vi])

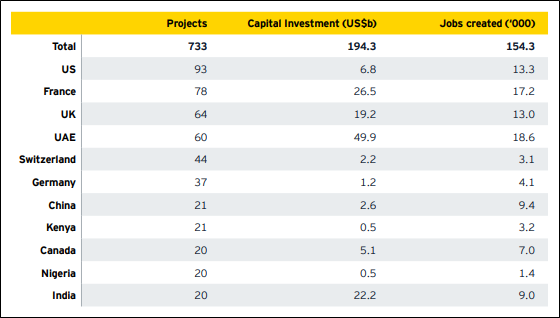

About the sources of FDI flows to Africa, the USA remains the largest investor in Africa by project numbers, contributing to 13% of Africa’s total investment — its highest since 2016. However, when assessed in terms of capital, the country is behind the UAE, France, and India. In 2022, the United States invested $7 billion in Africa, the most since 2018, with South Africa, Egypt, and Kenya receiving the most funds. Key initiatives announced were in South Africa (telecommunication), Egypt (business services), and Kenya (technology).([vii])

Under the African Continental Free Trade Area (AfCFTA), many initiatives between the United States and Africa, were established to enhance bilateral trade and investment. Since 2021, the U.S. government has sponsored more than 800 trade and investment projects worth $18 billion in 47 African countries, while the U.S. private sector has finalized investment deals in Africa totaling $8.6 billion. At the US-Africa Leaders’ Summit in December 2022, the U.S. announced its intention to invest $55 billion in Africa over the next three years. Of this, $15 billion will be in trade and investment commitments, deals and partnerships that advance key priorities in sustainable energy, health systems, agribusiness, digital connectivity, infrastructure and finance.([viii])

Africa’s capital inflows were led by the UAE in 2022 at $50 billion — seven times more than the amount committed by U.S. investors. FDI projects from the UAE also created the most employment (more than 18,000 jobs). Egypt and South Africa were the main beneficiaries, making up 95% of Africa’s total capital inflows from the UAE. The UAE is focused on developing Egypt’s CleanTech and South Africa’s smart and sustainable infrastructure development. The UAE invested approximately $25 billion in clean energy projects in Egypt and is developing a massive net-zero sustainable city called The Parks in South Africa, costing $20 billion. The UAE and South Africa will boost trade and investment in logistics, food production, tourism and energy. According to South African Minister Dr. Aaron Motsoaledi, the UAE will invest $10 billion in energy, oil, economic infrastructure, tourism and agriculture. The UAE is also Egypt’s largest investor, increasing investment under the 2019 Egypt-UAE joint strategic investment platform. In addition, the UAE announced a Comprehensive Economic Partnership Agreement (CEPA) with Kenya to deepen trade and investment ties.([ix])

China’s share of African FDI fell drastically to 2.9% in 2022, down from 11% in 2018. However, in terms of cumulative FDI between 2016 and 2022, China ranks fourth in projects and second in capital investment, trailing only the UAE. Its investments are extremely job-intensive, with more jobs created per FDI project than any other investing nation. The Green Finance & Development Center at Fudan University, Shanghai, argued that China’s investment in sub-Saharan Africa for global infrastructure development dropped 55% to $7.5 billion in 2022. China is a major infrastructure financier in sub-Saharan Africa, with a total investment of $155 billion over the past two decades. However, many African nations face a rising debt burden and are not able to take on additional loans, reducing construction and infrastructure demand, while China’s foreign investments shift to less risky and higher-yielding areas, impacting its influence across the continent.([x])

India has emerged as one of the top five investors in Africa in recent years, with cumulative investments in the continent amounting to $74 billion. Though only ranked as the 10th-largest investor by project number in 2022, India was the third-largest investor by capital and fifth by FDI score. Egypt was the largest recipient of India’s FDI in 2022, with six projects valued at $21 billion. Indian companies are increasingly active in natural resource-rich countries such as Nigeria and Ghana. Many Indian multinationals are attracted to agribusiness, pharmaceuticals, information and communications technology, as well as renewables. A Confederation of Indian Industry (CII) report cites Indian investments in Africa rising to $150 billion by 2030, with Indian infrastructure firms on the lookout for major opportunities.([xi])

Figure 3: Sources of FDI to Africa, 2023

Source: Africa Attractiveness Report 2023,https://assets.ey.com/content/dam/ey-sites/ey-com/en_za/topics/attractiveness/africa-attractiveness-2023/graphics/new-graphics/ey-com-en-za-2023-ey-africa-attractiveness-report-nov.pdf

Challenges and prospects

Although Africa is considered an attractive destination for investment, especially for its resource endowments, large population, and recently relatively high growth rates, there are still some challenges facing the investment flow, which makes the continent’s share of global foreign direct investment far below its potential.

In this context, factors that attract investment to Africa could be summarized as follows:

- Africa is “undiscovered” from a global investment perspective, resulting in very low valuations both in African debt and equity investments, which offer attractive entry points, especially when compared to valuations in many more developed markets; P/E ratios are mid-teens, and return on equity is mid to high 20s.

- Africa is experiencing a massive population boom; currently, 17% of the world’s population is African. At current rates of growth, Africa is growing by the equivalent population of France every two years and will double by 2050. It is expected to double again between 2050 and 2100 to 4.3 billion people or account for as much as 40% of the world’s population.

- Market capitalization to GDP is the lowest globally and investors are likely to benefit from capital market growth in the coming decades.

- The arrival of the internet, and other forms of communication, such as mobile phones, will increasingly lead to global companies “offshoring” in Africa to benefit from the low wage costs, and increasingly well-educated workforce.

- Increasing electrification is happening in Africa, as the need for large power plants fed by (in most cases) imported coal falls away to be replaced by solar and other forms of power generation that are considerably less expensive to implement and which do not require such an extensive power backbone as is found in countries that electrified earlier.

- Africa has benefited from significantly improved monetary and fiscal policy over the past three decades. This has resulted in, among other things, lower interest rates, manageable inflation levels, stable currencies, and African public debt levels that are low compared to those in developed markets.

But even with Africa’s wealth of labor and resources, both of these factors ought to raise Africa’s marginal product of capital and make the continent an especially desirable destination for capital flow. The volume of FDI flow to Africa is still very low compared to the opportunities or potentials of the African continent or as a share of the global investment flow, which provides an example of what is called the “Lucas Paradox”.([xii])

One set of explanations rests on the idea that investment projects that yield high economic rates of return are not as numerous in Africa as the simple neoclassical growth model seems to suggest. One argument is that, for a variety of reasons, the aggregate production function may be characterized by lower productivity levels in Africa compared to creditor countries. An alternative or complementary story relies on generalizing the aggregate production function to include the roles of human capital, public capital, and institutional capital. The relative endowment of these factors in the African context may also explain the decline in the marginal product of capital. These impacts raise questions about the abundance of investment opportunities that generate high economic rates of return in Africa today. To the extent that these factors reduce the marginal product of capital in Africa, they inhibit the arbitrage flows that, under the simplest neoclassical growth theory, would occur.([xiii])

The second set of explanations takes an agnostic view about the existence of such opportunities but argues that even if they existed, the flow of capital to finance them would tend to be hindered by a variety of factors. These factors include information conflicts, weak government balance sheets, low levels of national financial development, and problems related to private appropriation of social profits. All these factors are “structural” — not in the sense that they are permanent but rather that they are difficult to change in the short term. Added to this is short-term macroeconomic instability, partly driven by these fundamentals, but as experience in Africa and elsewhere has shown, this is more likely to change in the short term. However, the promise that working capital offers is that removing these investment barriers in Africa is likely to be rewarded relatively quickly by capital flows seeking to finance vital investment opportunities. The challenge facing policymakers is how to achieve this outcome.([xiv])

Investment potentials for 2024

In 2024, Africa is expected to be the second fastest-growing economic region in the world (after Asia) with a 4% average annual growth rate, according to the International Monetary Fund (IMF).

Recent conflict, military coups, the renewed Israel-Gaza conflict and the lingering Russia-Ukraine war are contributing to suppressing growth across the continent. Many African states were already suffering from slow recovery after the COVID-19 crisis, climate change shocks, increased food insecurity, political instability, weak global growth and high interest rates. More than half of the continent’s states (33 countries) are classified as least developed. These economic shocks have pushed an estimated 55 million people into poverty since 2020 and reversed more than two decades of progress in poverty reduction. Thus, although 2023 was a challenging year for investments, the continent continues to hold great potential for investors who want to propel Africa towards a brighter future while also generating competitive returns.

Much of these potentials will be driven by the exact same trends that are changing how Goodwell Investments does business in the West. Some of these trends will even have a greater impact in the African context. In its first blog post, Goodwell summarized the developments that caught its attention in 2023 and, according to it, will certainly impact the African investment space in 2024 and beyond.

The mining industry in Africa is a major contributor to the continent’s economy, with abundant deposits of precious metals and minerals. The oil and gas industry is also a vital sector, with the continent being home to significant reserves of oil and natural gas. Real estate is another growing sector in Africa, with an increasing demand for both residential and commercial properties. The technology industry is also on the rise, with a growing number of tech startups and companies emerging on the continent. Infrastructure development is also a key area for investment in Africa, with many opportunities in transportation, power, and water projects to support economic growth.

In 2023, the development of artificial intelligence (AI) made news worldwide. AI is starting to gain traction in Africa as well, and it may present enormous new prospects for quick advancements across numerous industries. Although Goodwell does not currently have any plans to directly invest in AI, the technology-driven businesses in their portfolio will undoubtedly benefit indirectly from it since it will allow them to enhance productivity, expand their customer base, and improve their workflows. AI can increase crop yields in the agriculture industry, for instance, by managing irrigation. However, technology can also enhance access to healthcare by facilitating improved patient data management and quicker detection and prediction of specific disease outbreaks. Additionally, AI has a lot of potential to drive financial inclusion, including introducing innovative tools to access credit risks, customized financial products, and providing financial knowledge.

The renewable energy industry in Africa is another promising one. Nigeria, Ghana, Ethiopia, and South Africa are among the nations aggressively pursuing the switch to more environmentally friendly energy. Africa has a lot of coastlines, but wind energy isn’t used enough. As of 2022, South Africa possessed the highest capacity of solar energy in Africa, with over six gigawatts. The largest wind farm, however, is located in Kenya and is called the Lake Turkana Wind Power Project. At 160 square kilometers, the wind farm can generate 310 MW of electricity, which is sufficient to power one million homes. Goodwell is eager to support this energy transition, especially in regions where people don’t have reliable access to the national grid. Their first investment in this sector is SparkMeter, a provider of grid management services, equipment and software solutions. They help increase access to reliable electricity in underserved communities by working with different types of energy providers, such as solar installers in Nigeria.

Additionally, several African countries are also slowly exploring the possibilities of electric vehicles, especially in densely populated urban areas. Instead of waiting for governments to act, many of the efforts are being led by innovative businesses. MAX, one of Goodwell’s investees in Nigeria, is leading the way in introducing electric motorbikes, for example. Other shipping and logistics firms Goodwell works with are starting to research LNG-powered vehicles.

The use of EVs can provide opportunities for sustainable economic growth, reduce air pollution and promote technological innovation in the transportation sector. However, EVs are just one part of the equation. Transitioning to greener mobility will also require ambitious infrastructure improvements, such as a robust network of charging stations. While this will certainly be a major challenge, it also presents huge opportunities for investors and local entrepreneurs who are early movers in this space.([xv])

According to the African Development Bank, Africa’s energy transition represents $100 billion per year in investment potential and investors could cover 70% of infrastructure financing requirements. The report also found that Africa’s investment opportunities in renewable resources and the alternative energy sector are abundant, as it is the fifth largest sector in investment opportunities. Further, the indicative return profiles for this sector are among the highest, where 80% of IOAs have an ROI of above 15% and all IOAs have a growth profit margin of above 25%.([xvi])

Conclusion

FDI has been a catalyst for economic growth and development in Africa, driven by factors such as abundant natural resources, growing markets, and significant growth rates. However, challenges such as political instability, corruption, inadequate infrastructure, and regulatory uncertainties still hinder FDI flow to Africa. Despite these challenges, Africa remains an attractive investment destination with untapped potential, especially in sectors like communications, renewable energy, banking services, and others. Efforts to address these challenges through adequate macroeconomic policy are crucial to maximizing the continent’s potential to attract FDI.

[i] “Charting the Trends that will Shape African Investment in 2024,” Goodwell, February 19, 2024,

https://goodwell.nl/news/charting-the-trends-that-will-shape-african-investment-in-2024/.

[ii] Divestment is the method of selling subsidiary properties, investments, or divisions to increase the parent company’s value. Often known as divestiture. In Nigeria, foreign direct investors have trebled their assets especially in the oil sector, with disposals reaching a staggering $200 million, according to the Central Bank of Nigeria’s economic report for 2023. Despite the profitability of their Nigerian assets, the IOCs are under increased shareholder pressure to accelerate their energy transition strategies. They’re reshaping their global portfolios towards lower-emissions-intensity operations and divesting non-core assets.

[iii] “Africa’s Macroeconomic Performance and outlook – January 2024” AFDB, February 16, 2024,

https://www.afdb.org/en/documents/africas-macroeconomic-performance-and-outlook-january-2024

[iv] World Investment Report 2023, “Regional Trends Africa,” UNCTAD,

https://unctad.org/system/files/non-official-document/wir2023-regional_trends_africa_en.pdf

[v] Ibid.

[vi] Jason Mitchell, “Mining and Gas Sectors Expected to Lead FDI into Africa in 2023,” Investment Monitor, January 6, 2023,

https://www.investmentmonitor.ai/features/mining-and-gas-lead-fdi-africa-2023/.

[vii] “A pivot to growth,” EY Attractiveness | Africa, November 2023,

[viii] Ibid.

[ix] Ibid.

[x] Ibid.

[xi] Ibid.

[xii] Robert Lucas posed a question several years ago that has continued to intrigue economists ever since: why doesn’t capital flow from rich to poor countries? This is a conundrum because poor countries are labor-abundant and capital-scarce relative to rich countries, and under the assumptions of the standard two-factor neoclassical growth model, this suggests that the marginal product of capital should be higher in poor countries than in rich ones. If so, the standard economist’s arbitrage story would suggest that capital should flow from where its returns are relatively low to where they are relatively high — that is, from rich to poor countries. Yet, this is not observed to happen to a significant extent — indeed, it appears to be happening to a smaller extent in today’s supposedly “globalized” world than it did at the turn of the 19th century. This puzzle has come to be referred to as the “Lucas paradox”. For more details, see: Eswar Prasad, Raghuram Rajan, and Arvind Subramanian, “The Paradox of Capital,” Finance & Development 44, no. 1 (March 2007),

https://www.imf.org/external/pubs/ft/fandd/2007/03/prasad.htm.

[xiii] Peter J. Montiel, “Obstacles to Investment in Africa: Explaining the Lucas Paradox,” IMF, 2006,

https://www.imf.org/external/np/seminars/eng/2006/rppia/pdf/montie.pdf

[xiv] Ibid.

[xv] “Charting the trends that will Shape African Investment in 2024,” op. cit.

[xvi] “UNDP Africa Investment Insight Report,” UNDP, July 12, 2023, https://www.undp.org/africa/investment-insights