The world economy is currently suffering from a severe debt crisis. This crisis is manifesting itself in a number of ways, including a worsening balance of payments deficit, a chronic public budget deficit, and continued pressure on the currency exchange rates of many countries. Both developed and developing countries are affected by this global crisis. Regardless of the level of economic and social progress, developing countries are not the only ones suffering from burdensome debt for their present and future. Rather, developed countries have also become trapped in a worsening debt crisis; this is evident in the economies of China and the United States, where debt is a major burden due to the acceleration of American indebtedness. It has reached more than $34 trillion currently.[i] The Chinese economy is suffering from sectoral crises that are closely linked to the exacerbation of debt challenges.

This study attempts to explore the most prominent developments in the global sovereign debt crisis and examines the reasons for its rapid deterioration over the past few years while determining the consequences of this crisis and how to deal with it and/or reduce its severity.

Developments in the sovereign debt crisis

The World Bank’s[ii] international debt report for 2023 confirms the growing risks of the sovereign debt crisis. When debt service payments reached the highest level in history, the financial burden of these payments exacerbated the challenges of the public budgets of countries, especially developing nations that are heavily indebted. With the average debt-to-GDP ratio in 28 developing economies reaching about 75 percent in 2023, these countries are now using about 23 percent of their export revenues to pay off their foreign debts.

UNCTAD[iii] estimates show the magnitude of global debt. The organization confirmed that global public debt reached a record level of about $92 trillion, highlighting the following:

- About 36 low-income countries are unable to repay their debts, and 3.3 billion people live in countries where debt payments exceed spending on health or education.

- The number of countries facing high levels of debt has increased sharply in the past decade, with some international estimates indicating that the number of these countries was only 22 in 2011 and then became 59 in 2022. Most of the debts of these countries are owed to foreigners.

- During the current year 2024, public debt servicing costs are expected to grow by 10% in developing countries and by a high rate of up to 40% in low-income countries.

The previous results of the public debt crisis confirm the reverse transfer of resources from developing countries to developed countries. In the same year, developing countries paid nearly $50 billion more to their external creditors than they received in new payments.[iv]

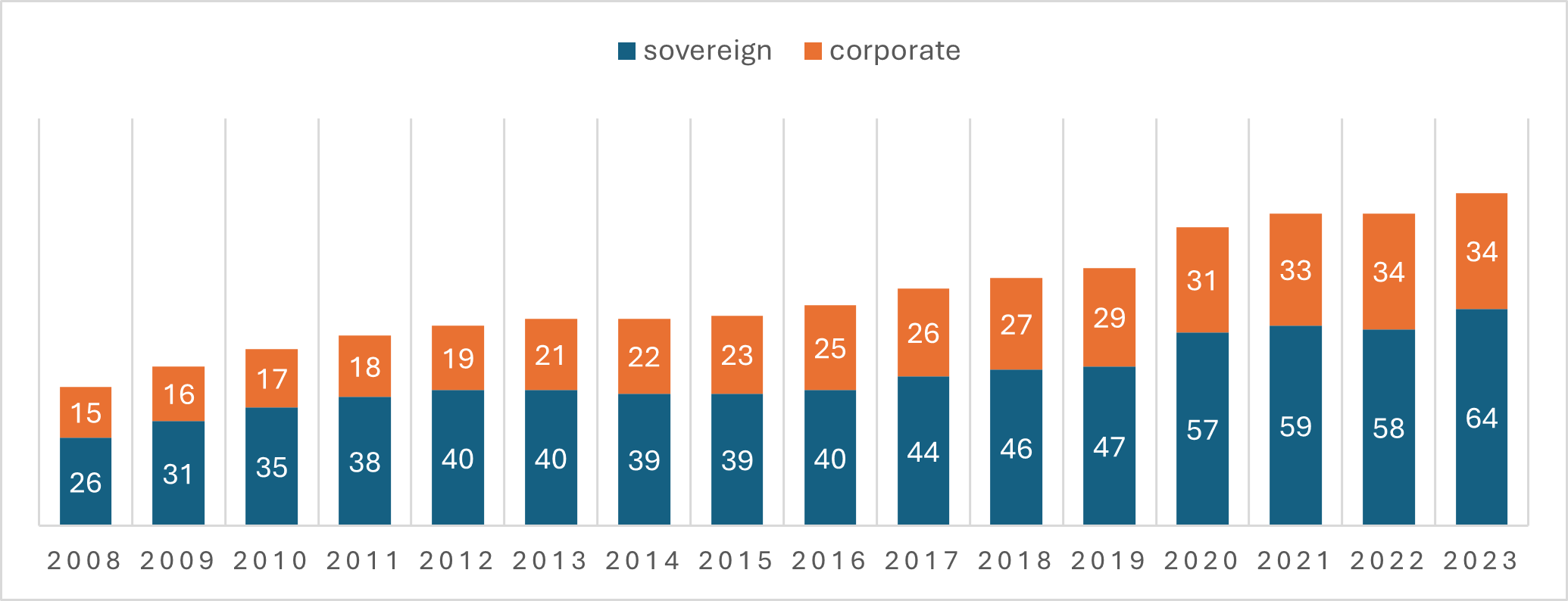

In terms of the historical development of the debt crisis, since 2008, sovereign bonds and corporate bonds have expanded so high that they reached, at the end of 2023, nearly US$100 trillion, equivalent to the size of the global gross domestic product. At the end of 2023, corporate bond debts reached Global growth reached US$34 trillion, more than 60 percent of the increase since 2008. It came from non-financial companies.

Figure 1: Evolution of sovereign debt of governments and companies globally in the period 2008-2023

Source: OECD (2024), Global Debt Report 2024: Bond Markets in a High-Debt Environment, OECD Publishing, Paris, https://www.oecd.org/finance/global-debt-report/ .

Advanced economies were also not exempt from the global debt crisis. In 2024, the total OECD government bond debt will have increased to US$56 trillion, an increase of US$30 trillion from 2008.[v]

Although corporate bonds do not bear a direct burden on government budgets and differ from the nature of sovereign debt, they nevertheless constitute a burden on the foreign exchange budget in heavily indebted countries, and the majority of them represent debts guaranteed by governments, which indirectly means a potential external obligation. It is the responsibility of international governments to contribute to the sovereign debt crisis, even in the event of faltering in heavily indebted and highly fragile economies, like those of developing nations in Asia, Africa, and Latin America. This leads us to analyze the degree of similarity or dissimilarity between the debt of developed countries and developing countries.

Sovereign debt crisis between developed and developing countries

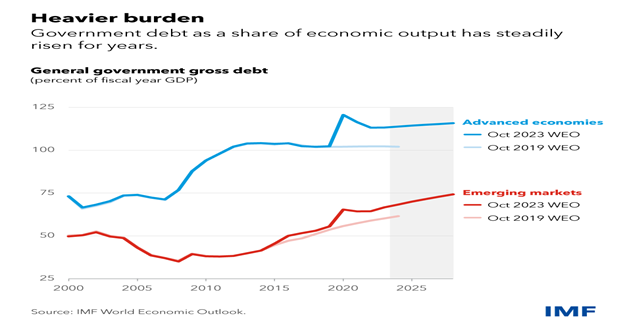

It should be noted that despite the huge burden of debt in both developed and developing economies, it differs in terms of size, quality, causes, results and repercussions between these two groups of the global economy. Unlike advanced economies, which have alternatives and capabilities to lessen or even mitigate their negative effects on economic activity, developing economies are faced with massive debts that they are unlikely to be able to overcome.

As a result, it can be concluded that there is a fundamental difference between the debt crises experienced by both developed and developing countries. This difference also appears in the value of debts, their sustainability, and the endurance capacity of each of them separately. In terms of value, developing economies bear lower amounts of global debt, but its quality is more severe for their economies. This is due to its limited carrying capacity and the narrow financial space to balance foreign exchange in the case of external debts.

Despite the existing disparity between developed and developing countries in their external debts, the debt crisis has gained exceptional momentum over the past two years, leading to the current year 2024. This can be confirmed by looking at the following notable developments regarding their debts.

In advanced economies, several developments in the sovereign debt crisis can be monitored as follows:

- Statistical estimates indicate that U.S. sovereign debt is rising[vi] by $1 trillion every 100 days after the debt reached $34 trillion for the first time in 2024.

- The U.S. government’s economic stimulus programs led to a deepening of the government deficit,[vii] which made the Congressional Budget Office predict[viii] that the federal government’s debt is on an unsustainable path, from 97% of GDP in 2023 to 116% by 2034. According to other projections, by 2023, the U.S. public debt is expected to surpass 106% of GDP,[ix] the record level since 1945, by the end of this decade.

- Regarding debt in Europe, the accumulation of debt jeopardizes France’s and Italy’s credit ratings,[x] thereby causing tensions between the reactivated financial controls and internal aspects of the main players’ economies, including the German economy. This is due to the suspension of the Eurozone’s financial rules since 2020.

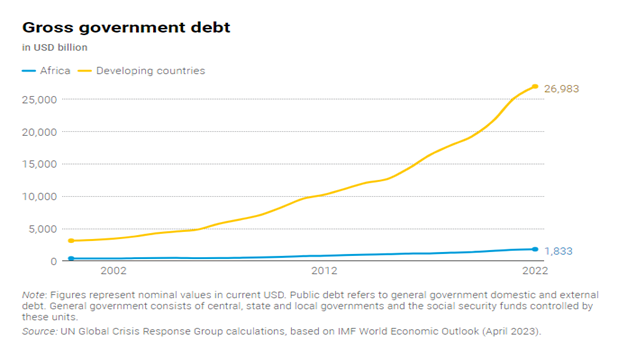

With respect to the evolution of debt in developing countries, the following facts explain the debt conditions in Africa:

- According to United Nations estimates, public debt in Africa is expected to remain higher in 2024 and 2025 than pre-pandemic levels. The total debt of the countries is expected to exceed $1.8 trillion, with eight African nations already suffering from debt distress. Some of these countries have already defaulted on their payments.[xi]

- 56 percent of African countries spend more on debt interest payments than on healthcare or climate action, with the continent’s average debt-to-GDP ratio rising from 39 percent to 70 percent over the past decade.

As far as the debt crisis in the Chinese economy is concerned, the worsening debt crisis in the real estate[xii] sector was evident when about 23 companies filed for liquidation. As a result, the debt crisis in Chinese cities and provinces has gotten worse.

In light of these developments in the global sovereign debt situation, identifying their causes and how they relate to changes in the geopolitical environment is still helpful in predicting their future and potential solutions.

How did geopolitical conditions exacerbate the severity of the global sovereign debt crisis?

There is a close relationship between the geopolitical developments that the world has witnessed over the past few years and the worsening sovereign debt crisis. The following points shed light on this relationship:

- At the beginning of 2020, the COVID-19 pandemic caused an increase in government intervention in economic activity globally, so this intervention constituted an additional deficit in public budgets that have been suffering from chronic deficits, especially in the case of heavily indebted countries.

- Despite the concerted global efforts to recover from the epidemic during 2021, the beginning of 2022 witnessed the crisis of the Russia-Ukraine war, which left severe global repercussions on inflation rates, especially the rise in energy and food prices and the intensification of interruption and fragmentation in the global economy and trade and logistics routes.

- To address these effects, the world’s economies resorted to the classic solutions of raising interest rates and adopting a policy of monetary tightening.

- As a result of this strict financing policy, U.S. interest rates reached the 5.5% range, which directly affected the global foreign debt crisis and exacerbated the burdens of accessing new debt for heavily indebted countries.

- The American monetary tightening contributed to a rapid change in the map of global capital flows towards the American financial market, especially a shift in the trends of hot money, which was considered a quick solution, despite its high cost, for developing countries to calm inflationary pressures and balance of payments deficits.

- Over the course of two years, global monetary tightening and rising real interest rates have contributed to the exacerbation of external debt payments and placed increasing pressure on global financial stability.[xiii]

While rising global interest rates have exacerbated global indebtedness, by 2023, nine low-income countries have fallen into debt distress, and another 25 countries are on the brink.[xiv] With inflationary pressures continuing until mid-2024 in the U.S. market above the Federal Reserve’s 2% target, the long-term U.S. monetary tightening and the slow shift to monetary easing contribute to continued expectations of the burden of external debt globally. This calls for contemplation of the risks of the debt crisis and the mechanisms for dealing with it and/or safely getting out of it.

Future risks and scenarios for the global debt crisis

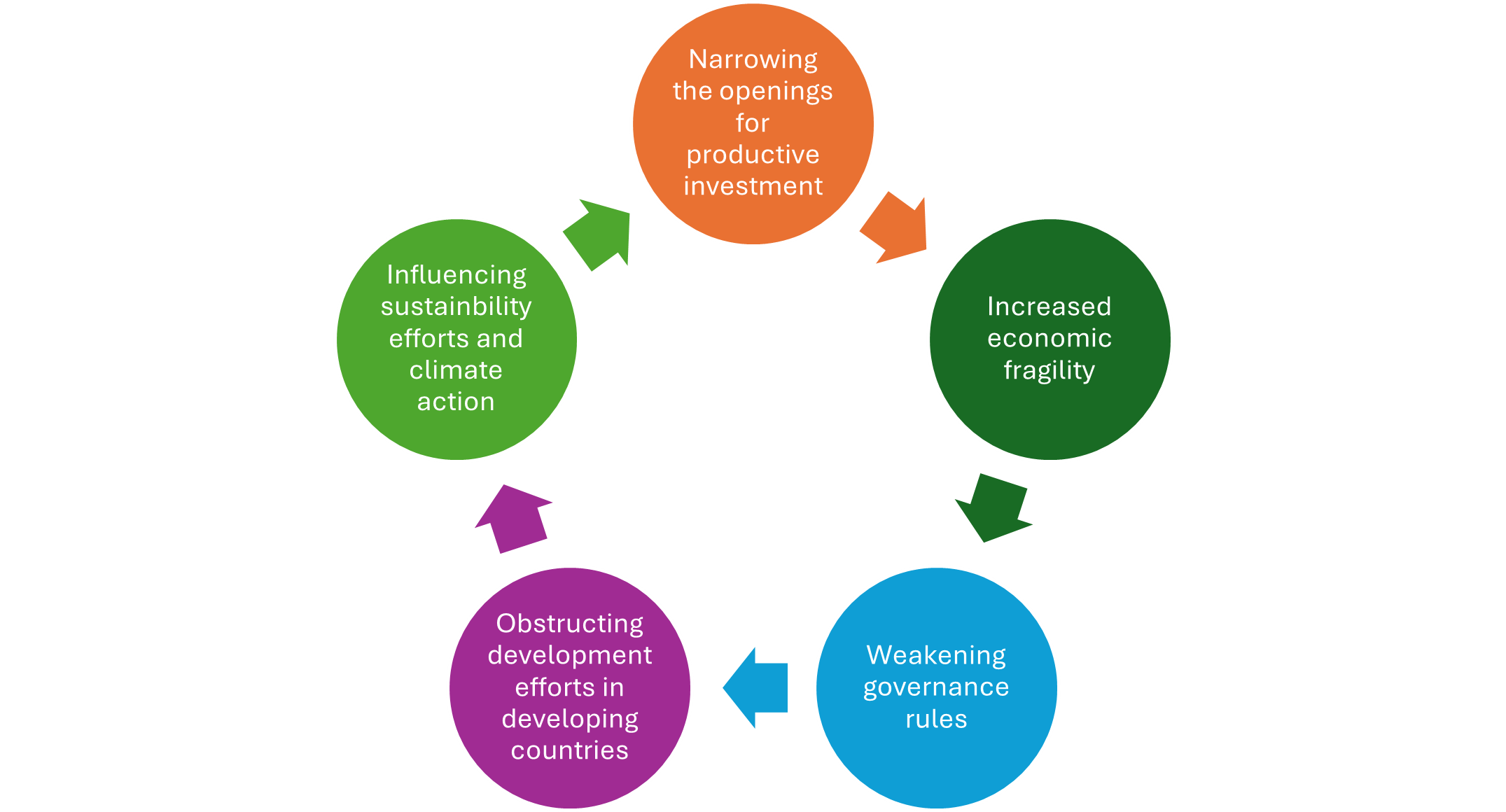

In light of the facts and previous trends of the global debt crisis in developed and developing countries, the world economy faces five economic risks as a result of the worsening of these debts, which are as follows:

- The first is that these debts, which have crippled global economies, weakened development efforts in many countries around the world, which was reflected in a decline in the creation of profitable investment opportunities for highly productive international companies. The first of these risks, then, is the narrowing of outlets for international investments, along with the narrowing of channels for the transfer of these investments internationally.

- The second of these risks is the result of the growth of global debt and the burdens of servicing it, including a corresponding increase in global economic fragility, especially the fragility of the international monetary system, which has become threatened by its historical origins. The dollar, which loses much of its purchasing power with the growth of U.S. inflation that occurs from time to time due to the huge amount of its debt, causes stormy monetary fluctuations due to its high status as a medium for international exchanges, a receptacle for global liquidity, and a basic asset within international reserves.

- The third global risk of debt is the weakening of the rules of global governance caused by the growth of non-productive debt, particularly in the case of heavily indebted countries in sub-Saharan Africa. It has been demonstrated that rising debt levels in these nations are counteracted by falling measures of accountability, the rule of law, openness, and enforcement in the local business environment.

- The fourth risk created by global debt is the obstruction of development efforts in developing countries in light of the huge development needs, as the debt in those countries has shifted from supporting development to obstructing it. These countries are now facing the impossible choice: either service their debts or serve their people. Some international statistics show that about 3.3 billion people live in countries that spend more on interest payments than they spend on education or health, as previously mentioned.[xv]

- The fifth of these risks is the negative effects that debt has on global climate action, in light of its weakening of the economic capabilities necessary to protect the environment and in light of the scarcity it causes in sources of international climate financing.

Regarding the expected outcomes for the global debt crisis, we are faced with two main scenarios that stem from an assessment of the current developments in the crisis:

- The least likely scenario is characterized by a global breakthrough in the volume, quality, and geographical distribution of debts globally, with rates of economic growth in the global economy outpacing rates of debt growth in both developed nations and heavily indebted countries. Finally, this scenario will depend on the availability of supportive international and local means, including alleviating debt burdens by creditors, developing local government rules, and supporting the business environment for the highly productive, high-value-added private sector.

- On the other hand, the most likely scenario is that the pace of international debt will continue in an upward direction, with some international efforts to calm its aggravation and prevent it from reaching the point of bubble bursting in developed countries or the point of no return in heavily indebted developing countries. That is, this scenario means that the global debt crisis will continue to escalate at rates that exceed the rates of global economic growth and global productivity growth over the next few years without a radical solution on the horizon, with the international opportunity costs of these debts continuing to rise.

Conclusion: Towards options for a secure way out of the global debt crisis

A number of international alternatives can be considered, as far as the solutions and options currently offered to global economic policymakers to get out of the debt crisis, are concerned. These options include:

- An investment policy can be considered in place of debt, which does not mean supporting privatization policies in heavily indebted countries. In order to enable developing countries to become viable from an economic and development point of view, international support may be considered by exchanging outstanding debts for production opportunities under the implementation offered to creditors and with local guarantees. At the same time, taking into account the economic feasibility of the swap transaction in view of the financial assistance provided to debtor countries and linking it with improving local governance indicators.

- It is also proposed to link climate action with the forgiveness of part of the debt, provided that this is led by an international effort under the auspices of the United Nations and its organizations supporting climate issues, including the Conference of the Parties (COP). It is also possible to finance part of the obligations arising from the Paris Climate Agreement and the Loss and Damage Fund. Taking this debt’s worth into consideration in favor of the countries most affected by extreme weather conditions.

- Strengthening the role of international organizations and multilateral banks in leading smart solutions to the debt crisis, which would ease pressures on the balance of payments of heavily indebted countries, provided that it is done in tandem with support for governance and transparency programs in indebted economies.

In all cases, there is no alternative to resorting to canceling some of the debts owed by heavily indebted countries and relying on debt diplomacy to support the debtor countries organizationally in a way that benefits the greatest possible settlements with the main creditors, including China and members of the Paris Club of creditors.

[i] Billy Bambrough, “U.S. Dollar Death Spiral ‘Crisis,’” Forbes, May 4, 2024, https://www.forbes.com/sites/digital-assets/2024/03/04/us-dollar-collapse-bank-of-america-issues-shocking-1-trillion-every-100-days-warning-amid-huge-bitcoin-ethereum-xrp-and-crypto-price-boom-to-rival-gold/?sh=4b7073dd8da0.

[ii] World Bank, International Debt Report 2023 (Washington, DC: World Bank, 2023), http://hdl.handle.net/10986/40670.

[iii] UNCTAD, “UNCTAD chief: Fractured world in crisis demands ‘immediate action’ from G20,” 2024, https://unctad.org/news/unctad-chief-fractured-world-crisis-demands-immediate-action-g20

[iv] “UN says solutions exist to rapidly ease debt burden of poor nations,” france24, April 18, 2024, https://www.france24.com/en/live-news/20240418-un-says-solutions-exist-to-rapidly-ease-debt-burden-of-poor-nations.

[v] OECD, Global Debt Report 2024: Bond Markets in a High-Debt Environment (Paris: OECD Publishing, 2024), https://doi.org/10.1787/91844ea2-en.

[vi] Phil Rosen, “The US national debt hits a new all-time high of $34 trillion,” Business Insider, January 3, 2024, https://markets.businessinsider.com/news/bonds/us-national-debt-economy-record-trillion-funding-republicans-democrats-recession-2024-1#:~:text=The%20US%20national%20debt%20just,level%20of%20debt%20in%202029.

[vii] Cointribune, “The American debt could cause the global economy to collapse,” April 2, 2024, https://www.cointribune.com/en/the-american-debt-could-cause-the-global-economy-to-collapse/.

[viii] Bhargavi Sakthivel et al., “A Million Simulations, One Verdict for US Economy: Debt Danger Ahead,” Bloomberg, April 2, 2024, https://www.bloomberg.com/news/articles/2024-04-01/us-government-debt-risk-a-million-simulations-show-danger-ahead?sref=BtkSCofS.

[ix] Eddy S., “The American debt could cause the global economy to collapse,” cointribune, April 2, 2024, https://www.cointribune.com/en/the-american-debt-could-cause-the-global-economy-to-collapse/

[x] Alice Gledhill and William Horobin, “France’s Mounting Debt Pile Threatens Rating as Reviews Kick Off,” Bloomberg, April 24, 2024, https://www.bloomberg.com/news/articles/2024-04-24/france-faces-credit-ratings-test-as-debt-pile-continues-to-mount?srnd=homepage-americas&sref=BtkSCofS. See also: Craig Stirling, “Italy’s ‘Superbonus’-Stoked Debt Draws Fitch’s Attention,” Bloomberg, April 24, 2024, https://www.bloomberg.com/news/articles/2024-04-24/italy-s-superbonus-stoked-debt-path-draws-fitch-s-attention?sref=BtkSCofS

[xi] UNCTAD, (2024), https://unctad.org/publication/world-of-debt/regional-stories.

[xii] GREG BAKER, “A debt crisis in China’s vast property sector is acting as a major drag on the economy,” April 17, 2024, https://www.kulr8.com/news/national/a-debt-crisis-in-chinas-vast-property-sector-is-acting-as-a-major-drag-on/image_8dc1a425-e604-53ab-8cc6-3ba050e6f3e3.html.

[xiii] Tobias Adrian et al., “The Fiscal and Financial Risks of a High-Debt, Slow-Growth World Higher long-term real interest rates, lower growth, and higher debt will put pressure on medium-term fiscal trends and financial stability,” IMF Blog, March 28, 2024, https://www.imf.org/en/Blogs/Articles/2024/03/28/the-fiscal-and-financial-risks-of-a-high-debt-slow-growth-world

[xiv] UNCTAD, “Trade and development report update,” April 2024, https://unctad.org/system/files/official-document/gdsinf2024d1_en.pdf.

[xv] OECD, Global Debt Report 2024: Bond Markets in a High-Debt Environment, (Paris: OECD Publishing, 2024), https://doi.org/10.1787/91844ea2-en