The financial sector around the world has witnessed significant advancements in banking and financial services, with Financial Technology (FinTech) representing the most recent phase of the evolution of the financial services sector. FinTech blends technological innovations with financial services, offering financial products and services in a novel, flexible, fast, and cost-effective manner. Companies providing FinTech services have emerged as strong competitors to traditional banking services and have contributed to the global FinTech market reaching $310 billion by the end of 2022.

Sub-Saharan Africa boasts the youngest population globally, with approximately 40% of its inhabitants aged 15 years and under, surpassing the global average of 26% as of 2021. This youthful demographic presents a ripe opportunity for FinTech adoption, as younger age groups are more inclined towards embracing technological innovations. Consequently, investors are increasingly directing their attention to the continent, recognizing the immense potential for growth and expansion in the FinTech sector. For instance, Wave, a Senegalese mobile payments company backed by Stripe, one of the world’s leading payments companies, exemplifies this trend, standing as the 7th largest FinTech company globally in terms of market valuation.

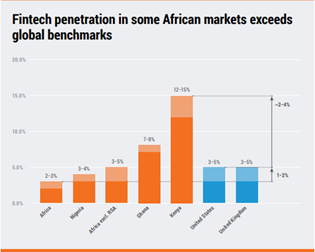

Moreover, Sub-Saharan Africa grapples with a substantially underbanked population, estimated at 42% of adults in 2022, which accounts for around 456 million people. In response, FinTech companies are seizing this opportunity by offering alternative financial solutions accessible through mobile platforms. This is facilitated by the widespread adoption of mobile technology across the region, with approximately 650 million mobile users. Notably, Sub-Saharan Africa leads the global market in mobile money transactions, with transactions totaling $490 billion in 2020, surpassing the second-largest market, South Asia, by an astounding 374%.[1]

In summary, Sub-Saharan Africa’s youthful population and large underbanked population, coupled with widespread mobile adoption, create fertile ground for FinTech innovation and investment. As FinTech companies continue to capitalize on these opportunities, the region stands poised to witness significant advancements in financial inclusion and digital transformation.

This insight aims to comprehend the evolution of FinTech applications in Sub-Saharan Africa, their contribution to improving financial and banking services, and the challenges facing the adoption of FinTech on the continent. The focus will be on the most successful FinTech applications in the region.

1. Financial technology and its relationship to the services sector

Concept of FinTech and its applications

Financial Technology, commonly known as FinTech, refers to financial services and products that utilize technology to enhance the quality of traditional financial services. These technologies are faster, cheaper, and more accessible, enabling a larger number of users to access them. FinTech can be defined as a new type of financial service relying on information technology and financial technology. It also refers to new solutions that gradually appear and significantly innovate in the applications, operations, products, and business models in the financial services industry. FinTech includes a group of companies that offer or facilitate financial services using modern technology, resulting in financial products and services that are easier to use and more affordable to provide. FinTech encompasses companies that develop innovative financial services and products such as electronic payments, digital wallets, money transfers, insurance, lending and financing, investment services, and trading platforms, relying heavily on the intensive use of information technology.

FinTech has facilitated the expansion of financial institutions’ customer base and enabled more refined customer segmentation. Technology allows companies to reach previously underserved segments of the population, while data analytics and digital platforms provide insights into the unique needs of different customer segments. This tailored approach not only enhances the customer experience but also promotes financial inclusion. For instance, JUMO, based in South Africa, uses data analytics to offer microloans and other financial services to individuals with limited credit histories, thereby increasing access to credit for underserved communities.[2]

Source: FinTech in the Middle East and North Africa,” https://www.findevgateway.org/sites/default/files/users/user611/ar_fintechmena_wamda.pdf.

Financial technology is also described as those products and services that leverage technology to improve the quality of traditional financial services. These technologies are distinguished by being quicker, more affordable, and more accessible to a greater number of people. In most cases, these services and products are developed by startups. Startups are newly established small companies aiming to expand by entering new markets or acquiring a significant share of existing markets through value propositions. Therefore, startups in the FinTech sector are small and newly established companies committed to enhancing banking services for individuals and businesses, either through collaboration or competition with existing financial service providers.[3]

Expected benefits of FinTech:

- Enhancing financial inclusion and containment.

- Improving financial services efficiency.

- Achieving economic efficiency gains.

- Transforming various aspects of financial service provision such as payments settlement, lending, savings, risk-sharing, and capital allocation.

2. Current situation of the services sector and financial services in Sub-Saharan Africa

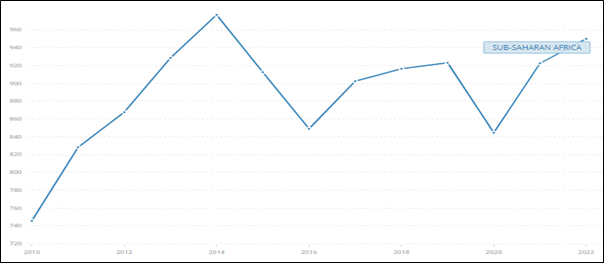

The services sector serves as a key driver of economic growth in Sub-Saharan Africa, contributing to GDP expansion, employment generation, trade facilitation, innovation, income generation, and inter-sectoral linkages. A vibrant and dynamic services sector is essential for promoting inclusive and sustainable economic development across the region.[4]

Services, value added (current US$): Sub-Saharan Africa 2010-2022

Source: World Bank Data (2023)

Financial services landscape

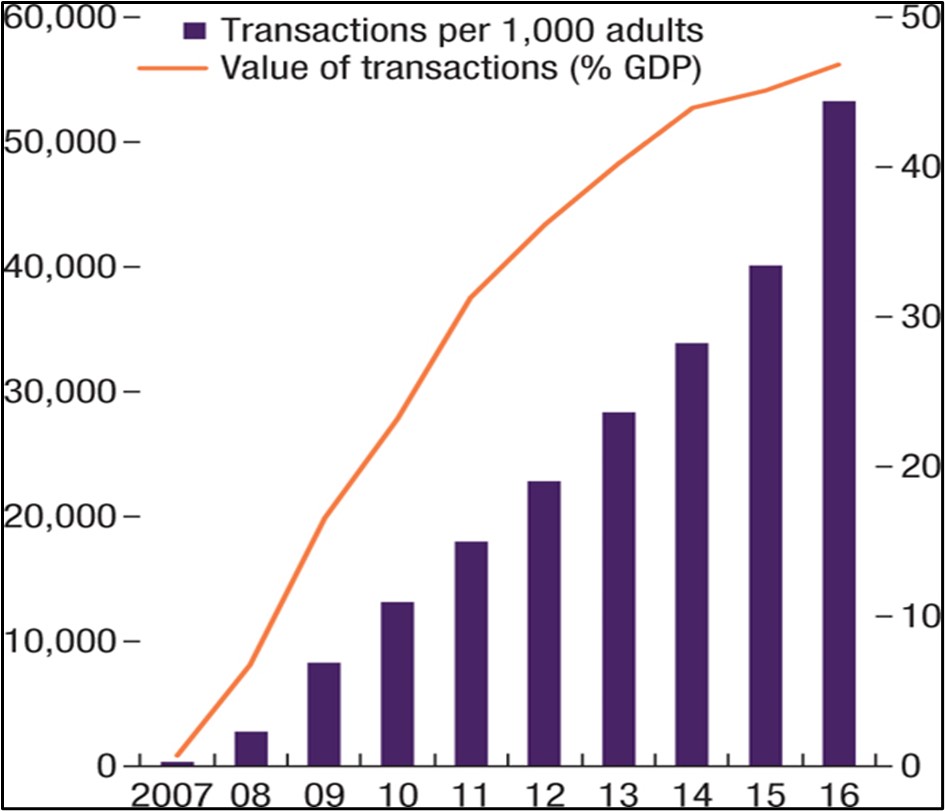

The financial services sector in Sub-Saharan Africa is characterized by a mix of traditional banking institutions and innovative FinTech solutions. Traditional banks often struggle to reach remote and underserved populations, leading to widespread financial exclusion. However, the rise of mobile money platforms, such as M-Pesa in Kenya and MTN Mobile Money in Uganda, has transformed the financial services landscape by providing people with access to banking services via mobile phones. Today, Kenya is one of the economies with the highest use of mobile money, with 53 transactions per adult per year (see figure on Kenya).[5]

Mobile money developments in Kenya

Source: Hector Perez-Saiz and Preya Sharma, “FinTech in Sub-Saharan African Countries: A Game Changer?,” IMF eLibrary, February 14, 2019, https://www.elibrary.imf.org/view/journals/087/2019/004/article-A001-en.xml

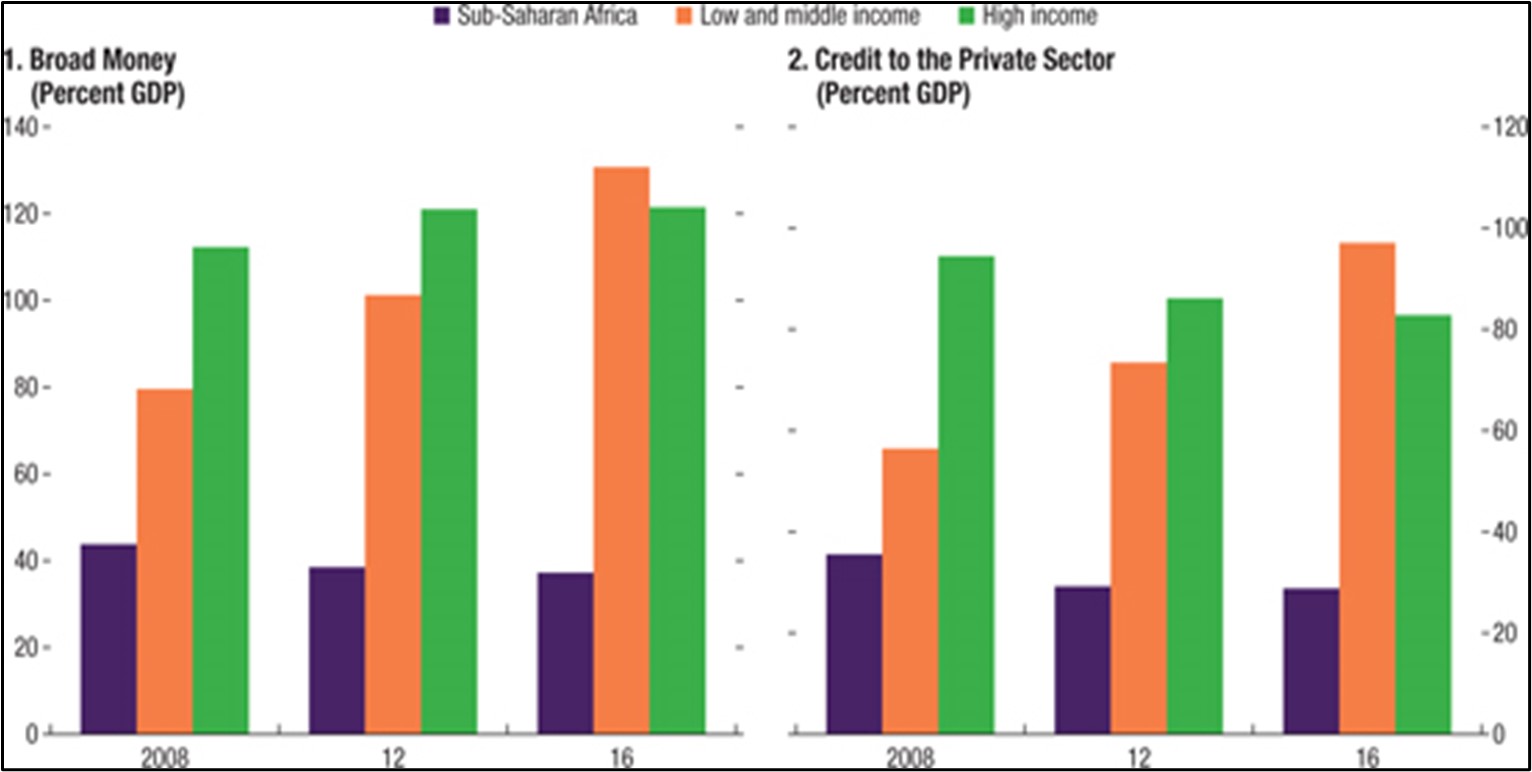

Indicators of financial development

Source: World Bank, World Development Indicators database.

The role of FinTech

FinTech has emerged as a disruptive force in Sub-Saharan Africa’s financial services sector, offering innovative solutions to address longstanding challenges. These solutions leverage technologies such as mobile connectivity, digital payments, and blockchain to provide efficient, affordable, and accessible financial services. FinTech startups are filling gaps in the market by offering services like microfinance, peer-to-peer lending, and digital insurance tailored to the needs of the region[6].

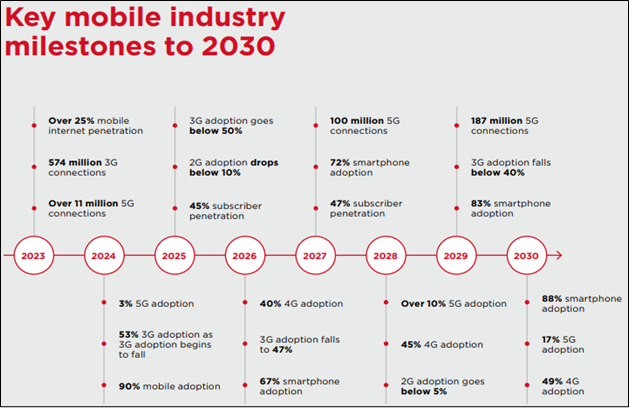

Empirical data reveals a steady increase in the number of mobile money accounts and transactions, indicating improved access to formal financial services. For instance, in Kenya, the adoption of M-Pesa has led to significant financial inclusion, with over 80% of the adult population having access to mobile money services by 2030 (source: GSMA 2023). Similar trends are observed in other Sub-Saharan African countries, with mobile money platforms like Tigo Pesa and MTN Mobile Money driving financial inclusion efforts.

Source: GSMA, The Mobile Economy in Sub-Saharan Africa, 2023, https://event-assets.gsma.com/pdf/20231017-GSMA-Mobile-Economy-Sub-Saharan-Africa-report.pdf.

Challenges facing the services sector[7]

Despite its potential to transform the financial landscape, FinTech encounters regulatory hurdles and trust issues in Sub-Saharan African countries. Empirical evidence highlights the significance of clear regulations and oversight to foster FinTech innovation while protecting consumer interests. Regulatory sandboxes, implemented in nations like Nigeria and Ghana, have spurred FinTech investment and experimentation. Additionally, blockchain technology is gaining traction for enhancing transparency and trust in financial transactions, as evidenced by its increasing use in property rights management and supply chain finance.

However, the services sector in Sub-Saharan Africa faces several challenges:

- Financial Inclusion: A sizable portion of the population remains unbanked or underbanked, curtailing access to vital financial services.

- Infrastructure Limitations: Limited access to reliable electricity and internet connectivity impedes the adoption of digital financial services, particularly in rural and remote areas.

- Regulatory Complexity: Complex and restrictive regulatory frameworks act as barriers to innovation and investment in the FinTech sector.

- Cybersecurity Threats: The swift digitization of financial services exposes users to risks like fraud and data breaches, eroding trust in digital platforms.

- Skills Shortage: The scarcity of proficient professionals in digital technology and financial literacy hampers the growth and acceptance of FinTech solutions.

Addressing the challenges[8]

To overcome these challenges and unlock the full potential of the services sector, Sub-Saharan African countries must take proactive measures:

- Policy Reforms: Governments should implement regulatory reforms to create a conducive environment for FinTech innovation while ensuring consumer protection and financial stability.

- Investment in Infrastructure: Infrastructure development, including the expansion of broadband internet and mobile connectivity, is essential to improving access to digital financial services.

- Capacity Development: Investing in education and skills training programs will help build a workforce capable of driving innovation and the adoption of FinTech solutions.

- Public-Private Partnerships: Collaboration between governments, financial institutions, technology companies, and civil society organizations is crucial to addressing the multifaceted challenges facing the services sector.

3. Embracing the financial technology revolution and its influence on digital payments in Sub-Saharan African countries

Africa is home to half of all registered and active mobile money accounts globally, accounting for approximately 30 billion transactions valued at $500 billion. Within Africa, Sub-Saharan Africa alone represents 64% of the total global mobile money accounts. The World Bank highlights the significant role of mobile money in poverty reduction and the reduction of transaction costs.[9]

The rapid advancement of technology has heralded the dawn of the FinTech revolution, transforming the landscape of electronic money within Sub-Saharan African countries. This surge in financial technology has not only reshaped how we manage and transact money but has also ushered in numerous benefits and opportunities tailored to the region:

- Driving Financial Inclusion: Fintech has emerged as a pivotal force in driving financial inclusion across Sub-Saharan Africa, particularly in regions underserved by traditional banking systems. Through the proliferation of mobile money platforms and digital wallets, previously unbanked individuals now have the means to participate in the formal economy. Platforms like M-Pesa have empowered millions to securely store, transfer funds, settle bills, and even access microloans.

- Streamlining Payment Processes: Traditional payment methods often entail cumbersome procedures and time-consuming transactions. However, FinTech solutions have revolutionized this landscape by offering seamless and instantaneous payments. With the advent of mobile payment applications like PayPal, Venmo, and Alipay in various Sub-Saharan African nations, sending and receiving money has become as effortless as a few taps on a smartphone screen. Additionally, digital payment solutions have reduced reliance on physical cash, mitigating the risks associated with carrying large sums of money for both individuals and businesses.

- Introduction of Digital Currencies: A significant stride facilitated by financial technology is the introduction of cryptocurrencies, with Bitcoin being a notable example. Virtual currencies have disrupted conventional notions of money by providing a decentralized and secure alternative. While cryptocurrencies present their own challenges, they hold promise for reshaping the global financial landscape, facilitating faster and more cost-effective cross-border transactions while enhancing transparency and traceability.

- Empowering Small Enterprises: Fintech innovations have democratized access to financial services for small and medium-sized enterprises (SMEs) across Sub-Saharan Africa. Platforms like Kickstarter and Indiegogo enable SMEs to raise capital directly from individual investors, bypassing traditional financial institutions. Moreover, online lending platforms offer simplified loan application processes, enabling swift access to capital for small businesses to fuel their growth.

- Strengthening Security Measures: Amidst the convenience of the digital age, the threat of fraud and cyberattacks looms large. However, FinTech companies have responded by implementing robust security measures such as biometric authentication, encryption, and AI-driven fraud detection systems. These technologies have bolstered the security of electronic financial transactions, fostering trust among users and mitigating financial risks.

The impact of the FinTech revolution on electronic money within Sub-Saharan Africa is profound. As the region embraces these innovations, it experiences a transition toward a digital economy characterized by borderless, efficient, and accessible financial services. By remaining adaptable and receptive to these transformative changes, Sub-Saharan African nations stand poised to reap the myriad benefits that FinTech has to offer in redefining the dynamics of electronic money.

4. Countries that have achieved success in localizing financial technologyTop of Form

Zambia has witnessed significant advancements in digital financial inclusion systems, the FinTech market, and associated services. For example, in Zambia, which had only 2% of adults having active digital financial accounts in 2014, the country had approximately 44% of the adult population with such accounts by 2019. The ecosystem there was very different prior to this time, but in just five years, it experienced a true revolution that surpassed all expectations, both locally and internationally. This sector is no longer limited solely to mobile money transfers. The use of digital financial services has evolved from the first generation of transfers, which include person-to-person transfers, cash withdrawals and deposits, and online purchases, to the second generation of digital products. This includes international transfers, commercial payments, and digital loans. Observers estimate that the Zambian market is ready for the next wave of comprehensive digital finance innovations.[10]

Top of Form

Nigeria stands out as the largest recipient of remittances in Sub-Saharan Africa, typically receiving over one-third of all remittance inflows to the region. Expected to reach $20 billion in 2024, these remittance flows significantly contribute to the country’s overall government budget, overshadowing official development aid. However, sending remittances to Nigeria remains costly, with an average cost of 10.4 percent for sending $200 from various countries in the second quarter of 2020. The onset of the COVID-19 pandemic further exacerbated this situation, leading to a 28 percent decrease in remittances and prompting the government to designate mobile money as an essential service to ensure its continued operation during lockdowns.

Simultaneously, Nigeria’s FinTech sector has flourished as one of the largest in Africa, driven by a young and tech-savvy population, government support for digital financial solutions, and a sizable unbanked population that presents an attractive market for companies seeking new customers. During a focus group session conducted for this study, both native and foreign-born young people in Nigeria reported relying on various fintech services, including major platforms like Binance (a leading cryptocurrency exchange) and popular apps such as Payoneer, Geegpay, and PayPal, to access favorable exchange rates and expedite transactions.

To promote official remittance inflows and encourage the adoption of digital solutions, the Central Bank of Nigeria announced in June 2023 that its digital currency, the eNaira, would be accepted as a payment option for inbound remittances. Additionally, the government is considering using the eNaira for welfare payments to citizens, thereby integrating remittances with essential services. However, the eNaira faces challenges in advancing digital financial inclusion, as only people with existing bank accounts can open an eNaira wallet, excluding the unbanked population, primarily rural and poorer communities, from its benefits. Furthermore, interoperability with other mobile money providers remains an issue, and initial interest in the eNaira has waned, with many wallets now inactive due to widespread distrust in the initiative and the government. The low confidence in the government, as evidenced by the 2021 Gallup World Poll, which showed that only 25 percent of Nigerians trust their national government, raises doubts about the eNaira’s ability to accelerate mobile money adoption and promote financial inclusion in Nigeria.

5. The impact of financial technology on attracting investments to sub-Saharan African countries

The impact of FinTech on attracting investments to Sub-Saharan African countries is profound and multifaceted, ushering in a new era of economic growth and development. Here are some key aspects of how FinTech is influencing investment in the region:[11]

- Improved Access to Investment Opportunities: FinTech platforms have democratized investment by providing individuals and businesses in Sub-Saharan African countries with access to a wide range of investment opportunities. Through online investment platforms, crowdfunding portals, and peer-to-peer lending platforms, investors can easily discover and participate in projects and ventures across various sectors, including agriculture, technology, real estate, and renewable energy.

- Reduced Transaction Costs: Traditional investment processes often involve high transaction costs, making it challenging for investors to engage in smaller-scale investments. FinTech solutions have significantly reduced these costs by streamlining processes such as transaction execution, settlement, and compliance. This reduction in costs has made investing in Sub-Saharan African countries more accessible and attractive to both domestic and international investors.

- Enhanced Transparency and Security: FinTech leverages innovative technologies such as blockchain and digital identity verification to enhance transparency and security in investment transactions. By providing immutable records of ownership and transactions, blockchain technology reduces the risk of fraud and corruption, thereby increasing investor confidence in the integrity of investment opportunities in Sub-Saharan African countries.

- Facilitated Cross-Border Investments: FinTech has facilitated cross-border investments by simplifying processes such as currency exchange, international payments, and regulatory compliance. Through digital payment platforms and blockchain-based solutions, investors can seamlessly invest in projects and businesses across Sub-Saharan African countries, transcending traditional barriers and unlocking new opportunities for diversification and growth.

- Promotion of Financial Inclusion: FinTech plays a crucial role in promoting financial inclusion by extending investment opportunities to previously underserved populations in Sub-Saharan African countries. Mobile-based investment apps and micro-investment platforms enable individuals with limited financial resources to participate in capital markets, thus broadening the investor base and attracting more investments to the region.

“The impact of financial technology on the performance of financial and banking services in Sub-Saharan Africa,” Faros Center for Consulting and Strategic studies, (2021). https://pharostudies.com/

“The impact of financial technology on the performance of financial and banking services in Sub-Saharan Africa,” Faros Center for Consulting and Strategic studies, (2021). https://pharostudies.com/ - Encouragement of Entrepreneurship and Innovation: FinTech ecosystems in Sub-Saharan African countries foster entrepreneurship and innovation by providing platforms for startups and small businesses to access funding and investment. Through crowdfunding campaigns, venture capital investments, and accelerator programs, FinTech stimulates the growth of innovative businesses and ventures, driving economic development and attracting investments from both local and international sources[12].

Overall, the impact of financial technology on attracting investments to Sub-Saharan African countries is transformative, creating new opportunities for growth, inclusion, and prosperity. As FinTech continues to evolve and expand its reach in the region, its role as a catalyst for investment and economic development is expected to grow, unlocking the full potential of Sub-Saharan African countries and driving sustainable progress for years to come.

6. The future outlook for transformative FinTech[13]

As technology continues to shape the landscape of financial services, there are numerous avenues for further research and exploration. There are promising opportunities for investigation in areas such as the impact of AI and machine learning on credit assessment, the scale and interoperability of blockchain solutions, or digital currencies’ potential. Moreover, there is a need to develop a deeper understanding of the social and economic ramifications of FinTech adoption, particularly concerning job creation, economic growth, and income distribution.

The technological influence on financial services in Sub-Saharan Africa is indisputable and diverse. From cost reduction and efficiency enhancement to fostering financial inclusion and reshaping traditional banking paradigms, technology has fundamentally altered the financial landscape. As the region continues to embrace innovative solutions, it is imperative for policymakers, regulators, and stakeholders to collaborate in harnessing the full potential of FinTech while addressing challenges and ensuring inclusive and sustainable growth.[14]

With a young and expanding population, a high rate of mobile phone penetration, and a substantial unbanked population, Sub-Saharan Africa provides an ideal environment for FinTech innovation. FinTech companies are rapidly advancing the development of innovative products and services, playing a pivotal role in transforming the financial landscape of the region and enhancing the lives of millions of people.[15]

Looking ahead, there are promising opportunities for further leveraging FinTech to advance the services sector in Sub-Saharan African countries. Empirical data suggests continued growth in FinTech investment and innovation, with venture capital investment in African FinTech startups reaching a record high of $1.3 billion in 2021.[16] Emerging technologies such as AI-driven solutions and blockchain applications hold significant potential for enhancing financial services accessibility and efficiency in the region.

Concluding remarks

- FinTech has emerged as a transformative force, particularly impacting financial inclusion in Sub-Saharan Africa. Mobile money platforms like Kenya’s M-Pesa and Zambia’s Kazang have revolutionized financial service delivery, offering features such as money transfers, bill payments, and access to credit via mobile phones. This innovation has extended formal financial services to millions previously excluded from the banking system. Kenya’s success with M-Pesa has inspired similar initiatives across the region, such as Tanzania’s Tigo Pesa and Uganda’s MTN Mobile Money.

- A significant advantage of FinTech in Sub-Saharan Africa is its ability to reduce costs and enhance operational efficiency in the financial ecosystem. Unlike traditional banking, which often involves high overheads from physical infrastructure and manual processes, digital platforms and mobile banking have significantly lowered these costs. Mobile money platforms enable transactions without physical branches, reducing operational expenses and fees.

- FinTech has also facilitated cross-border transactions and international remittances, addressing challenges posed by limited banking infrastructure and high transaction costs in the region. Services like World Remit enable efficient and cost-effective money transfers from the diaspora to home countries, supporting families and contributing to economic development.

- Despite advancements, infrastructural challenges persist in Sub-Saharan Africa, hindering the full potential of FinTech. Limited access to electricity and the internet in certain areas impedes the adoption of digital financial services. Improving infrastructure, such as expanding internet connectivity and energy access, is essential to fully realizing the benefits of FinTech across the region.

- The clearing and settlement of payments rely on scheme rules to ensure the efficient exchange of transactional information and the transfer of value between parties. Overall, a well-functioning payment system is essential for facilitating economic transactions and promoting financial inclusion.[17]

- Regulating FinTech poses challenges due to its dynamic nature, requiring responsive frameworks to balance innovation and consumer protection. Regulatory sandboxes, like Nigeria’s, provide a controlled environment for start-ups to test their products under supervision. Technology, such as blockchain, enhances transparency and trust in financial transactions, addressing historical challenges in the sector.

- Looking ahead, research opportunities abound in exploring AI’s impact on credit assessment, blockchain scalability, and digital currency potential. Understanding the social and economic implications of FinTech adoption, particularly in terms of job creation and income distribution, is crucial. With a young population, high mobile phone penetration, and a large unbanked population, Sub-Saharan Africa presents an ideal environment for FinTech innovation, which continues to transform the financial landscape and improve lives across the region.

References

- 4C Group, “What the future holds for FinTech in Africa,” ITWeb, January 9, 2024, https://www.itweb.co.za/article/what-the-future-holds-for-fintech-in-africa/wbrpOMg2WXg7DLZn.

- Achieng, R., “How Fintech Became the Gateway to Predatory Lending in Sub-Saharan Africa,” Bot Populi, 2023, https://botpopuli.net/how-fintech-became-the-gateway-to-predatory-lending-in-sub-saharan-africa/

- Alhassan, Tijani Forgor, and Ahou Julie Koaudio, “Mobile money development in sub-Saharan Africa: Its macroeconomic effects and role in financing development,” Advances in Economics, Business and Management Research 105, 2019, https://www.atlantis-press.com/proceedings/iscde-19/125924614.

- Cambridge Centre for Alternative Finance (CCAF), “FinTech Regulation in Sub-Saharan Africa,” 2021, https://www.jbs.cam.ac.uk/wp-content/uploads/2021/11/2021-11-fintech-in-sub-saharan-africa.pdf

- Chongo, C., “The Impact of FinTech on Financial Services in Sub-Saharan Africa,” LinkedIn, August 15, 2023, https://www.linkedin.com/pulse/impact-fintech-financial-services-sub-saharan-africa-clarence-chongo/.

- Curran, Níamh, “Future of Fintch in Africa 2023: Data penetration could be improved with better infrastructure,” Finextra, 2023, https://www.finextra.com/the-long-read/755/future-of-fintech-in-africa-2023-data-penetration-could-be-improved-with-better-infrastructure.

- Elliott, Mark, “Driving FinTech adoption in Sub-Saharan Africa,” mastercard.com, March 14, 2023, https://www.mastercard.com/news/eemea/en/perspectives/en/2023/driving-fintech-adoption-in-sub-saharan-africa/.

- FinTech Global, “FinTech investment in Africa nearly quadrupled in 2021, driven by PayTech and Lending deals,” January 19, 2022, https://fintech.global/2022/01/19/fintech-investment-in-africa-nearly-quadrupled-in-2021-driven-by-paytech-and-lending-deals/

- FinTech in the Middle East and North Africa, https://www.findevgateway.org/sites/default/files/users/user611/ar_fintechmena_wamda.pdf.

- FinTech -Zambia, Statista, April 2023, https://www.statista.com/outlook/dmo/fintech/zambia.

- GSMA, “The Mobile Economy in Sub-Saharan Africa,” 2023, https://event-assets.gsma.com/pdf/20231017-GSMA-Mobile-Economy-Sub-Saharan-Africa-report.pdf.

- Gule Girma, A., and Fariz Huseynov, “The Causal Relationship between FinTech, Financial Inclusion, and Income Inequality in African Economies,” Journal of Risk and Financial Management 17, no. 1 (2023), https://www.mdpi.com/1911-8074/17/1/2.

- Mothobi, O., and Kago Kebotsamang, “The Impact of Network Coverage On Adoption of Fintech And Financial Inclusion In Sub-Saharan Africa,” Journal of Economic Structures, 2024, https://journalofeconomicstructures.springeropen.com/articles/10.1186/s40008-023-00326-7

- Ndung’u, N., “Fintech in sub-Saharan Africa,” WIDER Working Paper, United Nations University World Institute for Development Economics Research, 2022, https://includeplatform.net/wp-content/uploads/2022/10/wp2022-101-fintech-sub-saharan-africa.pdf

- Ogbonna, Kelechukwu Stanley, et al, “Financial Technology and Performance of Financial Institutions in Sub-Saharan African Economies: 2005-2021,” African Banking and Finance Review Journal (ABFRJ), 1, no. 1, (2023), http://www.abfrjournal.com/

- Partech Africa “Africa Tech Venture Capital Report,” 2023.

- Perez-Saiz, Hector and Preya Sharma, “FinTech in Sub-Saharan African Countries: A Game Changer?,” IMF eLibrary, February 14, 2019, https://www.elibrary.imf.org/view/journals/087/2019/004/article-A001-en.xml.

- Silvia Baur-Yazbeck, Silvia, Judith Frickenstein, and David Medine, “Cyber Security in Financial Sector Development: Challenges and potential solutions for financial inclusion,” CGAP & GIZ, November 2019, https://documents1.worldbank.org/curated/en/209721593689624542/pdf/Cyber-Security-in-Financial-Sector-Development-Challenges-and-Potential-Solutions-for-Financial-Inclusion.pdf.

- The impact of financial technology on the performance of financial and banking services in Sub-Saharan Africa,” Faros Center for Consulting and Strategic studies, (2021). https://pharostudies.com/

- UN Capital Development Fund (UNCDF), “Growing Digital Financial Inclusion in Zambia,” December 2019, p. 3, https://finca.org/wp-content/blogs.dir/1/files/2014/02/28.11.2019.MM4P.Growing-Digital-Financial-Inclusion-in-Zambia.English.pdf.

- Yermack, D., “Fintech in Sub-Saharan Africa: What Has Worked Well, and What Hasn’t,” SSRN, 2018, https://www.researchgate.net/publication/327610745_Fintech_in_Sub-Saharan_Africa_What_Has_Worked_Well_and_What_Hasn’t

[1] FinTech Global, “FinTech investment in Africa nearly quadrupled in 2021, driven by PayTech and Lending deals,” January 19, 2022, https://fintech.global/2022/01/19/fintech-investment-in-africa-nearly-quadrupled-in-2021-driven-by-paytech-and-lending-deals/.

Ogbonna, Kelechukwu Stanley, et al, “Financial Technology and Performance of Financial Institutions in Sub-Saharan African Economies: 2005-2021,” African Banking and Finance Review Journal (ABFRJ) 1, no.1, (2023), http://www.abfrjournal.com/.

[2] Chongo, C., “The Impact of FinTech on Financial Services in Sub-Saharan Africa,” LinkedIn, August 15, 2023, https://www.linkedin.com/pulse/impact-fintech-financial-services-sub-saharan-africa-clarence-chongo/.

“FinTech -Zambia,” Statista, April 2023, https://www.statista.com/outlook/dmo/fintech/zambia.

[3]“FinTech in the Middle East and North Africa”,

https://www.findevgateway.org/sites/default/files/users/user611/ar_fintechmena_wamda.pdf.

[4] Achieng, R., “How Fintech Became the Gateway to Predatory Lending in Sub-Saharan Africa,” Bot Populi, 2023, https://botpopuli.net/how-fintech-became-the-gateway-to-predatory-lending-in-sub-saharan-africa/.

[5] Ndung’u, N., “Fintech in sub-Saharan Africa, WIDER Working Paper, United Nations University World Institute for Development Economics Research,” 2022, https://includeplatform.net/wp-content/uploads/2022/10/wp2022-101-fintech-sub-saharan-africa.pdf.

Cambridge Centre for Alternative Finance (CCAF), FinTech Regulation in Sub-Saharan Africa, 2021, https://www.jbs.cam.ac.uk/wp-content/uploads/2021/11/2021-11-fintech-in-sub-saharan-africa.pdf.

[6] Achieng, R., “How Fintech Became the Gateway to Predatory Lending in Sub-Saharan Africa,” op. cit.

[7] Silvia Baur, et al., “Cyber Security in Financial Sector Development: Challenges and potential solutions for financial inclusion,” CGAP & GIZ, 2019,

Abeba Gule Girma and Fariz Huseynov, “The Causal Relationship between FinTech, Financial Inclusion, and Income Inequality in African Economies,” Journal of Risk and Financial Management 17, no. 1, 2023, https://www.mdpi.com/1911-8074/17/1/2.

[8] Hector Perez-Saiz and Preya Sharma, “FinTech in Sub-Saharan African Countries: A Game Changer?,” IMF eLibrary, February 14, 2019, https://www.elibrary.imf.org/view/journals/087/2019/004/article-A001-en.xml.

Mark Elliott, “Driving FinTech adoption in Sub-Saharan Africa,” mastercard.com, March 14, 2023, https://www.mastercard.com/news/eemea/en/perspectives/en/2023/driving-fintech-adoption-in-sub-saharan-africa/.

[9] 4C Group, “What the future holds for FinTech in Africa,” ITWeb, January 9, 2024, https://www.itweb.co.za/article/what-the-future-holds-for-fintech-in-africa/wbrpOMg2WXg7DLZn.

Ndung’u, N., “Fintech in sub-Saharan Africa,” WIDER Working Paper, United Nations University World Institute for Development Economics Research, 2022, https://includeplatform.net/wp-content/uploads/2022/10/wp2022-101-fintech-sub-saharan-africa.pdf

[10] UN Capital Development Fund (UNCDF), “Growing Digital Financial Inclusion in Zambia,” December 2019, p.3, https://finca.org/wp-content/blogs.dir/1/files/2014/02/28.11.2019.MM4P.Growing-Digital-Financial-Inclusion-in-Zambia.English.pdf.

[11] “The impact of financial technology on the performance of financial and banking services in Sub-Saharan Africa,” Faros Center for Consulting and Strategic studies, (2021) https://pharostudies.com/.

Onkokame Mothobi and Kago Kebotsamang, “The Impact of Network Coverage On Adoption of Fintech And Financial Inclusion In Sub-Saharan Africa,” Journal of Economic Structures, 2024, https://journalofeconomicstructures.springeropen.com/articles/10.1186/s40008-023-00326-7.

[12] Cambridge Centre for Alternative Finance (CCAF), “FinTech Regulation in Sub-Saharan Africa,” 2021, https://www.jbs.cam.ac.uk/wp-content/uploads/2021/11/2021-11-fintech-in-sub-saharan-africa.pdf

[13] Onkokame Mothobi and Kago Kebotsamang, “The Impact of Network Coverage On Adoption of Fintech And Financial Inclusion In Sub-Saharan Africa,” Journal of Economic Structures, 2024, https://journalofeconomicstructures.springeropen.com/articles/10.1186/s40008-023-00326-7

[14] Níamh Curran, “Future of Fintech in Africa 2023: Data penetration could be improved with better infrastructure,” Finextra, 2023, https://www.finextra.com/the-long-read/755/future-of-fintech-in-africa-2023-data-penetration-could-be-improved-with-better-infrastructure.

[15] Chongo, C., “The Impact of FinTech on Financial Services in Sub-Saharan Africa,” LinkedIn, August 15, 2023, https://www.linkedin.com/pulse/impact-fintech-financial-services-sub-saharan-africa-clarence-chongo/

[16] Partech Africa, “Africa Tech Venture Capital Report,” 2023.

[17] Tijani Forgor Alhassan and Ahou Julie Koaudio, “Mobile money development in sub-Saharan Africa: Its macroeconomic effects and role in financing development,” Advances in Economics, Business and Management Research 105, 2019, https://www.atlantis-press.com/proceedings/iscde-19/125924614.

David Yermack, “Fintech in Sub-Saharan Africa: What Has Worked Well, and What Hasn’t,” SSRN, 2018, https://www.researchgate.net/publication/327610745_Fintech_in_Sub-Saharan_Africa_What_Has_Worked_Well_and_What_Hasn’t

Ogbonna, Kelechukwu Stanley, et al, “Financial Technology and Performance of Financial Institutions in Sub-Saharan African Economies: 2005-2021,” African Banking and Finance Review Journal (ABFRJ) 1, no.1, (2023), http://www.abfrjournal.com/