Beyond Olympic medals or the number of fighter jets and ballistic missiles, the ultimate expression of national power and prosperity nowadays is public infrastructure, both hard (physical) and soft (digital). If anything, infrastructure development capacity has become the ultimate proxy for global influence, if not the pivot of 21st century geopolitics. There are at least three interrelated reasons why infrastructure development has become so integral to national and international discourse in the past decade.

To begin with, rapidly developing economies as well as developed nations are confronting a massive infrastructure spending gap. As early as 2017, the Asian Development Bank (ADB) warned that the Asian region alone is grappling with a $459 billion annual infrastructure financing gap, a sizeable figure that has doubled to almost $907 billion in more recent years amid growing focus on inclusive and socialized infrastructure development. Over the next decade, the Manila-based development bank estimates $1.7trillion annual financing gap in Asia alone. The challenge is even more daunting on the global level, with McKinsey estimating $3.7 trillion annual spending gap until 2035 and the Global Infrastructure Hub estimating a $15 trillion global gap over the next two decades.[1]

Aside from fiscal constraints, the urgency behind infrastructure development is also a reflection of rapid technological advancements in critical infrastructure and the corresponding need to swiftly upgrade existing networks. This is especially true in the telecommunications sector, whereby the advent of next-generation 5G networks has proven a game-changer, both on a technological as well as regulatory level (to be discussed in greater detail in succeeding sections). The full-spectrum disruption wrought by the COVID-19 pandemic has only accelerated the need for digital infrastructure development, as fintech companies and work-from-home regimes upend traditional modes of economic activity.

Infrastructure development has also become important for political reasons, given its (real and perceived) centrality to turbocharged economic growth, large-scale employment-generation, and enhancing the performance-based legitimacy of incumbent administrations. Dating back to ancient empires, leaders often enhanced their political capital by overseeing mega-projects, which transcended their transient tenure in office. Nineteenth century France under Louis-Napoleon III took this political realization to its logical conclusion, best reflected in Georges-Eugène Haussmann’s iconic transformation of Paris’ basic infrastructure and overall aesthetic sensibilities.[2]

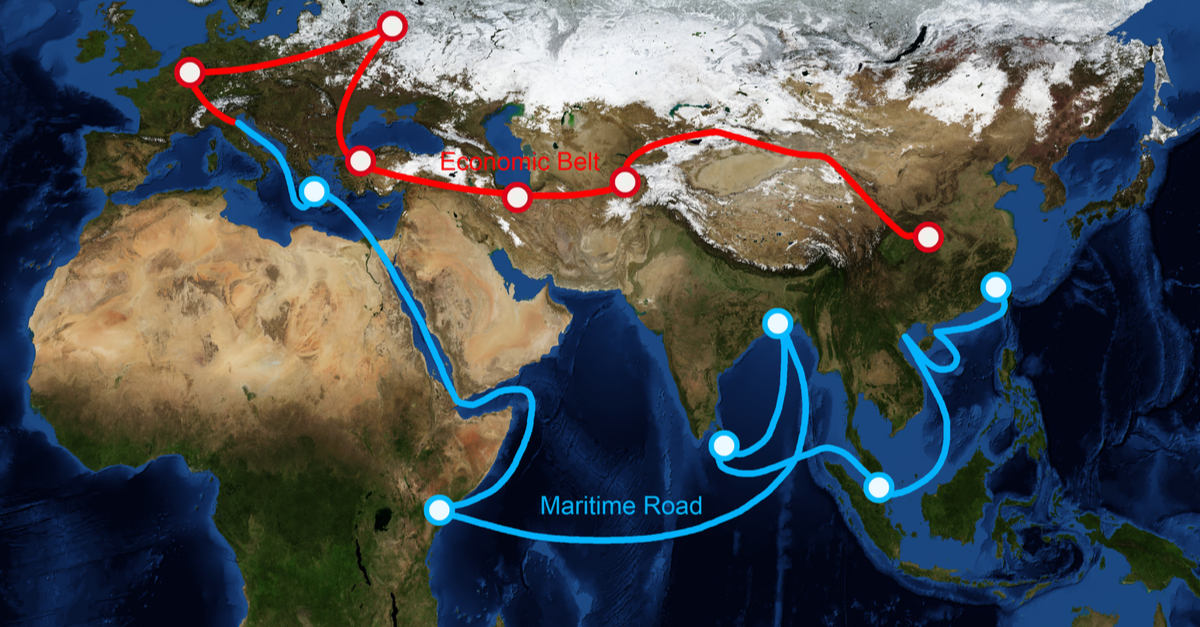

A century later, leaders as varied as Dwight Eisenhower and Lee Kuan Yew embarked on similar massive infrastructure initiatives, which altered the face and the fate of their respective nations with long-term economic consequences. Given the deep recession caused by the raging pandemic, a growing number of policy-makers are relying on infrastructure development as their primary counter-cyclical tool to stimulate battered economies. In short, infrastructure development allows policy-makers to hit three stones at the same time, namely (i) upgrade decrepit or outmoded infrastructure to enhance economic competitiveness, (ii) transition into a more diversified and digitalized economy, and (iii) enhance the performative reputation and political capital of incumbent administrations.[3] And if there is one country that has best realized the importance of infrastructure development to our contemporary global order, it’s arguably China. Under the Belt and Road Initiative (BRI), the Asian superpower oversaw 2,881 projects across multiple continents, with an estimated value of US$3.45 trillion upon completion, within less than a decade.[4]

The New Vanguard of Globalization

China is not the only Asian country with global infrastructure ambitions. Over the past decade, Japan, the traditional engine of pan-Asian industrialization, has launched its own Connectivity Initiative and Partnership for Quality Infrastructure projects, which cuts across East Asia and beyond. Neighboring South Kora, Asia’s other economic dynamo, has introduced its own “New Northern” and “New Southern” Policies, targeting resource-rich economies in Central Asia, Siberia, and Southeast Asia. Meanwhile India, the other Asian giant, has launched its own International North–South Transport Corridor and East-West Corridor, which cuts across and integrated strategic markets from South Asia to West Asia and the broader Eurasian landmass.[5]

But there is quite nothing like China’s BRI, a multi-trillion-dollar vision that aims to place Beijing at the heart of an emerging global economic order, namely globalization with Chinese characteristics. As Chinese President Xi Jinping put it, the BRI is “the project of the century” like no other, a profound reflection of an increasingly post-American order in Asia and beyond. To be fair, Xi’s predecessors, beginning with Jiang Zemin, had already pushed for a “Go Out” and “Going Global” strategy, encouraging Chinese national champions to expand their footprint in global markets.[6] There were also serious discussions over a “March West” strategy, aimed at bolstering Chinese investments in strategically-located Central Asia and West Asian economies, in response to the announcement of the Obama administration’s announcement Pivot to Asia (P2A) doctrine a decade ago.[7]

To understand China’s BRI is to understand Chinese grand strategy-making. The origins of the BRI are, quite surprisingly, not to be found in Zhongnanhai, the seat of China’s power, but instead in initial efforts by multinational companies and provincial government units to diversify the country’s distribution networks by focusing on land-based transportation via transcontinental railways. In effect “bottom-up commercial interests” — beginning with a 2009 deal between American computer company Hewlett-Packard (HP) and the provincial authorities in Chongqing for cost-effective railway connections between Chinese production sites and European markets — paved the way for an increasingly trans-regional infrastructure network.[8]

As Xi consolidated power over all three pillars of power, namely party, state and central military commission, Beijing incorporated these spontaneous, local-level infrastructure diversification initiatives into a mega-global project under the direction of the national government. In 2014, the BRI plan was officially incorporated into China’s national economic development strategy at the Central Economic Work Conference. A year earlier, Xi and his deputies made a series of pronouncements that underscored Beijing’s newfound role as the vanguard of economic globalization.First came Xi’s major speech in at the Nazarbayev University in Almaty, Kazakhstan, where the Chinese leader declared his plans for creating a modern version of the ancient Silk Road, which extended from Western Europe to China via the Middle East, South Asia and Southeast Asia. About a month later, Xi, speaking before the Standing Committee of the Politburo (SCP), the country’s elite policy-making body, announced his “peripheral diplomacy” strategy, whereby he made it clear that wining over estranged neighbors through expanded economic influence was of paramount interest.[9]

As prominent Chinese scholar Yan Xuetong bluntly put it: “The policy now is to allow these smaller [neighboring] countries to benefit economically from their relationships with China. For China, we need good relationships more urgently than we need economic development. We let them benefit economically, and in return we get good political relationships. We should ‘purchase’ the relationships.”[10] To this end, Xi launched the BRI — initially covering as many as 64 nations accounting for 62 percent of the world’s population and almost a third of the global economic output — under the supervision of the country’s major policy (rather than purely commercial) banks, namely The Industrial and Commercial Bank of China, China Development Bank, Bank of China, and Export-Import Bank of China.

More than Meets the Eye

In line with Chinese statecraft tradition, the BRI was never about a single objective or two. Nor was it ever about purely economics or, alternatively, a geopolitical scheme per se. In light of the commercially-driven and geographic origins of the BRI, the mega-infrastructure project has always had a development-centered agenda. First of all, the BRI, which originated in the country’s geographic heartland, aimed at narrowing developmental gaps between the more prosperous eastern and southeastern coastal regions clustered around the Pearl River Delta (PRD), on one hand, and the less developed central and western interior regions, which also happen to host most of the country’s ethnic minority groups.

Second, the BRI aimed at assisting and promoting State-Owned Enterprises (SOEs), responsible for tens of millions of jobs, through provision of big-ticket projects overseas. This explains why up to 90 percent of BRI contracts concerning transport equipment, worth $263 billion in 2018 alone, went to Chinese SOE contractors. Third, the BRI also helps China to boost domestic growth by overcoming the steady slowdown in global trade, which peaked in 2016.[11] By enhancing the port facilities and transportation capacities of export markets, China would be in a far better position to continue its march as the world’s largest exporting nation.[12]

Nevertheless, the BRI also meant that China would also enhance the country’s strategic foothold across global sealines of communications, as Chinese companies poured massive investments into prized port facilities from Greece to Pakistan, Sri Lanka and the Strait of Malacca. China’s growing presence in resource-rich Africa, Latin American, and Asian countries also means greater access to strategic commodities, which are crucial to the country’s long-term development.[13]

The BRI also helps China to realize its Internet Plus and Made in China 2025 industrial policy strategies, which aim to increase the country’s domestic self-sufficiency in cutting-edge technologies from 40% local input in 2020 to 70% by 2025. Ultimately, China aims to globalize its industrial and technological standards, as more countries lock into Chinese-exclusive high-tech infrastructure.[14] By the middle of the century, China aims to become “the world’s major scientific and technological power,” one that can boast of “first-class institutes, research-oriented universities and innovation-oriented enterprises.”[15]

At its core, the BRI is part of China’s broader efforts to mitigate structural imbalances within its own economy, enhance its technological self-sufficiency, expand its global investment and technological footprint, and protect its sealines of communications. But it also helps the Asian superpower to establish networks of influence, if not neo-tributary dependence (i.e., Tianxia). Given the sheer breadth and scale of BRI, China’s early and decisive lead has, quite predictably, been met with a mixture of skepticism, regulatory bottlenecks, and geopolitical pushback.

On one hand, the COVID-19 pandemic, which has squeezed sovereign fiscal resources as well as global flow of labor and capital, has taken a toll on BRI projects. Beijing itself has admitted that at least 20% of slated projects were “seriously affected” by the pandemic.[16] This comes on top of political backlash against Chinese infrastructure projects in key regions such as Southeast Asia, a new theatre of Sino-American rivalry, with some countries openly fretting about non-fulfillment of large-scale promises (Philippines), chronic project completion delays (Indonesia), lack of input by local suppliers and regulatory incompatibility (Thailand), and, in the most dramatic case, “debt trap” diplomacy (Malaysia) altogether, with former Malaysian Prime Minister Mahathir Muhamad openly warning of “new colonialism”.[17]

The Pushback

China’s growing economic footprint has also provoked a pushback by rival powers, most especially the United States, Japan and key Western allies in Europe and Australia. The former Donald Trump administration openly accused China of engaging in ‘predatory’ investment practices; warned key allies against adopting Chinese technology in critical infrastructure, especially 5G networks; and launched counter-initiatives such as the more modest $113 million infrastructure-building fund as well as a more ambitious $60 billion Better Utilization of Investments Leading to Development (BUILD) initiative, which aimed at mobilizing private sector investments in strategic destinations; and the Indo-Pacific Transparency Initiative, which aimed at exposing China’s alleged predatory investment practices.[18]

The status of implementation of the Trump administration’s counter-BRI initiatives are, at best, murky. By and large, the consensus among experts is that the former American leadership was more on the offensive and, accordingly, fell short of mobilizing a tangible alternative to China’s BRI. As a result, the Joseph Biden administration has adopted a more (literally and figuratively) constructive approach, whereby Washington, in tandem with key allies, is seeking to provide alternative platforms for global infrastructure development.

There has been a seismic shift in terms of economic policy in Washington and other major Western capitals. In the past year, the new American leadership has picked up where Trump left by negotiating a bilateral high-tech initiative with Japan, activating the Blue Dot Network (BDN) initiative with Australia and Japan, and launching, with fellow Group of 7 (G7) countries, the Build Back Better World (B3W) initiative, which aims to “help narrow the US$40-plus trillion infrastructure need in the developing world, which has been exacerbated by the Covid-19 pandemic”. Unlike the Trump administration, Biden is more committed to an integrated, alliance-based response to China’s growing influence.[19] The global scramble for infrastructure development is now in full force.

The Biden administration and its allies are gradually and steadily mobilizing a counter-BRI coalition. Their overall goal is not to match China on a dollar-by-dollar basis er se — given the discrepancies in fiscal flexibility and capital mobilization structures between Communist China and Western nations — but instead preserve global standards of good governance and environmental sustainability. And in contrast to China, where the ruling party exercises significant discretion on overall capital mobilization as well as strategic decisions of major companies, the Biden administration and its allies are instead focused on multistakeholder, multilateral initiatives, which draw on the resources and expertise of Big Tech, Wall Street, sovereign wealth funds, civil society groups, and relevant inter-governmental organizations such as the Organization for Economic Co-operation and Development (OECD).

It remains to be seen whether more ‘non-aligned’ countries such as India and Singapore, not to mention Beijing-friendly treaty allies such as South Korea, will be eventually integrated into the Biden administration’s multilateral efforts. So far, however, China’s BRI has faced (real and potential) competition on four fronts. First of all, there is Japan, which, despite the “Lost Decades”, is still the world’s third largest economy and a global manufacturing powerhouse. Under former Prime Minister Shinzo Abe, the country’s longest-serving post-war head of government, Japan proactively doubled down on its strategic investment footprint in key regions such as Southeast Asia.

Eager to keep China’s influence in check, the Abe administration launched a $110 billion infrastructure investment program for Asia, pledging to provide high-quality infrastructure investments that are consistent with good governance standards and, crucially, generate jobs for locals. In particular, Abe targeted fellow US treat allies such as the Philippines, which has been tilting into Beijing’s orbit in recent years. In fact, Japan has remained as the leading export destination, a top long-term investor, and the number one source of Overseas Development Assistance to the Southeast Asian country in recent years. Even in terms of sheer numbers, Japan has confidently gone head-to-head with China.[20]

Crucially, Japanese investments, even when smaller, tend to generate more than four times jobs than those by China. Across Southeast Asia, Japan’s new infrastructure projects (worth $367 billion) are actually larger than that of China’s ($255 billion), with strategic states of Vietnam, the Philippines and Indonesia absorbing the bulk of Tokyo’s infrastructure development offensive. When Chinese big-ticket projects ran into trouble, as in the Jakarta-Bandung high-speed railway project, the host country openly sought Japanese assistance to revamp and finish the project. If anything, Japan has consistently been voted as the most trusted external power for Southeast Asia in the annual survey of the Singapore-based Institute of Southeast Asian Studies (ISEAS).[21]

Japan’s current prime minister Yoshihide Suga, Abe’s protégé and hand-picked successor, has similarly prioritized Japan’s economic diplomacy in Southeast Asia, his first foreign visit destination last year. Suga, the first foreign leader to visit the White House under the Biden administration, has stepped up to the plate by also launching bilateral initiatives to counter China’s BRI. During his mid-2021 visit to Washington, Suga and Biden signed a $4.5 billion joint high-tech infrastructure initiative, with the clear aim of enhancing the two allies’ ability to compete with China in high-end technologies, especially in new-generation telecommunications networks, Artificial Intelligence (AI), and electric cars.[22]

China’s Huawei Technologies Co., in particular, has been a great source of concern for the US and its allies. For a starter, the Chinese telecom giant has rapidly become a global leader and, more crucially, a pioneer in 5G network development, which represents a technological leap that may allow Beijing to exert unprecedented control over flow of data and sensitive communications. Western governments have accused the Chinese company of potentially providing “back door” access to Beijing authorities into the critical infrastructure of host nations.

Though ostensibly a privately-owned company, Western experts have raised alarm bells over new Chinese regulations and national intelligence legislations, which provide the Chinese Communist Party growing supervision over the conduct and strategic decisions of home-grown business entities. As a result, a number of countries, including Australia, Brazil, Malaysia and the United Kingdom have reconsidered their adoption of Huawei 5G network investments.[23]

The US is also actively working with allies and partners such as Sweden, host to Siemens telecom giant, and South Korea, a leading technological power, to not only reconsider collaboration with Huawei but also provide alternative options, including the potential development of 6G technology. Taiwan, the world’s leading chip producer, would also be crucial to an ongoing global high-tech race between the West and China. With the US Department of Commerce mulling a Section 232 investigation into US reliance on Chinese rare earths, counter-BRI initiatives between US and its key allies will likely expand into joint initiatives on strategic resources.[24]

Third, the Biden administration has also revived its predecessor’s ‘minilateral’ initiatives, namely the previously-dormant Blue Dot Network (BDN) in tandem with Australia and Japan. Earlier this year, the three governments, in cooperation with the OECD, hosted a major event in Paris, which brough together leading experts, civil society groups, sovereign wealth fund managers, and 150 global executives responsible for US$12 trillion in combined portfolio. The US State Department hailed the group’s inaugural meeting in Paris as a concerted effort to ensure, “The Blue Dot Network will be a globally recognized symbol of market-driven, transparent and sustainable infrastructure projects.”[25]

Finally, this year also saw the Group of Seven (G7) club of industrialized nations vowing to launch a global infrastructure initiative, namely the “Build Back Better World” (B3W), which aims to provide a “values-driven, high-standard and transparent” alternative to the BRI among developing countries. Over the long-run, an expanded G7, which is set to include Australia, South Korea, and India, is aiming to “collectively catalyze” potentially trillion of dollars, drawn from public-private-partnership schemes, to help narrow the global infrastructure spending gap.[26] Down the road, the main objective of all these interconnected initiatives is to consolidate developmental aid and investment plans of developed nations as well as draw on the expertise, influence and eventually the sizeable capital of global investors to bolster big-ticket infrastructure projects, which are in consonance with and reinforce established good governance standards.

Conclusions

For developing countries, more competition means greater room for maneuver, diversified partnerships, and a greater access to high-quality big-ticket investments. As the late Singaporean leader Lee Kuan Yew once told his American interlocuters, “[G]ive the region options besides China.”[27] And there are signs that Beijing has also got the message. On his part, President Xi Jinping has underscored his commitment to make the BRI more fiscally and environmentally sustainable, taking note of initial criticisms that greeted massive Chinese infrastructure plans across the developing world.[28]

During the 2021 Boao Forum in Hainan, the Chinese leader has also reached out to private investors, including Big Tech companies in the West, in order explore potential public-private-partnership schemes in the future.[29] In the past, China also showed tremendous flexibility when under criticism, most notably when it decided to forego full veto powers within the Beijing-based Asian Infrastructure Investment Bank (AIIB).[30]

Even more encouragingly, China’s tech champions such as Huawei’s CEO Ren Zhengfei have expressed their willingness to collaborate with the West and, if necessary, even share part of their 5G technology in order to head of lose-lose-confrontation.[31] Ultimately, infrastructure development schemes shouldn’t be reduced to and defined by an ‘East vs West’ dichotomy, since any binary approach only risks creating a technological iron curtain, which, in turn, could precipitate decoupling within the broader global economy.

Global entrepôts and financial hubs such as Singapore and Switzerland could serve as crucial ‘neutral’ platforms for raising large-scale infrastructure-related capital in ways that transcend any putative “Ne Cold War” between rival superpowers. Given the scale of the global infrastructure challenge, flexible and cross-cutting partnerships schemes, if not tech alliances of convenience, are indispensable to aiding post-pandemic recovery as well as long-term economic dynamism in an increasingly crowded, digitalized world.

References:

[1] Madera, Sherry. 2020. “Bridging the global infrastructure investment gap requires better data” REFINITIV. https://www.refinitiv.com/perspectives/future-of-investing-trading/bridging-the-global-infrastructure-investment-gap-requires-better-data/

[2] For biography of Napoleon III and his legacy, see Strauss-Schom, Alan. 2018. “The Shadow Emperor: A Biography of Napoleon III”, St. Martin’s Press: New York.

[3] Heydarian, Richard Javad. 2020. “Why the US-led response to China’s belt and road is a cause for celebration, not alarm,” South China Moring Post. https://www.scmp.com/comment/opinion/article/3138474/why-us-led-response-chinas-belt-and-road-cause-celebration-not

[4] Madera, Sherry. 2020. “Bridging the global infrastructure investment gap requires better data” REFINITIV. https://www.refinitiv.com/perspectives/future-of-investing-trading/bridging-the-global-infrastructure-investment-gap-requires-better-data/

[5] Heydarian, Richard Javad. 2019. “The Indo-Pacific: Trump, China and the New Struggle for Indo-Pacific”, Palgrave Macmillan: Singapore, pp. 93-148.

[6] Shambaugh, David. “China’s Soft Power Push.” Foreign Affairs. June 16, 2015. https://www.foreignaffairs.com/articles/china/2015-06-16/china-s-soft- power-push.

[7] Cai, Peter. “Understanding China’s Belt and Road Initiative.” Lowly Institute. March 22, 2017. https://www.lowyinstitute.org/publications/ understanding-belt-and-road-initiative.

[8] TJMA, 2019. “Empty trains on the modern Silk Road: when Belt and Road interests don’t align (Updated)”, Panda Paw, Dragon Claw, https://pandapawdragonclaw.blog/2019/08/23/empty-trains-on-the-modern-silk-road-when-belt-and-road-interests-dont-align/

[9] Heydarian, Richard Javad. 2019. “The Indo-Pacific: Trump, China and the New Struggle for Indo-Pacific”, Palgrave Macmillan: Singapore, pp. 93-118.

[10] Moriyasu, Ken. “China Needs to ‘Purchase’ Friendships, Scholar Says.” Nikkei Asian Review. March 2, 2015. https://asia.nikkei.com/NAR/Articles/ China-needs-to-purchase-friendships-scholar-says.

[11] Appelbaum, Binyamin. “A Little-Noticed Fact About Trade: It’s No Longer Rising.” The New York Times. October 30, 2016. https://www.nytimes. com/2016/10/31/upshot/a-little-noticed-fact-about-trade-its-no-longer- rising.html.

[12] Hurley, John, Scott Morris, and Gailyn Portelance. “Examining the Debt Implications of the Belt and Road Initiative from a Policy Perspective.” Center for Global Development. March 2018. https://www.cgdev.org/sites/default/ files/examining-debt-implications-belt-and-road-initiative-policy-perspective.pdf.; Cai, Peter. “Understanding China’s Belt and Road Initiative.” Lowly Institute. March 22, 2017. https://www.lowyinstitute.org/publications/ understanding-belt-and-road-initiative.

[13] Kaplan, Robert. The Return of Marco Polo’s World: War, Strategy, and American Interests in the Twenty-First Century. New York: Random House, 2018.

[14] Kennedy, Andrew. “Rethinking Energy Security in China.” East Asia Forum. June 6, 2010. https://www.eastasiaforum.org/2010/06/06/rethinking-energy- security-in-china/.

[15] Reuters Staff, 2016. “China’s President Xi pledges more support for technology firms”, Reuters. https://www.reuters.com/article/us-china-tech/chinas-president-xi-pledges-more-support-for-technology-firms-idUSKCN0YM089

[16] Reuters Staff, 2020. “China says one-fifth of Belt and Road projects ‘seriously affected’ by pandemic”, Reuters https://www.reuters.com/article/us-health-coronavirus-china-silkroad-idUSKBN23Q0I1

[17] Heydarian, Richard Javad 2021. “At a strategic crossroads: ASEAN centrality amid Sino-American rivalry in the Indo-Pacific”, in Rivalry and Response: Assessing Great Power Dynamics in Southeast Asia, ed, Jonathan Stromseth. Brookings Institution Press: Washington DC.

[18] Heydarian, Richard Javad. 2019. “The Indo-Pacific: Trump, China and the New Struggle for Indo-Pacific”, Palgrave Macmillan: Singapore

[19] Klein, Betsy & Maegan Vazquez. 2021. “Biden aims to counter China’s global infrastructure project with new G7 initiative”, CNN. https://edition.cnn.com/2021/06/12/politics/joe-biden-china-infrastructure/index.html

[20] Heydarian, Richard Javad 2021. ‘Japan leads the ‘middle powers’ in shaping Asia’s future’, Japan Times. https://www.japantimes.co.jp/opinion/2021/05/17/commentary/japan-commentary/japan-a-leader-in-shaping-asias-future/

[21] Ibid.

[22] Sanger, David & Katie Rogers, 2021. “Biden and Suga Agree U.S. and Japan Will Work Together on 5G” The New York Times, https://www.nytimes.com/2021/04/16/us/politics/biden-5g-japan.html

[23] Heydarian, Richard Javad. 2021. “SE Asia fragments on pro and anti-Huawei lines”, Asia Times. https://asiatimes.com/2021/07/se-asia-fragments-on-pro-and-anti-huawei-lines/

[24] Ibid.

[25] See the US State Department official statement https://www.state.gov/welcoming-the-inaugural-meeting-of-the-blue-dot-network-executive-consultation-group/

[26] See White House official statement https://www.whitehouse.gov/briefing-room/statements-releases/2021/06/12/fact-sheet-president-biden-and-g7-leaders-launch-build-back-better-world-b3w-partnership/

[27] Wall Street Journal, 2010 “WikiLeaks: Singapore’s Lee Rates China’s Leaders”, https://www.wsj.com/articles/BL-CJB-11993

[28] Goh, Brenda & Kate Cadell. 2019. “China’s Xi says Belt and Road must be green, sustainable,” Reuters. https://www.reuters.com/article/us-china-silkroad-idUSKCN1S104I

[29] Bloomberg News, 2021. “China’s High-Profile Boao Forum Returns With Investment in Focus” https://www.bloomberg.com/news/articles/2021-04-18/china-s-high-profile-boao-forum-returns-with-investment-in-focus

[30] Wei, Lingling & Bob Davis, 2015. “China Forgoes Veto Power at New Bank to Win Key European Nations’ Support”, Wall Street Journal. https://www.wsj.com/articles/china-forgoes-veto-power-at-new-bank-to-win-key-european-nations-support-1427131055

[31] The Economist, 2019. “Ren Zhengfei may sell Huawei’s 5G technology to a Western buyer” https://www.economist.com/business/2019/09/12/ren-zhengfei-may-sell-huaweis-5g-technology-to-a-western-buyer