Momentum for the global energy transition is expected to accelerate following the COP28 pledge supported by 124 signatories to triple capacity in renewable energy to at least 11,000 gigawatts by 2030 and demonstrate similar levels of ambition in promoting the development of zero-emission technologies.[i] To achieve net-zero targets, not only will the power supply need to be decarbonized, but emissions in the broader economy will also need to be replaced through electrifying mass transport systems and personal mobility, deploying battery technology at all scales for energy storage, and establishing smart grids and charging infrastructure for electric transport.

On a technical level, enabling this objective will require a global expansion in the manufacturing of solar power panels, photovoltaic modules, batteries, wind turbine blades, smart grid components, and other technologies. From an economic perspective, the future potential of clean energy manufacturing is evident insofar as replacing existing high-carbon electricity generation assets with clean sources becomes the platform on which to develop a climate change industrial base built on clean technologies. Chiefly, supporting the energy transition will require rapid growth in dedicated manufacturing, with the market size for clean energy manufacturing expected to triple to approximately US$650 billion a year by 2030.[ii] These markets are of clear interest to nations leading the energy transition: announcing the US$3 billion Climate Fund on the 2nd of December at COP28, U.S. Vice President Kamala Harris described the investment made by her administration as the largest climate investment in the history of the country, with around US$10 trillion committed over ten years to building manufacturing plants for solar panels, wind turbines, electric vehicles, and batteries.

The importance of energy security and the prospects of long-term clean energy investment mean that national policy responses have started to focus on prioritizing the security and resilience of critical mineral supply chains, with energy transition discussions among policymakers and business communities accompanied by concerns over potential minerals supply bottlenecks. However, these national and narrowly plurilateral approaches and willingness to compete in securing supplies suggest a move away from multilateralism and towards potential further fragmentation of the international regime for critical minerals.

The tension between national objectives and the goal of global decarbonization sits at the heart of the broader debate on critical minerals and will be addressed in the conclusion.

Critical minerals key to the energy transition

Beyond technical and economic aspects, the challenge faced by states seeking to decarbonize energy systems and economies is anchored by the necessity of securing sufficient supplies of critical minerals. While definitions vary slightly—the International Energy Agency focuses on around a dozen minerals[iii] while the U.S. Department of Energy classifies eighteen minerals as critical for energy[iv]—these minerals are generally agreed to include lithium, cobalt, nickel, manganese, and graphite for battery production; rare earth elements (REEs), which are indispensable to the production of electric motors and wind turbines; and copper and aluminum, which are used extensively in electrical networks. The relative lack of substitutes means that significant restrictions on the global supply of critical minerals also risk interrupting global decarbonization momentum. Beyond market dynamics, the return of geopolitical instability in the Middle East and growing tensions between China and the West also play into fears of future supply chain disruptions.

Against this background, the international supply chain outlook for critical minerals is uncertain, with supply chains under pressure from three key drivers. Firstly, the magnitude of projected global demand growth for critical minerals is expected to strain capacity in mining, production, and refining. Secondly, supply risk is increasing due to the problem of the geographical concentration of critical minerals. Global trade disruptions experienced during the COVID-19 pandemic and subsequent energy market supply shocks from the Russia-Ukraine conflict have likely also sensitized policy and business leaders to the issue of resilience and security in global supply chains. Thirdly, geopolitical rivalries are growing as major powers compete to secure access to critical minerals. The rationale in this case extends beyond short-term energy security and aims to reinforce long-term economic security through the creation of internationally competitive manufacturing and export industries.

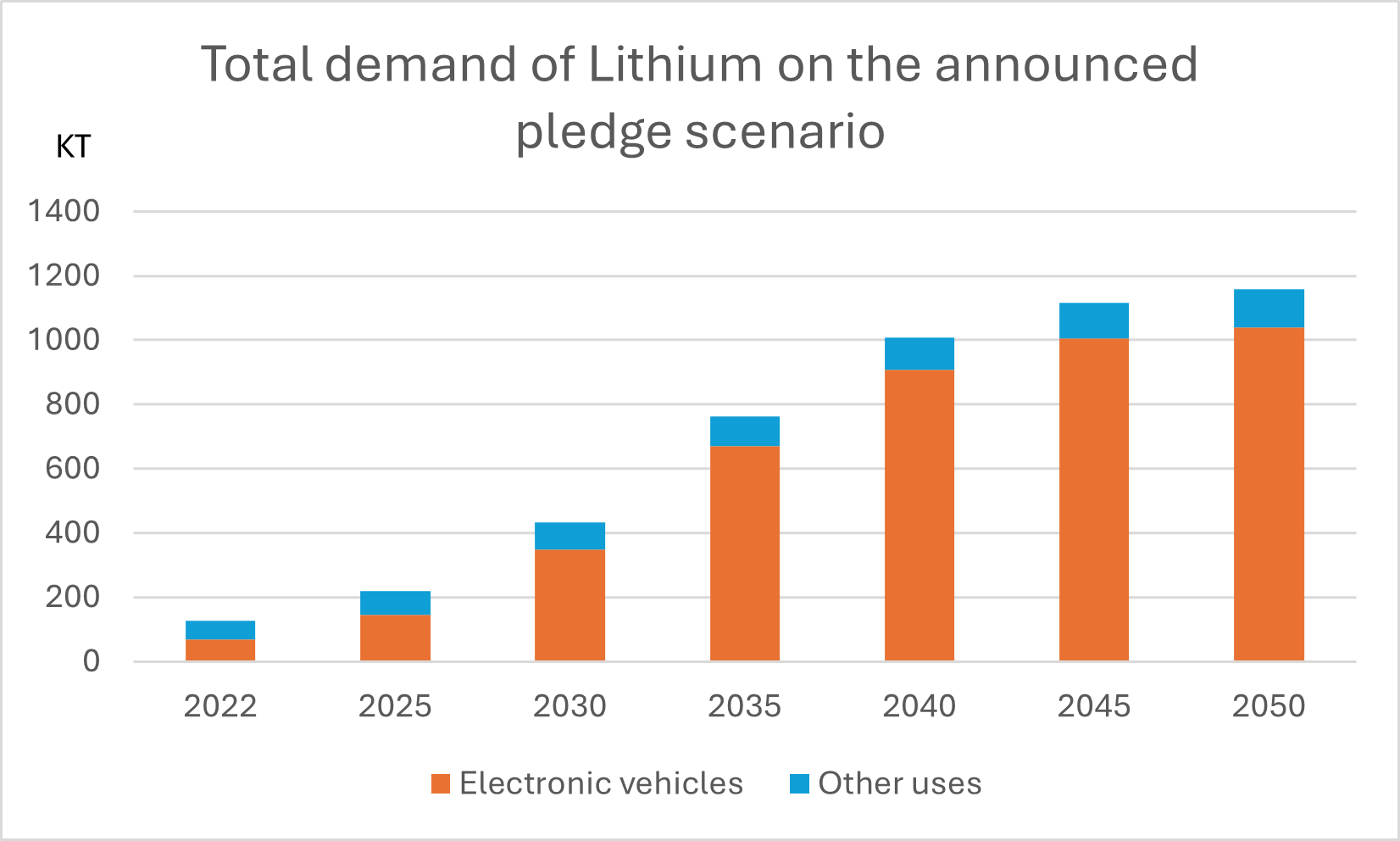

Chart 1: Global lithium demand forecast 2050

Source: IEA Critical Minerals Market Review 2023

With the world shifting towards cleaner alternatives and consumers increasingly opting for the use of electric vehicles rather than those with combustion engines, demand for lithium used in batteries is expected to keep on increasing over the next 30 years, as shown in Chart 1. The high demand for lithium is driven not only by battery demand but also because of its use as a key material in the production of glass, medications, and ceramics. This raises a bigger question about the future of lithium production in countries like Australia, which alone produces 52% of the world’s lithium and has the largest reserve globally.[v] With this increasing demand, there is considerable opportunity for Australia and Chile (the latter is the second largest lithium producer) to increase lithium production, thereby diversifying their respective mining and production sectors while supporting domestic green growth policies.

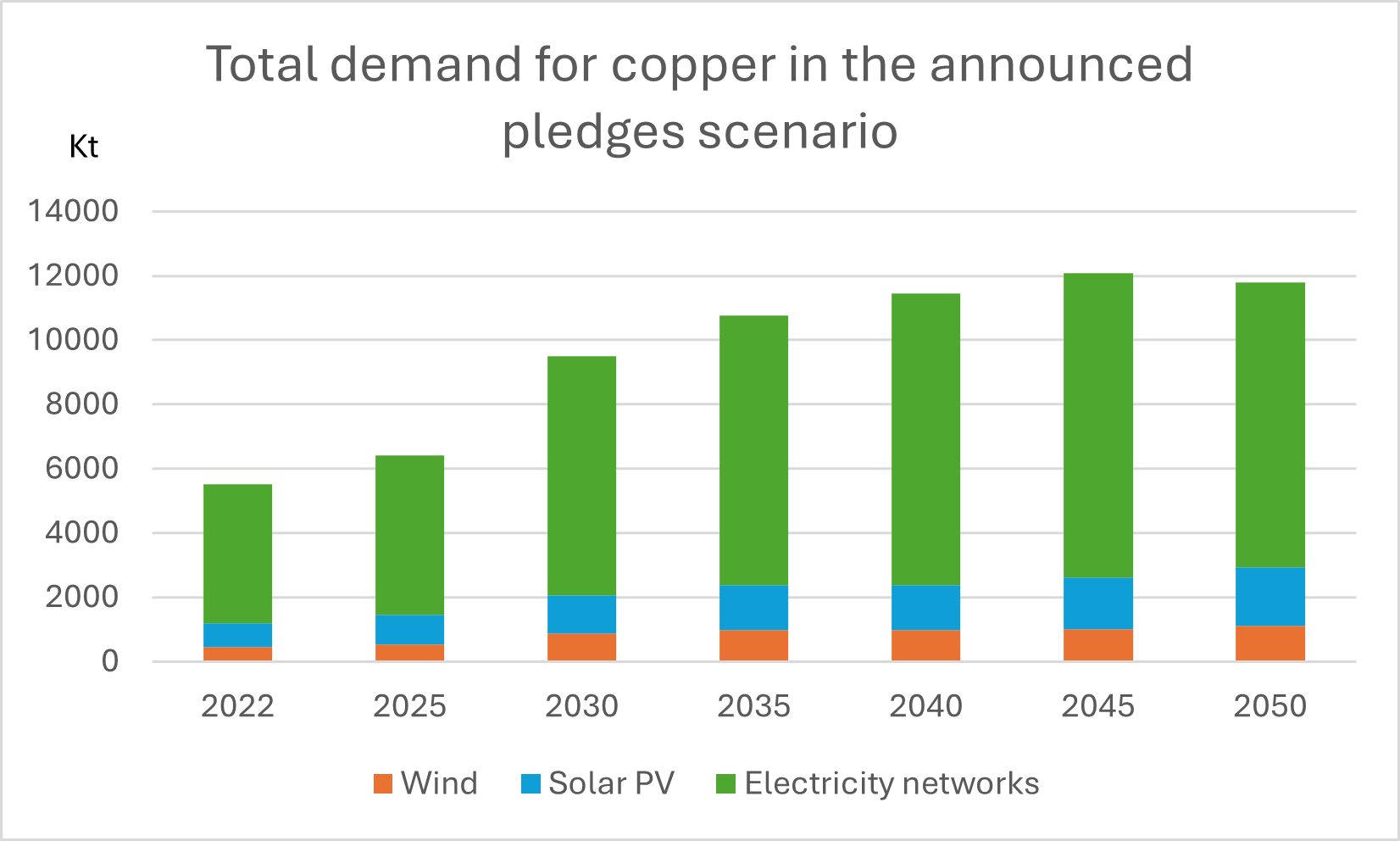

Chart 2: Global copper demand forecast 2050

Source: IEA Critical Minerals Market Review 2023

In reference to Chart 2, copper, due to its thermal and electrical conductivity, is used in many technical applications, such as construction and other industrial and domestic applications. With the rapid and widespread adoption of these technologies, the demand for copper in the energy transition is expected to grow by nearly 600% by 2030.[vi] The global copper industry will be growing substantially in the upcoming years as countries leading the energy transition will accelerate investment in wind and solar power requiring copper in large quantities. Another opportunity arises here for Chile, which has the largest copper mines in the world.

Economic fundamentals: the forecast demand-supply mismatch in critical minerals

With renewable energy sectors fundamentally reliant on critical mineral supplies to meet global emissions pledges, future demand for critical minerals has been characterized by the IEA as involving a shift from “a fuel-intensive to a mineral-intensive energy system” that will “supercharge demand for critical minerals.” The intensiveness of critical minerals’ use in renewable energy and batteries underpins this future demand: around 200kg of critical minerals are needed for each electric vehicle battery,[vii] while an onshore wind plant requires nine times more mineral resources than a gas-fired plant.[viii] These realities of the energy transition are reflected in the magnitude of demand projections for critical minerals, which are expected to undergo a four-fold growth in demand by 2040 over the 2020 baseline.[ix]

Beyond renewables and batteries, economy-wide decarbonization will also eventually involve net-zero industry, aviation, maritime, and defense sectors, each of which will contribute to driving demand for critical minerals as commercially viable technologies emerge. A further demand contributor will be the digital infrastructure supporting the climate economy, which will require the manufacturing of displays and semiconductors, next-generation communication, quantum computing, and hard infrastructure for new energies and smart cities. The breadth and technology intensiveness of decarbonized economies mean that highly complex critical minerals supply chains will need to be established and maintained; the market size for clean energy manufacturing alone is expected to triple to approximately US$650 billion a year by 2030.

The projected four-fold increase in global demand for critical minerals, coupled with long lead times for mining investment and the problem of geographical concentration, is expected to make securing sufficient, reliable, and affordable supplies extremely challenging. Concentration analysis by the IEA and the Organisation for Economic Co-operation and Development (OECD) shows a high geographical concentration of most key minerals in relatively few geographies. The concentration ratio is particularly high for lithium, cobalt, manganese, and graphite. For example, over fifty percent of global lithium supplies come from Australia, while the remaining fifty percent approximately is sourced from Chile, China, and Argentina. Lithium aside, several key critical minerals are concentrated in Africa, with the continent accounting for around 80% of global manganese, platinum, and chromium supplies, 47% of world cobalt supplies, and 21% of graphite supplies.[x] Substantial concentration also exists in China, with the country accounting for approximately fifty percent of global supplies of arsenic and gallium, which are vital to the production of microchips.

Importantly, the problem of concentration isn’t limited to the extraction of critical minerals but also exists in relation to processing and refining. For example, around eighty percent of global cobalt is processed by China, while the raw cobalt ore is overwhelmingly supplied by mines in the Democratic Republic of the Congo. China is also the largest producer of rare earth elements, accounting for approximately seventy percent of mining and ninety percent of the processing of REEs in 2022 and 2023.

In practice, this geographical concentration within the borders of relatively few countries is a potential risk to the resilience of international supply chains. Under a scenario in which a nation is vulnerable as a downstream consumer of critical minerals produced by another country, there is an understandable reluctance to accept geopolitical or market risks in the mineral supply chain. The indispensable role of critical minerals in future energy capacity makes a degree of politicization inevitable, with the importance of critical minerals to renewable energy and batteries placing the discourse within the sphere of energy security. Moreover, the currently unstable state of global geopolitics also likely plays into planning scenarios, reinforcing fears that supply chain disruptions could affect energy production and the ability to implement the energy transition.

This is altogether unsurprising, as international energy relations have long been a key concern of geopolitics. Short-term price volatility has already entered the critical minerals field, with the price of lithium increasing by two-and-a-half times over 2022, reaching US$80,000 a ton in December 2022, before collapsing to current price levels of around US$15,000 per ton in March 2024. Also in 2022, the prices of nickel and aluminum, for which Russia is a major global supplier, similarly spiked over the course of the year but have since returned to lower levels. In the medium-to-long term, potential bottlenecks in the supply of critical minerals could compromise countries’ overall prospects of a successful energy transition.

Geopolitical rivalries for supply security and energy transition industrial leadership

While the immediate focus is the challenge of managing high demand against low or unstable supplies of critical minerals, a longer-term objective also exists: establishing industrial and technological leadership in energy transition industries. The economic importance of energy transition industries becomes clear when considering the level of policy support offered by governments to clean energy investment: the June 2023 update of the IEA Government Energy Spending Tracker estimates a total figure of US$1.34 trillion allocated by governments for clean energy investment support since 2020.[xi]

In this sense, the vast number of new economic growth engines associated with the new climate economy make it clear that alongside the global decarbonization agenda, there are national economic and strategic interests at stake. In light of expected industry-wide transformations over the coming decades, nations are seeking to position themselves as industrial and manufacturing leaders in the clean energy technologies that will drive the future climate economy.

Specific policy programs designed to expand investment into areas of the economy associated with low-carbon energy include the U.S. Inflation Reduction Act (IRA) of 2022,[xii] which presents a cleantech investment plan valued at US$369 billion, and Europe’s flagship cleantech policy, the Green Deal Industrial Plan, which is similarly conceived to establish and maintain the continent’s industrial leadership in low-carbon energy technologies.[xiii] The Green Deal Industrial Plan includes initiatives covering climate, the environment, energy, transport, industry, agriculture and sustainable finance and reflects the ambition of becoming the first carbon-neutral continent by 2050. Japan too has enacted a green subsidy program in May 2023 intended to unlock US$1 trillion in investments for low-carbon infrastructure over the coming decade. The program aims to help accelerate Japan’s clean energy transition by supporting technologies such as low-carbon hydrogen and ammonia. The deployment of policy instruments such as the IRA, the European Green Deal, and Japan’s green subsidy program has a knock-on effect on demand for critical minerals.

Naturally, the industrial policy objective of growing economies around technologies and markets associated with the energy transition and digital transition requires stable, long-term access to critical minerals as a matter of economic security.

Against this uncertain outlook for international supply chains of critical minerals, the United States, the European Union, Canada, Australia and others have implemented policies to bolster supply chain resilience. In the United States, a series of policy documents have clearly enunciated the relationship between critical minerals, energy security, and national security. The geopolitical backdrop to this scenario is principally that of over-reliance on China, with the 2010 “Rare Earth Crisis,” during which exports of REEs to Japan were temporarily restricted by China, held up as an example of the need to diversify supplies. In 2022, U.S. President Joe Biden noted the dependence of the United States on “unreliable foreign sources for many of the strategic and critical materials necessary for the clean energy transition.”[xiv] Within the same context, Presidential Determination No. 2022-11 invoked Section 303 of the Defense Production Act (DPA) and directed the U.S. Department of Defense to strengthen the industrial base for large-capacity batteries used in “the automotive, e-mobility, and stationary storage sectors.”[xv] More recently, the position was reinforced in the fourth update (2023) of the Critical Materials Assessment policy document by the U.S. Department of Energy, which categorizes critical minerals as important to the energy independence and national security of the U.S.[xvi] Europe’s policy trend is similar, with EU Commission President von der Leyen remarking in early 2023 that Europe is 98% dependent on China for REEs vital for manufacturing key technologies including wind power generation, hydrogen storage and batteries.

Conversely, several countries holding globally significant reserves of critical minerals have seemingly reverted to what has been described as resource nationalism, whereby exports of critical minerals are subject to bans or various restrictions to impede their sale on international markets. For example, China’s safeguarding of critical minerals supply is on a strengthening trend, with restrictions implemented in August 2023 for critical minerals gallium and germanium, followed by export controls on high-grade graphite in December.[xvii] Similarly, measures to limit the export of certain critical minerals have also been adopted by Indonesia and Zimbabwe, both of which are seeking to boost domestic supply chains in the production of EV batteries.[xviii]

Given these uncertainties around the supply of critical minerals, maintaining access now occupies a central place on the policy radar of major powers, with the United States, for example, recently announcing that “a robust, resilient, sustainable, and environmentally responsible domestic industrial base” is a critical component of clean energy manufacturing supply chains and a clean energy economy.[xix] Similarly, Canada’s policy position acknowledges the centrality of critical minerals to the energy transition, stating: “There is no energy transition without critical minerals… It is therefore paramount for countries around the world to establish and maintain resilient critical minerals value chains.”[xx]

While certain policy responses have targeted an increase in domestic extraction or recycling capacities—the Australian Critical Minerals Plan of 2023 and Canada’s promotion and facilitation of domestic mining being notable examples—it is generally not feasible for one country to develop an autonomous or ‘self-sufficient’ end-to-end supply chain. Given these constraints, the United States, the United Kingdom, the European Union, and Japan have embarked on a program of Critical Mineral Agreements (CMAs), which reciprocally commit partners to free trade in key critical minerals. A flurry of recent activity has seen the U.S. and Japan conclude CMA negotiations in March 2023, followed by the launch of negotiations for a CMA with the EU in the same month. In late 2023, the U.S. reportedly expressed an interest in a CMA with Indonesia ahead of a meeting between U.S. President Joe Biden and Indonesian President Joko Widodo.

More broadly, the Minerals Security Partnership (MSP), established in 2022, convenes a relatively restricted group of governments and private companies to discuss critical minerals projects across the supply chain segments of exploration, processing, refining and recycling. The membership of the MSP—Australia, Canada, Finland, France, Germany, India, Italy, Japan, Norway, South Korea, Sweden, the United Kingdom, the United States, and the European Union—reflects the close political, economic, and strategic ties of the participating countries.

The prevalent dynamic of international cooperation in the field of critical minerals therefore appears to be a retreat from a global market in critical minerals and a preference for bilateral or plurilateral arrangements with political allies. Perhaps the turmoil experienced over the last three years, coupled with the future strategic-economic importance of critical minerals, has encouraged a retreat into a risk management policy mindset whereby national policies are narrowly framed around the resilience and security of critical minerals supply chains. These policy responses, while understandable in terms of shoring up national energy and economic security, have commensurately weakened the impulse towards global collaboration on critical minerals. Under this view, the security of supply can only be ensured through national supply chain autonomy or by resorting to a limited number of trusted bilateral partnerships.

There is likely a price penalty associated with narrow bilateral or plurilateral agreements since the market for critical minerals will no longer be an efficiently functioning global market based on trade and investment openness. A further criticism is that, because planning and policy moved very quickly to a policy of bilateral or plurilateral alliances, ethical and environmental considerations associated with critical minerals mining may have necessarily taken a backseat.

Global decarbonization at risk from narrow interests?

However, the biggest criticism of bilateral/plurilateral alliances and resource nationalism is that these narrow trends are thoroughly at odds with solving the global problem of climate change through the energy transition. After decades of consolidating a scientific consensus and coalescing multilateral political support, the global energy transition towards zero-carbon economies is accepted as the solution to the world’s problem of climate change. On the premise that a global problem requires a global solution, it follows that enabling resources for the energy transition—whether finance, technology, or critical minerals—ought to be available globally, with the supply and processing of minerals critical for the energy transition a matter concerning every country.

In practice, this means that international supply chains must be implemented to be not only resilient but also accessible and equitable. The global diplomacy context of COP28 is aligned with this notion, with the Secretary-General of the United Nations, António Guterres, noting the imperative of ensuring that the extraction of critical minerals is just and equitable.[xxi] The WTO also emphasizes the importance of unfettered trade as “an important element in the collective effort to support a sustainable transition to a low-carbon economy.”[xxii]

These multilateral impulses, speaking to the need for global inclusiveness in access to supplies of key minerals for the energy transition, are, however, fundamentally in tension with the emerging geopolitical competition based on national primacy. Bilateral or restricted plurilateral arrangements such as the MSP, together with examples of resource nationalism by countries rich in critical minerals, are similarly in tension with the global goal of decarbonization.

From the perspective of equity and inclusiveness in the global energy and digital transitions, there is a need to harness critical minerals to benefit the technological, economic, and social development of low-income countries of the global South. In this regard, nascent conversations between G7 finance leaders and developing countries to support critical mineral supply chains focused on domestic refining and processing, as well as strategies to promote critical minerals R&D and recycling, hold great promise.[xxiii]

India, for instance, emerged post-COP28 to being committed to a more sustainable future and the often-overlooked story of key minerals has taken center stage in India’s quest for a greener, more resilient future. Although the country declares that it will derive half of its installed electric power capacity from non-fossil fuel sources by 2030, it confronts a significant obstacle in terms of the availability, extraction, and processing of these minerals, which are primarily controlled by a small number of nations.[xxiv] India relies heavily on Chinese imports of critical minerals, which poses a substantial risk to the strategic goals of a developing country like India.

On the other hand, examining the world’s leading exporters of critical minerals, we find Chile at the top of the List. Being the lead in this industry, Chile has the potential to become an important global supplier of many minerals that are used in various products, but for this to be feasible, there should be a solid industrial policy. Considering the geopolitical aspect, Chile must maintain a neutral ground when it comes to cases such as the China-U.S. rivalry to be able to play a role in both supply chains.

China consumed more than 65% of Chile’s mineral exports in 2021, worth $22.5 billion, or 6% of the Chilean GDP.[xxv] With this great consumption, the policy approach adopted by the U.S. would ideally reduce disruptions in supply chains and increase efficiency in developing value chains. Most of Chile’s production of copper is shipped in semi-processed form, as their last constructed smelter was back in 1990. Given the size of Chile’s copper resources, China is interested in co-investing in projects to upgrade Chile’s existing smelters; however, given the strategic importance of reserves of critical minerals, China’s interest in Chile is likely to encourage geopolitical rivalry with other major consumers of critical minerals, in particular the U.S.

[i] COP28, “Global Renewables and Energy Efficiency Pledge,” 2023, https://www.cop28.com/en/global-renewables-and-energy-efficiency-pledge.

[ii] IEA, “Energy Technology Perspectives 2023,” https://www.iea.org/reports/energy-technology-perspectives-2023.

[iii] IEA, The Role of Critical Minerals in Clean Energy Transitions, (Paris: OECD Publishing, 2021), https://www.oecd-ilibrary.org/energy/the-role-of-critical-minerals-in-clean-energy-transitions_f262b91c-en.

[iv] U.S. Department of Energy, “Notice of Final Determination on 2023 DOE Critical Materials List,” (2023), https://www.energy.gov/sites/default/files/2023-07/preprint-frn-2023-critical-materials-list.pdf.

[v] World economic Forum, “This chart shows which countries produce the most lithium,” January 5, 2023, https://www.weforum.org/agenda/2023/01/chart-countries-produce-lithium-world/.

[vi] World Economic Forum, “Which countries produce the most copper?,” December 12, 2022, https://www.weforum.org/agenda/2022/12/which-countries-produce-the-most-copper/.

[vii] World Trade Organization (January 2024).

[viii] IEA, World Energy Outlook Special Report, “The Role of Critical Minerals in Clean Energy Transitions,” May 2021, https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

[ix] Leurent, T., and Kratsis, S., “Digital twins can boost mining output to drive the energy transition. Here’s how” Davos Agenda, World Economic Forum, (June 2023), https://www.weforum.org/agenda/2023/06/digital-twins-mining-energy-transition/.

[x] Baskaran, G., “Prospects for U.S. Minerals Engagement with Africa, Center for Strategic and International Studies (CSIS), (August 2023), https://www.csis.org/analysis/prospects-us-minerals-engagement-africa.

[xi] International Energy Agency. (2023). Government Energy Spending Tracker. Retrieved from https://www.iea.org/reports/government-energy-spending-tracker-2.

[xii] United States Congress. (2022). H.R.5376 – United States Inflation Reduction Act of 2022, https://www.congress.gov/bill/117th-congress/house-bill/5376/text.

[xiii] European Commission. (February 2023). The Green Deal Industrial Plan: putting Europe’s net-zero industry in the lead, Press Release, https://ec.europa.eu/commission/presscorner/detail/en/ip_23_510.

[xiv] U.S. Department of Defense, Press Release, Defense Production Act Title III Presidential Determination for Critical Materials in Large-Capacity Batteries, April 5, 2022, https://www.defense.gov/News/Releases/Release/Article/2989973/defense-production-act-title-iii-presidential-determination-for-critical-materi/.

[xv] United States Presidential Determination No. 2-22 – 11, (March 2022).

[xvi] Diana J. Bauer, Ruby T. Ngyuen, Braeton J. Smith, “Critical Materials Assessment,” U.S. Department of Energy (July 2023), https://www.energy.gov/sites/default/files/2023-07/doe-critical-material-assessment_07312023.pdf.

[xvii] FTI Consulting, Energy Insights, “China’s Export Controls on Critical Minerals – Gallium, Germanium and Graphite” (December 2023), https://www.fticonsulting.com/insights/articles/chinas-export-controls-critical-minerals-gallium-germanium-graphite.

[xviii] Crochet, V., and Zhou, W., “Critical insecurities? The European Union’s trade and investment strategy for a stable supply of minerals for the green transition”, Blog of the European Journal of International Law, (February 2023), https://www.ejiltalk.org/critical-insecurities-the-european-unions-trade-and-investment-strategy-for-a-stable-supply-of-minerals-for-the-green-transition/.

[xix] The White House, Presidential Determination No. 2-22 – 11, Memorandum on Presidential Determination Pursuant to Section 303 of the Defense Production Act of 1950, as amended, (March 2022), https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/31/memorandum-on-presidential-determination-pursuant-to-section-303-of-the-defense-production-act-of-1950-as-amended/.

[xx] Government of Canada, “The Canadian Critical Minerals Strategy From Exploration to Recycling: Powering the Green and Digital Economy for Canada and the World” (December 2022), https://www.canada.ca/en/campaign/critical-minerals-in-canada/canadas-critical-minerals-strategy.html.

[xxi] “COP28: Extraction of minerals needed for green energy must be ‘sustainable and just’, says Guterres,” Africa Renewal, December 3, 2023, https://www.un.org/africarenewal/magazine/december-2023/cop28-extraction-minerals-needed-green-energy-must-be-%E2%80%98sustainable-and-just%E2%80%99.

[xxii] Snoussi-Mimouni, M. and Avérous, S., “High demand for energy-related critical minerals creates supply chain pressures”, World Trade Organization Data Blog, (January 2024), https://www.wto.org/english/blogs_e/data_blog_e/blog_dta_10jan24_e.htm.

[xxiii] The White House, “G7 Hiroshima Leaders’ Communiqué,” (May 2023), https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/20/g7-hiroshima-leaders-communique/.

Kalantzakos, S., “The Race for Critical Minerals in an Era of Geopolitical Realignments,” The International Spectator 55, no. 33 (2020), https://doi.org/10.1080/03932729.2020.1786926.

[xxiv] Vaid, M., “From dependency to dominance: India’s Critical Mineral Crusade,” The Diplomat, January 10, 2024, https://thediplomat.com/2024/01/from-dependency-to-dominance-indias-critical-mineral-crusade/.

[xxv] Hernandez-Roy, C., Ziemer, H., and Laske, N., “De-risking Critical Mineral Supply Chains: The role of Latin America,” CSIS, April 11, 2024, https://www.csis.org/analysis/de-risking-critical-mineral-supply-chains-role-latin-america.