Introduction

In an era marked by growing demands for efficiency, sustainability, flexibility and strong international connectivity, the logistics sector has become a focal point for strategic consideration in international trade, which serves as a cornerstone in the flow of goods across borders. As a result, the evolution of this industry not only reflects technological advancement but also mirrors the intricate relationship between economic forces on a global scale.

This study aims to examine the factors that influence the growth of the logistics sector by offering a detailed and context-specific analysis of how logistics practices impact global trade. It does this by using the efficiency assessment to assess how advancements in logistics, such as streamlined supply chains or cutting-edge transportation systems, improve the effectiveness of global trade routes.

Besides, the issue of how logistics infrastructure affects a country’s ability to access global markets, like port capacity, transport networks and customs procedures, is being examined. Additionally, the impact of adopting new technologies in the logistics sector on the speed, accuracy and reliability of the global trade process will be explored.

It is also crucial to assess how sustainable logistic practices, such as green transportation and eco-friendly packaging, influence a country’s environmental footprint in the context of global trade.

This study seeks to offer insights into the potential avenues for further enhancement and optimization, as well as best practices, challenges and potential areas for improvement in logistics services to foster an efficient global trade environment. This is done by conducting a comprehensive analysis of recent developments and emerging technology.

The study covers the position of the logistics sector in the Gulf Cooperation Council (GCC) region, measuring the impact of its development on its position in global trade, highlighting the practices that had been established in the Gulf region, and examining the economic impact of its GDP and its trade volume worldwide.

Foreign trade promotion mechanism

One of the few positive outcomes of the prolonged coronavirus pandemic has been growing digitalization of business investments in communications, contact-free transactions, artificial intelligence and robotics. We can therefore observe that companies have increased their investments in their online businesses significantly, despite the statements made regarding the disruption caused by COVID-19 and its impact on the global economy.

Therefore, in line with the increasing connectivity among world economies and consumers’ rising demand for affordable, timely products, logistics services are progressively intensifying their role as the powerhouse of global trade.[1] It is one of the determinants of a country’s competitiveness on export markets and its ability to secure imports for production and consumption in the global economy.[2]

In this regard, the growing emergence of new disruptions in the logistics sector is likely to have more amplifying impact on trade volume. These new disruptions encompass technological advancement and innovative approaches that streamline operations and improve efficiency, which reduces the time consumption. It redefines how goods are transported across borders, handled at ports, tracked by customers, stored and delivered to end users, offering a high probability of achieving global trade reform, expanding market opportunities, fostering partnerships and transforming overall logistics operations.[3]

Many logistics companies and industry players have taken proactive approaches to respond to these challenges by utilizing improved collaboration within their logistics ecosystem. This has been demonstrated by several evidences, including the following:

- Accurate demand forecasting in order to expect customers’ needs and plan production, accordingly, using highly advanced analytics data.

- Implementing inventory management to avoid overstock or stockout situations.

- “Warehouse Management System” (WMS) that helps the companies to manage their daily inventories through screening the stock and control the products from the point they reach the companies until their transfer to the distribution centers. This system is a crucial component in supply chain management, as it provides companies with an accurate vision of the whole stock in the warehouse.

- Technology integration such as “Supply Chain Management” (SCM) software which is used to track and monitor the supply chain to achieve a high level of transparency, visibility and efficiency across the whole process.

- Transportation optimization through choosing an effective mode of transportation that achieves cost savings and improves delivery performance.

- Sustainability and compliance with ethical environmental standards to better manage climate-related risks and enhance resilience and sustainability features across the various stages of operations.

Technological advancements in logistics services

In the context of the logistic services revolution, many technological systems have been developed and applied by many leading countries to enhance the efficiency, accuracy and visibility of their logistic operations. Hence, the implementation of the AR system (Augmented Reality) is a perfect tool to improve and facilitate the supply chain process, which is now playing an important role in revolutionizing inventory management, by minimizing time consumption, and providing real-time data, visualization and visibility. AR technology displays all the relevant information about images and labels in a real-world environment; it also shows their locations and the efficient route in the warehouse, so this will help to increase accuracy and speed. Moreover, “Transportation Management System” (TMS) is a logistic platform that uses technology to help businesses plan, execute and optimize the physical movement of goods and services incoming and outgoing and achieve better shipment visibility and management for customers.

“Enterprise Resource Planning” (ERP) is also a unified software single platform that is applied by companies to manage their day-to-day business activities, such as accounting procurement, human resources, project management, and risk management. ERP systems help businesses better coordinate their resources by giving them visibility into key performance indicators and enabling them to manage inventory and warehouse operations.[4]

GCC unique approach in tackling logistics

Delivering on its historic and remarkable position as a leading regional trading hub, the Gulf Cooperation Council (GCC) countries have progressively ranked logistics services high among their national agendas. Capitalizing on their strategic geographical position as a link between the east and the west, most GCC countries have secured significant investments in developing logistics infrastructure, promoting trade facilitation measures and increasing the adoption of logistics-related technology.[5]

Central to the GCC countries unique approach to realizing the hidden potential of their logistics services is the expansion of free and specialized economic zones (SEZ). The prime location, combined with the proximity to the world marine’s busiest routes, has further facilitated the expansion of SEZs across the region, not only for scaling up the logistics services domain but also for attracting foreign investors and localizing target industries. According to a recent report by pwc, the current and planned SEZs in the GCC countries are expected to surpass the 100,000 hectares by 2040, making them larger than the size of the Kingdom of Bahrain.[6]

Having said that, it is noteworthy that most SEZs across the region have geared towards target investors and leading logistics companies in the world by offering customized regulation, tailored incentives, 100% ownership of businesses, secured partnerships with reliable public sector entities, reduced tax rates, a simplified investor journey and preferential trade measures.

GCC logistics as a vehicle of economic diversification

The GCC is the most advanced model of sub-regional integration in the MENA region, and its objectives are among the most ambitious in the developing world. It has evolved well beyond a focus on free trade in goods to embrace high levels of cross-national labor and capital mobility and the progressive opening of many sectors within each economy. Under the customs union agreement and the adoption of the common market agreement, member countries have eliminated intra-regional tariffs, unified external tariffs, and eased trade restrictions, which leads to a notable increase in the value of goods traded among member states.[7]

Due to trade volume statistics, both Saudi Arabia and the United Arab Emirates (UAE) are considered to be the major trading partners in the region, and they highly rely on their logistics capabilities to scale up their manufacturing activities. During the last 26 years, Saudi Arabia’s exports to the UAE have increased at an annualized rate of 12.4%, from $672 million in 1995 to $14 billion in 2021. On the other hand, the UAE’s exports to Saudi Arabia have increased at an annualized rate of 17.3%, from $350 million in 1995 to $22.3 billion in 2021.[8] According to the observatory of economic complexity reports the trade volume between the UAE and Saudi Arabia has increased by 28% since 2018 reaching 137.51 billion in 2022.[9]

The GCC countries have always been known for their significant hydrocarbon industry, but recent evidence shows that diversification efforts across the region’s countries have paid off. The recent economic slowdown since the beginning of 2023 due to OPEC+ production cuts has been quite offset by robust performance among non-oil activities, thanks to long-lasting diversification efforts backed by leading initiatives and supporting accommodative policies targeting vital non-oil sectors.[10]

Having said that, it is worth noting that the logistics services sector was one of the engines of economic diversification across the countries in the region. Moreover, several countries have leveraged the sector externalities as enabling conditions for the development of other sectors.

As part of the Saudi Vision 2030, the National Industrial Development and Logistics Program (NIDLP) was launched to facilitate the country’s transformation into a leading global player in the logistics and industry sectors. The program aims at leveraging Saudi Arabia’s logistics competitive advantage to become a global logistics hub before being utilized as a key enabler for the success of the ‘Made in Saudi’ program to scale up local content among non-oil sectors while paving the way for Saudi Arabia’s 4th Industrial Revolution. In 2022, transportation and storage captured 5.2% of the overall real GDP.[11]

In the same context, the UAE’s largest operator of fully integrated economic zones, KEZAD Group, is operating 12 economic zones spreading across the emirate of Abu Dhabi. Following the creation of world-class logistics services via advanced transportation infrastructure together with multimodal connectivity by road, sea, air, and future rail networks, the group has further customized its logistics offering to target specific industries. Currently, the group is offering tailored logistics solutions for the automotive industry and specialized logistics solutions for the food processing industry. In 2022, transportation and storage captured 4.8% of the overall real GDP.[12]

Improvements in GCC logistics have facilitated key socio-economic gains, enabling the region’s logistics hub to become a central node in the worldwide circulation of commodities. It has increased efficiency through better transportation, streamlined customs processes, and advanced tracking systems, fostering the movement of goods across GCC countries and reducing the time, lowering the cost, and gaining customer satisfaction.

Additionally, logistics improvements have facilitated the penetration of new markets, enabling better connectivity between GCC countries and international markets, allowing new trade routes and large varieties of goods and services. Also, it has supported attracting Foreign Direct Investment (FDI) and expanding multinational companies’ operations in the GCC countries.

This makes it clear that trade facilitation tools and cooperation in the logistics sector within the Gulf region are essential for maintaining regional stability. Not only these measures strengthen economic and diplomatic ties within the region but also positions the GCC as a more competitive economic pillar on the global scale, giving the region a competitive edge from its shared infrastructure investments. Because it will promote economic synergy, support the growth and development of the GCC countries and result in cost savings in the transportation and distribution sectors. In the meantime, it is better coordination of activities in supply chain and optimization of inventory management and minimizing disruptions. Additionally, this will support trade product diversification among them by reducing dependence on specific goods or trading partners.

Assessing GCC logistics progress: The Logistics Performance Index (LPI)

The Logistics Performance Index (LPI) is an interactive benchmarking tool created by the World Bank to help countries identify the challenges and opportunities they face in their performance in trade logistics and what they can do to improve their performance. It was first launched in 2007 to assess logistics performance across 150 countries. The LPI 2023 edition allows for comparisons across 139 countries, reflecting the resilience of countries logistics following two global disruptions, namely the COVID-19 pandemic and the Russian-Ukrainian war.[13]

Hence, the LPI measures logistics performance across six components and offers a combination of the weighted average of the country’s scores on customs performance, infrastructure quality, ease of arranging shipments, logistics service quality, shipments tracking and tracing, timeliness of shipments as well as practical data measuring logistics efficiency.

According to the LPI’s most recent findings (2023 edition), the top 10 rankings have been captured by high-income economies, with Singapore scoring 4.3 out of 5, while 8 of the top 10 are European countries. The index results showed that the average time of a container trip across all trade routes from checking in at the source port to checking out at the destination port would take 44 days, with 60% of that time spent at sea.

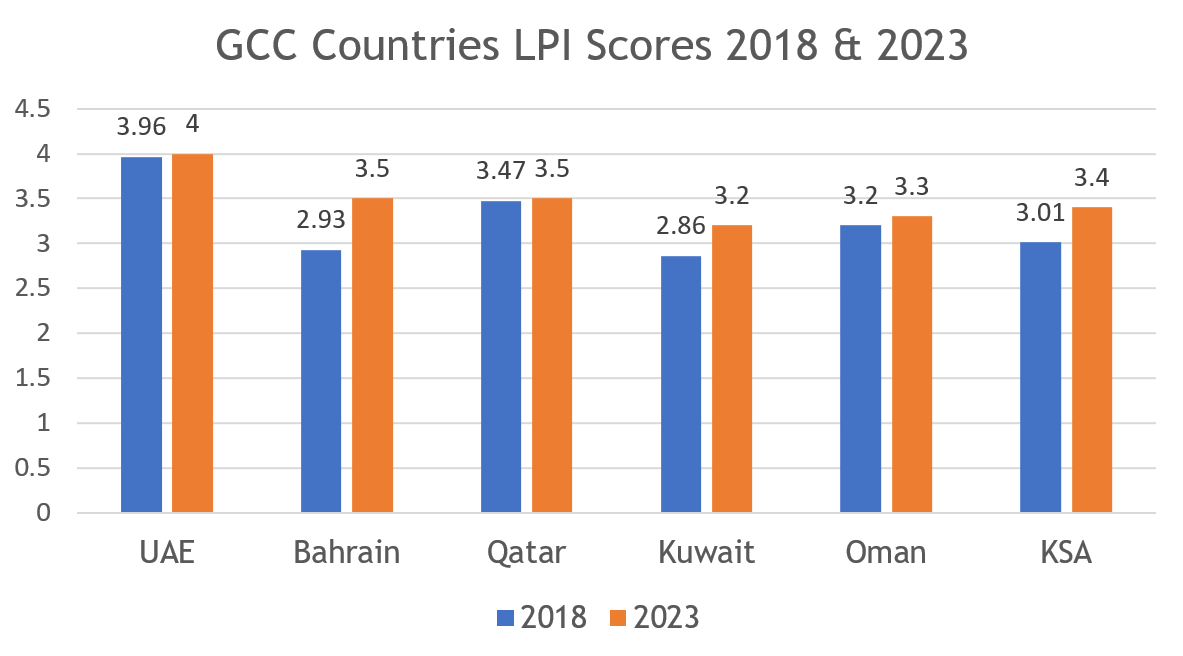

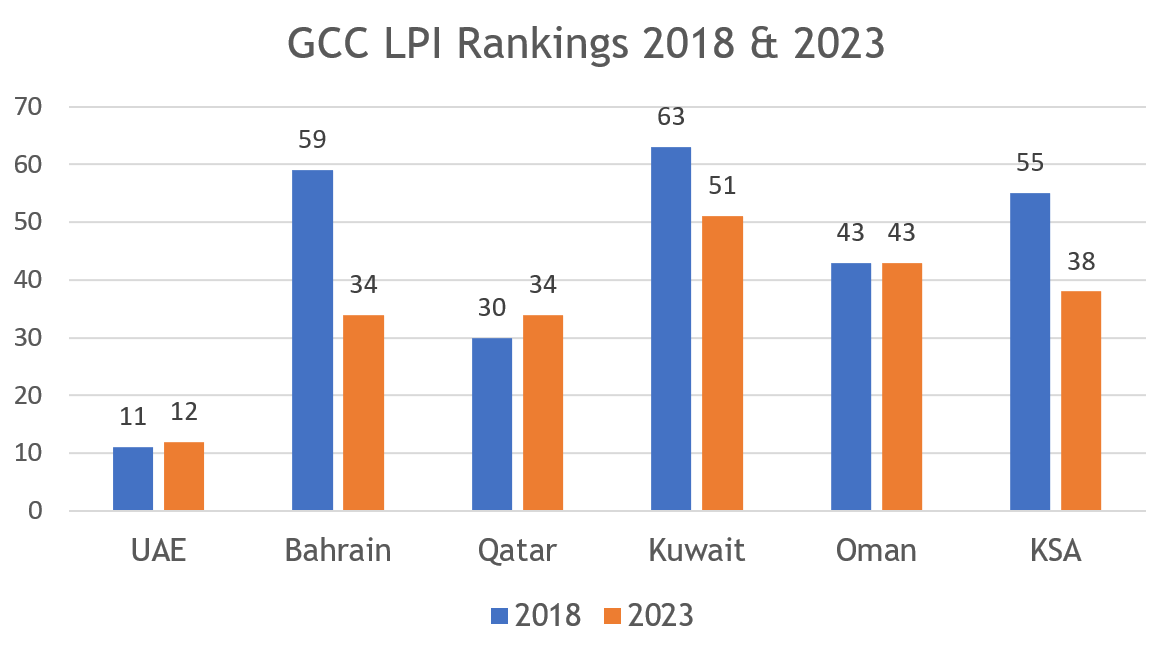

Regionally, logistics performance across the GCC countries showed very positive signs, with all six countries recording upgrades in their scores in 2023 compared with 2018, reflecting the region’s logistics hub’s ability to bounce back from crises and ensure continuity of trade during hard times.

Source: The Logistics Performance Index 2023, World Bank

In terms of rankings, most GCC countries improved their global positions, with the UAE topping the GCC region and the Arab world. The UAE ranked 12th globally, followed by Bahrain (34th globally and 2nd regionally). Moreover, the UAE ranked 4th globally on the “Timeliness sub-indicator, which measures the frequency with which shipments reach consignees within the scheduled or expected delivery time.

Meanwhile, it is noteworthy that Bahrain demonstrated the most improving performance across the GCC, where the country progressed from 59 globally in 2018 to 34 globally in 2023 (jumping 25 positions). The recent remarkable improvement in Bahrain logistics performance could be justified in light of the recent launch of the Logistics Services Sector Strategy in November 2021, aiming at positioning Bahrain as one of the top 20 global destinations for logistics services by 2030. The step was backed by effective strategic initiatives, which focus on reviewing laws and regulations, developing infrastructure facilities, enhancing policies and procedures, providing incentives for investors, promoting investment opportunities, and strengthening regional and international engagement.[14]

Source: The Logistics Performance Index 2023, World Bank

Additionally, Saudi Arabia has advanced to 38 globally, while its best performance was achieved on the infrastructure sub-indicator, which assesses the quality of trade- and transport-related infrastructure, where Saudi Arabia recorded the 30th globally. This progress was due to the structural reforms and qualitative strategic measures that had a significant impact and radically transformed the transport and logistics system, in addition to enhancing its operational efficiency across every sector’s performance in accordance with international indicators and enhancing the country’s position as a global logistics hub.

On the other hand, a careful assessment of the main limitations and weakness areas among GCC logistics hubs, reveals a common decline within the customs sub-indicator, which measures the effectiveness of border management clearance and customs. In fact, most GCC countries, except for Kuwait, scored lowest in that sub-indicator, indicating the growing need for further integration of customs digital solutions, and better compliance transparency through information on laws, regulations, and administrative guidelines.

Key success stories for GCC countries in the freight and logistics sector

- In September 2023, Aramex announced the successful testing of its drone and roadside deliveries in Dubai. This is part of the company’s Future Delivery Program, which is aimed at enhancing last-mile logistics using smart shipping solutions to enable quicker, more sustainable, and cost-effective deliveries.

- In May 2023, Etihad Rail and DHL entered into a partnership agreement, establishing a new joint venture. This collaboration will enable DHL to carry out its operations in the UAE and utilize rail transportation as a key route for distributing goods within the country.

- In May 2023, Masstrans Freight LLC opened a new office in JAFZA (Jebel Ali Free Zone), Dubai, to improve its freight services in the UAE.

- In 2022, Saudi Arabia’s logistics industry reached USD 18 billion, making it among the highest emerging market in the GCC. In 2021, around USD 15 billion was invested in Saudi Arabia’s infrastructure and transportation projects. Saudi Arabia’s ambitious plan involves investing USD 147 billion in transport and logistics infrastructure over eight years, aiming to make the country a major global aviation hub, with around 35% funded by the government and the rest from the private sector. In addition to that, in 2021, the Saudi Arabian government constructed a new rail infrastructure and invested around SAR 562.66 billion (USD 149.83 billion) in transport and logistics. Saudi Arabia’s ongoing rail project is the 1,300 km Land Bridge, which will connect the country’s ports on the Red Sea coast to those on the Arabian Gulf. It is expected to cost between USD 7 billion and USD 26 billion when completed in 2026.

- Qatar’s southern region is set to attract USD 8.17 billion in direct investments for development, aiming to establish a regional hub for investments and logistics services.

- The GCC Freight and Logistics Market size is estimated at 47.59 billion USD in 2023 and is expected to reach 66.61 billion USD by 2029, growing at a 5.76% Compound Annual Growth Rate (CAGR) during the forecast period (2023-2029).

- The GCC Railway appears to be reviving, which could transform trade and connectivity across the Gulf. The railway’s construction improved regional connectivity by reducing transportation times and costs between major GCC cities and ports, improving trade flows, and attracting investments.

EU exemptions for shipping lines expiration impact

The European Commission has decided not to extend the EU legal framework, which exempts liner shipping consortia from EU antitrust rules, since it is no longer adapted to those new market conditions. Though the EU clarified that it won’t mean that shipping lines will no longer be able to cooperate, they will instead have to assess the compatibility of their agreements with the standard EU antitrust rule.[15]

The European Commission will no longer promote the Consortia Block Exemption Regulation (CBER) in the shipping sector and therefore it will let it expire on 25 April 2024. The CBER allows shipping lines, under certain conditions, to enter into cooperation agreements to provide joint cargo transport services, also known as ‘consortia’. Additionally, the CBER was not enabling smaller carriers to cooperate with each other and offer alternative services in competition with larger carriers.

Recently, a certain group of shipping companies got used to controlling most of the market share. As a result of that decision, their profit will be affected after their earnings have plunged after a period of bumper profits during the COVID-19 pandemic, especially with an increase in online demand over supply. There were almost nine shipping line companies that were violating the law as they were controlling most of the world trade value. Meanwhile, the cost of shipment through these companies reached its peak and their profits jumped, and the customers faced very hard times with the delay in their imported and exported products as the ports were very congested.[16]

A reduction in the number of shipping alliances will lead to higher shipping costs and reduce efficiency in the short term; however, in the long term, it could lead to more competition and an efficient shipping industry, providing diverse, quality, and affordable products or services. Moreover, competition leads to companies seeking opportunities for a competitive edge over one another, with the slightest benefit to the individual customer leading to a far greater market share.[17]

This could have a positive long-term impact on the trade flow of GCC countries, which will no longer be controlled by large dominant liner shipping consortia, leading to changes in shipping dynamics, costs and open competition among other shipping companies. It might influence shipping routes pricing strategies and services levels, with potential implications for the efficiency and cost effectiveness of trade activities involving GCC countries.

Challenges and recommendations

The logistics services sector in the GCC countries has gone a very long way toward transforming the region’s economies into reliable and attractive trade and logistics hubs. In doing so, most GCC countries have embarked on similar approaches and measures, not only for sectoral development itself but also for manufacturing promotion purposes, securing foreign investment flows, and energizing the entire region’s economic diversification goals.

Measuring progress shows that generally, the GCC logistics sector did well across many dimensions, while several countries in the region rank the sector very high among their national agendas to ensure the superiority of their logistics offerings regionally and internationally. However, the logistics sector, like many other sectors, is currently facing multiple challenges and disruptions, as well as shifting patterns and uncertainty. As a result, there may be potential challenges and shaky roads ahead for the logistics sector in the GCC because these companies are less digitized than their counterparts in more developed markets, and less is being spent on the kinds of infrastructure projects that require significant freight shipments.[18]

Therefore, the GCC must capitalize on new digital tools and applications to remain competitive with global players and must move fast or risk ceding the first-mover advantage to their competitors. In this respect, it is noteworthy that recently, governments in the region have made large-scale investments in digital to promote sustainable economic growth. Saudi Vision 2030, for example, seeks to increase the private sector’s role in the economy and diversify away from dependence on oil to improve logistics throughout the country.

The UAE has an even stronger focus on transportation and logistics (T&L). The UAE Vision 2021 sets goals for innovation, including making digital technology one of seven primary national sectors, and it aspires to make the country first overall in the global rankings of air transport and port infrastructure, and among the top 10 in terms of logistics. For these broad initiatives, investing in T&L is a short-term goal and a means of hitting more ambitious economic targets.

Despite the significant contribution of SEZs as a key common feature among most GCC logistics development plans, it is widely perceived that most of these plans are supply-driven, trying to offer the best incentives from the regulator/developer point of view, which in many cases fail to realize the desired goals. According to UNCTAD, only 35% of free zones are fully or sufficiently utilized, with the rest being somewhat underutilized, while across the GCC region, a recent pwc report estimated that only about 25% of the available SEZ land in the GCC is developed and only two SEZs (both in the UAE) have developed more than 75% of their total reserved area.[19]

Therefore, SEZs offerings for logistics are highly recommended to consider demand-driven or customer-pull (Customer-Centric View) measures to ensure effective utilization of their offerings. For example, a reduced utility tariff would benefit a typical manufacturer much more than a logistics player.

Additionally, with several GCC logistics development strategies highly embarking on the sector as a potential job creation anchor, many evidences show that automation and rising technology adoption are reshaping the logistics workforce, allowing the sector players to offer better services with lower costs (fewer workers). Indeed, many labor-intensive logistics operations are gradually being completely automated or are on their way to being so, which will adversely affect the workforce.

Automation has nearly disrupted every aspect of the logistics processes, while the increasing use of big data, along with acceleration innovation and logistics-related technology, has penetrated last-mile delivery via the growing use of autonomous vehicles or delivery drones.

In this regard, it is recommended to carefully assess the logistics future, as trends reveal that regulatory and demand pressures toward environmental sustainability are on the rise. Green logistics extends to include as many forms as possible, ranging from between using sustainable fuels, shorter routes, minimizing waste, sustainable transportation modes, energy-efficient operations, sustainable procurement, and parenting with green solutions companies. Recent World Bank survey findings indicate a rising occurrence of such forms and applications among shippers and logistics operations, where almost 75% of shippers had asked for such options “often” or “nearly always” when exporting to top-performing logistics countries.

This trend is in line with growing commitments across the GCC region to achieve net zero emissions by 2050 (mainly from the UAE and KSA) via reducing logistics-related greenhouse gas emissions and other harmful emissions. This will provide the region’s logistics operations with improved conditions for navigating logistics in the future, as well as long-term profitability, competitive advantage, improved partnerships and customer satisfaction.

To highlight the points made above, let me briefly outline some crucial strategies to help the Gulf region’s logistics industry operate more effectively, promote economic growth, stimulate its economy and boost the volume of regional trade:

- Harmonizing and streamlining the logistic sectors’ regulations and procedures among Gulf countries in a way that facilitates the supply chain process and supports a business-friendly environment for logistic companies; and implementing effective and transparent customs procedures to cut down on delays and bureaucratic procedures for import and export activities.

- Redesign traditional business models and processes through digital methods. Companies across all industries now collect real-time performance information and use advanced analytics and business intelligence to make smarter decisions. This could reduce operational costs by 10 to 30 percent through efficiency gains while minimizing operational risks and reducing asset breakdowns by up to 75 percent.

- Increase customer satisfaction and loyalty by considering all freight carriers into a single database, which is provided for free to companies looking to better organize and track their shipments. Enterprise clients can use this database to plan future shipments and set up automatic reorder cycles, which helps them keep less inventory on hand. Along with running algorithms, and digitizing a large portion of the paperwork process, it is modeled after the U.S.-based freight forwarder “Fleport”.

- The adoption of a digital web-based marketplace for international freight shipping, developed by a company named “Freightos,” which gathers quotes for services from thousands of freight forwarders. This new business model allows shipping customers to see what is available in terms of price, service levels, and transit times, and then make an instant booking through the website.[20]

- Foster collaborations between public and private sectors to encourage innovation.

- Development of risk mitigation strategies to address disruptions in the supply chain and embrace modern technologies to optimize supply chain process.

- Integration of sustainable practices to minimize environmental impact and promote eco-friendly practices.

[1] Logistics services critical for trade and economic development — DDG Gonzalez,” World Trade Organization, October 15, 2021, https://www.wto.org/english/news_e/news21_e/ddgag_18oct21_e.htm.

[2] Christina Wiederer, “Boosting trade and economic development through better logistics,” World Bank blogs, April 21, 2023,

https://blogs.worldbank.org/trade/boosting-trade-and-economic-development-through-better-logistics.

[3] McKinsey & Company, “Logistics Disruptors,” https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/logistics-disruptors.

[4] “11 Major Innovations in the Logistics Industry,” iThink Logistics, https://www.ithinklogistics.com/blog/11-major-innovations-done-to-transform-the-logistics-industry/.

[5] Raphael A. Espinoza, Ghada Fayad, Ananthakrishnan Prasad, The Macroeconomics of the Arab States of the Gulf, IMF eLibrary, November 21, 2013, https://www.elibrary.imf.org/display/book/9780199683796/9780199683796.xml.

[6] Amr Goussous et al., “Re-birth of Special Economic Zones in the GCC: Capturing the full potential of Special Economic Zones,” pwc, 2020, https://www.pwc.com/m1/en/publications/documents/re-birth-of-special-economic-zones-gcc.pdf.

[7] “Economic integration in the Gulf Cooperation Council (GCC),” The World Bank Group, http://documents.worldbank.org/curated/en/621311468276383272/Economic-integration-in-the-Gulf-Cooperation-Council-GCC.

[8] “Historical Data,” OEC, https://oec.world/en/profile/bilateral-country/sau/partner/are.

[9] “UAE-Saudi trade hits $160bn in 5 years,” Arabian Business, September 22, 2023, https://www.arabianbusiness.com/abnews/uae-saudi-trade-hits-160bn-in-5-years.

[10] “Economic Diversification Efforts Paying Off in GCC Region but More Reforms Needed,” The World Bank, November 22, 2023, https://www.worldbank.org/en/news/press-release/2023/11/22/economic-diversification-efforts-paying-off-in-gcc-region-but-more-reforms-needed.

[11] Ibid.

[12] Khalifa Economic Zones Abu Dhabi (KEZAD Group),” https://www.kezadgroup.com/about-us/kezad-group-overview/#.

[13] “The Logistics Performance Index and its Indicators,” The World Bank, 2023, https://lpi.worldbank.org/sites/default/files/2023-04/LPI_2023_report_with_layout.pdf.

[14] Bahrain Economic Development Board, “Transportation and Logistics Business Opportunities,” https://www.bahrainedb.com/business-opportunities/logistics.

[15] “EU scraps competition law exemptions for shipping lines,” Financial Times, October 10, 2023, https://www.wto.org/english/news_e/news21_e/ddgag_18oct21_e.htm.

[16] “Liner Shipping Consortia to Lose EU Antitrust Block Exemption From 2024,” Shipping Telegraph, October 10, 2023,

[17] “Logistic industry in GCC- statistics & facts,” statista, May 30, 2023,

https://www.statista.com/topics/7399/logistics-industry-in-the-gulf-cooperation-council/.

[18] “Putting GCC transportation and logistics in the driver’s seat,” strategy&, https://www.strategyand.pwc.com/m1/en/reports/putting-gcc-transportation-and-logistics-in-the-drivers-seat.pdf.

[19] “World Investment Report 2019: Special Economic Zones,” UNCTAD, 2019, https://unctad.org/system/files/official-document/wir2019_en.pdf.

[20] “Putting GCC transportation and logistics in the driver’s seat,” op. cit.